Click for more.

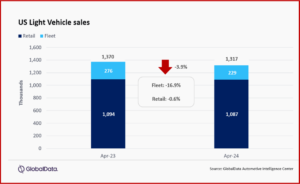

US Light Vehicle (LV) sales declined by 3.9% Year over Year (YoY) in April, to 1.32 million units, according to a preliminary analysis just released by the respected GlobalData* consultancy. This means a 20-month YoY growth streak ended. However, GlobalData said that was “unsurprising” because April 2023 had an additional selling day.

“Calendar effects meant that it was always going to be challenging to match last year’s sales in April. However, with replenished inventory levels helping the market to recover a year ago, the industry is now facing a higher bar in order to keep growing,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

“Lower pricing and higher incentives will likely be required to push sales up to the next level, but there are a number of headwinds keeping the market in check at present. Financing remains expensive due to the lack of movement in interest rates, and model year changeovers are further increasing MSRPs. Meanwhile, the bumpy roll-out of EVs continues to present difficulties, as new EVs are generally priced at too high a point to have mass appeal, while widespread availability is not always guaranteed,” said Oakley.

Affordability matters to, well, market size.

US Observations and Comments

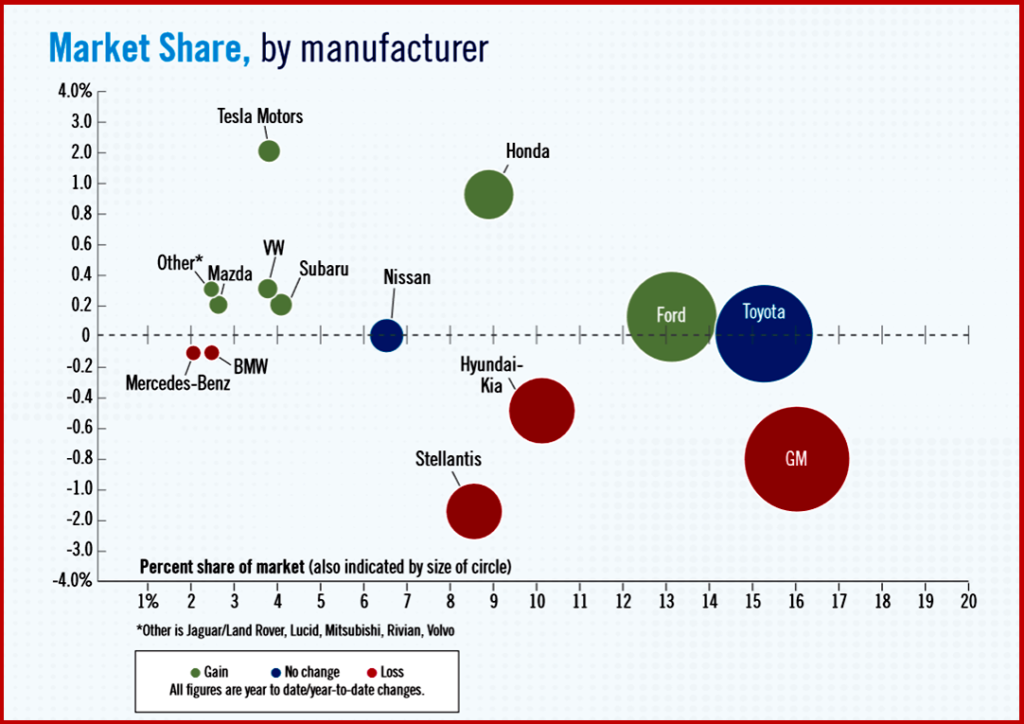

GM has now led US sales rankings for three straight months, after beating Toyota Group by around 10k units in April.

- At a brand level, Toyota was the bestseller, with sales of 183,000 units, ~18,000 ahead of Ford and with Chevrolet again in third at144,000.

- For the first time since September 2023, the Ford F-150 was the bestselling model in April, at 40,700. The Toyota RAV4’s six-month streak at the top of the rankings came to an end, as it sold 39,100. The Ford F-150 likely benefitted from the release of 2024 model year vehicles that could not previously be sold due to a components issue.

- Compact Non-Premium SUV once again was the leading segment in April, but at 21.0%, its market share was the lowest of the year to date. Midsize Non-Premium SUV came in second on 15.7%,while Large Pickup saw its highest market share since December at 13.3%.

- US inventory levels at the end of March rose to 2.6 million units, up 40% from March2023 and 3% higher than February 2024. However, days’ supply slipped to 48 days from 50 days in February. Inventory of Small and Compact SUVs was up more than60% from a year ago, which should be supportive of our forecast for the year. April is expected to continue the expansion of inventory, with volume projected to have increased 2% from March and days’ supply expected to increase back to 50 at the industry level.

