CarMax (NYSE: KMX) today reported results for the third quarter ended November 30, 2024. Total gross profit of $677.6 million increased by 10.6% year-over-year (YoY) because of higher volumes and margins. Gross profit per retail used unit was $2306, in line with the prior year’s Q3. Gross profit per wholesale unit was $1015, up $54 per unit. Extended Protection Plans (EPP) margin per retail unit of $573, was an increase of $53.

“I am pleased with the positive momentum that we are driving across our diversified business model. Our solid execution and a more stable environment for vehicle valuations enabled us to deliver robust EPS growth driven by increases in unit sales and buys, solid margins, growth in CAF income, and ongoing management of SG&A,” said Bill Nash, president and chief executive officer.

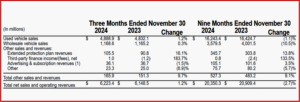

Click to enlarge.

“Our associates and our best-in-class omni-channel experiences are key differentiators that enable our success. We are excited to leverage the capabilities we have built to drive growth as we access the largest total addressable market within our industry,” said Nash.

Q3 Summary

Sales: Combined retail and wholesale used vehicle unit sales were 320,256, an increase of 5.8% from the prior year’s third quarter.

- Total retail used vehicle unit sales increased 5.4% to 184,243 compared to the prior year’s third quarter. Comparable store used unit sales increased 4.3% from the prior year’s third quarter.

- Total retail used vehicle revenues increased 1.2% compared with the prior year’s third quarter, driven by the increase in retail used units sold, partially offset by the decrease in average retail selling price, which declined approximately $1,100 per unit or 3.9%.

Total wholesale vehicle unit sales increased 6.3% to 136,013 versus the prior year’s third quarter.

- Total wholesale revenues increased 0.3% compared with the prior year’s third quarter, driven by the increase in wholesale units sold, partially offset by the decrease in the average wholesale selling price of approximately $500 per unit or 5.7%.

- CarMax bought 270,000 vehicles from consumers and dealers, up 7.9% compared to last year’s third quarter. Of these vehicles, 237,000 were bought from consumers and 33,000 were bought through dealers, an increase of 4.1% and 46.7%, respectively, from last year’s third quarter.

Other sales and revenues increased by 9.7% compared with the third quarter of fiscal 2024, representing an increase of $14.6 million, primarily reflecting an increase in EPP revenues resulting from stronger margins.

Online retail sales (2) accounted for 15% of retail unit sales, compared to 14% in the third quarter of last year. Revenue from online transactions (3) , including retail and wholesale unit sales, was $2.0 billion, or approximately 32% of net revenues, up from 31% in last year’s third quarter.

Gross Profit

- Total gross profit was $677.6 million, up 10.6% versus last year’s third quarter. Retail used vehicle gross profit increased 6.8% and retail gross profit per used unit was $2,306, in line with last year’s third quarter.

- Wholesale vehicle gross profit increased 12.3% versus the prior year’s third quarter. Gross profit per unit increased $54 from the prior year’s third quarter to $1,015.

- Other gross profit increased 24.6% primarily reflecting growth in EPP revenues resulting from stronger margins as well as service gross profit driven by cost coverage measures, increased efficiencies, and positive retail unit growth.

SG&A

- Compared with the third quarter of fiscal 2024, SG&A expenses increased 2.8% or $15.8 million to $575.8 million, primarily driven by an increase in compensation and benefits due to year-over-year corporate bonus accrual dynamics. Partially offsetting this was a decrease in advertising expenditure due to timing.

- SG&A as a percent of gross profit decreased 640 basis points to 85.0% in the third quarter compared to 91.4% in the prior year’s third quarter, driven by the growth in gross profit and ongoing cost management efforts in the stores and customer experience centers.

CarMax Auto Finance (4)

- CAF income increased 7.6% to $159.9 million driven by growth in CAF’s net interest margin percentage and average managed receivables. This quarter’s provision for loan losses was $72.6 million compared to $68.3 million in the prior year’s third quarter.

- As of November 30, 2024, the allowance for loan losses of $478.9 million was 2.70% of ending managed receivables, down from 2.82% as of August 31, 2024. The allowance for loan losses was down from 2.92% a year ago, due to the effect of the previously disclosed tightening of CAF’s underwriting standards.

- CAF’s total interest margin percentage, which represents the spread between interest and fees charged to consumers and our funding costs, was 6.2% of average managed receivables, up from the prior year’s third quarter but consistent with this year’s second quarter. After the effect of 3-day payoffs, CAF financed 43.1% of units sold in the current quarter, down slightly from 44.0% in the prior year’s third quarter. CAF’s weighted average contract rate was 11.2% in the quarter, down from 11.3% in the third quarter last year.

Share Repurchases

- During the third quarter of fiscal year 2025, we repurchased 1.5 million shares of common stock for $114.8 million. As of November 30, 2024, we had $2.04 billion remaining available for repurchase under the outstanding authorization.

Location Openings

- During the third quarter of fiscal 2025, we opened one new store in Alliance, Texas.

Inevitable CarMax Footnotes

(1) Comparisons to the prior year’s third quarter unless otherwise stated

(2) An online retail unit sale is defined as a sale where the customer completes all four of these major transactional activities remotely: reserving the vehicle; financing the vehicle, if needed; trading-in or opting out of a trade in; and creating a remote sales order.

(3) Revenue from online transactions is defined as revenue from retail sales that qualify for an online retail sale, as well as any EPP and third-party finance contribution, wholesale sales where the winning bid was an online bid, and all revenue earned by Edmunds.

(4) Although CAF benefits from certain indirect overhead expenditures, we have not allocated indirect costs to CAF to avoid making subjective allocation decisions.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

CarMax FY Q3 Net Profit Up 1.2%

CarMax (NYSE: KMX) today reported results for the third quarter ended November 30, 2024. Total gross profit of $677.6 million increased by 10.6% year-over-year (YoY) because of higher volumes and margins. Gross profit per retail used unit was $2306, in line with the prior year’s Q3. Gross profit per wholesale unit was $1015, up $54 per unit. Extended Protection Plans (EPP) margin per retail unit of $573, was an increase of $53.

“I am pleased with the positive momentum that we are driving across our diversified business model. Our solid execution and a more stable environment for vehicle valuations enabled us to deliver robust EPS growth driven by increases in unit sales and buys, solid margins, growth in CAF income, and ongoing management of SG&A,” said Bill Nash, president and chief executive officer.

Click to enlarge.

“Our associates and our best-in-class omni-channel experiences are key differentiators that enable our success. We are excited to leverage the capabilities we have built to drive growth as we access the largest total addressable market within our industry,” said Nash.

Q3 Summary

Sales: Combined retail and wholesale used vehicle unit sales were 320,256, an increase of 5.8% from the prior year’s third quarter.

Total wholesale vehicle unit sales increased 6.3% to 136,013 versus the prior year’s third quarter.

Other sales and revenues increased by 9.7% compared with the third quarter of fiscal 2024, representing an increase of $14.6 million, primarily reflecting an increase in EPP revenues resulting from stronger margins.

Online retail sales (2) accounted for 15% of retail unit sales, compared to 14% in the third quarter of last year. Revenue from online transactions (3) , including retail and wholesale unit sales, was $2.0 billion, or approximately 32% of net revenues, up from 31% in last year’s third quarter.

Gross Profit

SG&A

CarMax Auto Finance (4)

Share Repurchases

Location Openings

Inevitable CarMax Footnotes

(1) Comparisons to the prior year’s third quarter unless otherwise stated

(2) An online retail unit sale is defined as a sale where the customer completes all four of these major transactional activities remotely: reserving the vehicle; financing the vehicle, if needed; trading-in or opting out of a trade in; and creating a remote sales order.

(3) Revenue from online transactions is defined as revenue from retail sales that qualify for an online retail sale, as well as any EPP and third-party finance contribution, wholesale sales where the winning bid was an online bid, and all revenue earned by Edmunds.

(4) Although CAF benefits from certain indirect overhead expenditures, we have not allocated indirect costs to CAF to avoid making subjective allocation decisions.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.