- Much like the global outlook, the forecast for the US remains consistent with our previous forecast, up 4% to 16.1 million . Despite the slight pullback in April, fleet sales growth is expected to outpace that of retail sales, as fleet share of total LV sales is forecast to climb to 18.6%, the highest level since 2019. The outlook for LV sales in 2025 is holding at 16.6 million units, as sales growth moderates slightly to 3%.

“We are closely watching the availability of lower priced vehicles, which have lagged the recovery until recently. As entry-level inventory continues to rise and incentives increase to entice consumers still on the sidelines to re-enter the new vehicle market, we feel the market is poised to continue to expand, even if at a slower pace,” said Jeff Schuster, Vice President Research and Analysis, Automotive, at GlobalData.

“However, the strength of the economy and likely longer road to lower interest rates may act as a constraint to any acceleration of growth this year, creating another challenge for the industry in setting near-term strategy as automakers and the supply base seek supply and demand equilibrium in the near-term environment,” said Shuster.

Global Sales

Global LV sales finished the first quarter at 20.7 million units, up 4% from Q1 2023. The selling rate averaged 83.0 million n units during the quarter, with the March selling rate being largely in line with February. Sales volume grew just 1% from March 2023, with mixed results at a regional level.

Domestic sales in China accelerated in March, increasing 4% YoY and, when combined with the 7% increase in North America, stable growth at the topline level continues.

LV sales in Japan fell again, down 21% on suspension of production at Toyota and Daihatsu amid safety concerns.

Europe was mixed with Western Europe contracting 1% YoY but recovery in Russia and Ukraine– and growth in Turkey – driving Eastern Europe to a 24% YoY increase.

The outlook for 2024 is unchanged from last month at 89.2 million units, a 3% increase from 2023. “This year remains a balancing act between supply and demand. As production constraints fully dissipate, natural demand will be able to be met at current price levels, keeping growth rates in check,” said the forecasting team at GlobalData.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

April 2024 US Vehicle Sales Drop Slightly

Click for more.

US Light Vehicle (LV) sales declined by 3.9% Year over Year (YoY) in April, to 1.32 million units, according to a preliminary analysis just released by the respected GlobalData* consultancy. This means a 20-month YoY growth streak ended. However, GlobalData said that was “unsurprising” because April 2023 had an additional selling day.

“Calendar effects meant that it was always going to be challenging to match last year’s sales in April. However, with replenished inventory levels helping the market to recover a year ago, the industry is now facing a higher bar in order to keep growing,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

“Lower pricing and higher incentives will likely be required to push sales up to the next level, but there are a number of headwinds keeping the market in check at present. Financing remains expensive due to the lack of movement in interest rates, and model year changeovers are further increasing MSRPs. Meanwhile, the bumpy roll-out of EVs continues to present difficulties, as new EVs are generally priced at too high a point to have mass appeal, while widespread availability is not always guaranteed,” said Oakley.

Affordability matters to, well, market size.

US Observations and Comments

GM has now led US sales rankings for three straight months, after beating Toyota Group by around 10k units in April.

“We are closely watching the availability of lower priced vehicles, which have lagged the recovery until recently. As entry-level inventory continues to rise and incentives increase to entice consumers still on the sidelines to re-enter the new vehicle market, we feel the market is poised to continue to expand, even if at a slower pace,” said Jeff Schuster, Vice President Research and Analysis, Automotive, at GlobalData.

“However, the strength of the economy and likely longer road to lower interest rates may act as a constraint to any acceleration of growth this year, creating another challenge for the industry in setting near-term strategy as automakers and the supply base seek supply and demand equilibrium in the near-term environment,” said Shuster.

Global Sales

Global LV sales finished the first quarter at 20.7 million units, up 4% from Q1 2023. The selling rate averaged 83.0 million n units during the quarter, with the March selling rate being largely in line with February. Sales volume grew just 1% from March 2023, with mixed results at a regional level.

Domestic sales in China accelerated in March, increasing 4% YoY and, when combined with the 7% increase in North America, stable growth at the topline level continues.

LV sales in Japan fell again, down 21% on suspension of production at Toyota and Daihatsu amid safety concerns.

Europe was mixed with Western Europe contracting 1% YoY but recovery in Russia and Ukraine– and growth in Turkey – driving Eastern Europe to a 24% YoY increase.

The outlook for 2024 is unchanged from last month at 89.2 million units, a 3% increase from 2023. “This year remains a balancing act between supply and demand. As production constraints fully dissipate, natural demand will be able to be met at current price levels, keeping growth rates in check,” said the forecasting team at GlobalData.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.