Click for more.

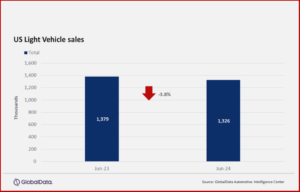

The CDK Cyberattack [1] negatively affected the US Light Vehicle Market, according to preliminary estimates just released by the respected GlobalData consultancy.* Light Vehicle (LV) sales fell by 3.8% year-on-year (YoY) in June, to 1.33 million units. The CDK cyberattack has caused significant disruption across the industry, and therefore some brands could potentially see larger revisions than would normally be the case. Still, sales in June are unlikely to change for many of the largest OEMs, while there is a possibility that volumes in July will see a boost instead,” according to GlobalData.**

“Although the industry has become accustomed to dealing with adversity in recent years, the CDK cyberattack was another curve ball that disrupted activity on a number of levels during June. Many dealers that use CDK’s software found it difficult to conduct normal business operations, although reports suggest that workarounds were found in many cases,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

US inventory likely ended June at just above 2.7 million units, on par with the level seen last month, but an increase of nearly 42% from June 2023. Days’ supply is expected to be at 50 days, which is the same as last month. With recovery from the cyberattack expected to be robust in July, inventory will contract more than typical during the month’s summer production shutdown for some of the domestic manufacturers. Production levels are expected to resume some inventory rebuilding in August and will be managed to demand through the remainder of 2024.

“The sales data also supports this idea of resilience, as volumes were certainly not as low as might have been the case, especially given that the attack occurred on June 19th and affected the busiest weeks of the month, as well as a quarter end. Still, there was undoubtedly a negative impact for some OEMs, as we would have expected sales to grow modestly YoY had the cyberattack not happened. Some buyers may have chosen to defer their purchase until the issue was resolved, but with the restoration of systems expected imminently, we anticipate that most of the lost sales will be recovered in July,” said Oakley.

The data problem: It is not possible to provide retail/fleet splits this month due to the CDK cyberattack, said GlobalData. General Motors (GM) once again led the market in June at 227,120. It is leading by ~34,000 units over second-placed Toyota Group at 193,120, which was impacted by stop-sale orders on some models. Ford Group was the third-largest OEM with 160,000 units.

For brands, Toyota continued to lead on 165,000 units despite the recalls, with second-placed Ford seemingly affected by the cyberattack, as its volumes were a modest 153,000 units. Chevrolet was the next closest challenger behind Ford, on144,000 units.

“The first half of 2024 surpassed our high expectations thanks to our teams’ continued focus on customers with even more great products, including electrified vehicles,” said Jack Hollis, executive vice president, Sales, TMNA in the Toyota sales release. “Lexus recorded its best-ever first half in its 35-year history, Toyota remains the number one retail brand in the industry, and our diverse portfolio of 29 electrified vehicle options between the Toyota and Lexus brands made up nearly 40 percent of our total sales volume through June,” said Hollis.

For the first time since March, the Toyota RAV4 returned to the top of the model sales rankings, on 41,700 units, as Toyota reported that the cyberattack had little impact on its sales activity. This bumped the Ford F-150 to the runner-up position, with 37,600 units.

Compact Non-Premium SUVs continued to see an easing in market share in June, accounting for 20.2% of total sales, although this was still 5.1 percentage points ahead of the next largest segment, Midsize Non-Premium SUVs. The Large Pickup segment enjoyed its highest market share since January 2023, at 14.1%.

Click for more.

Global Risk?

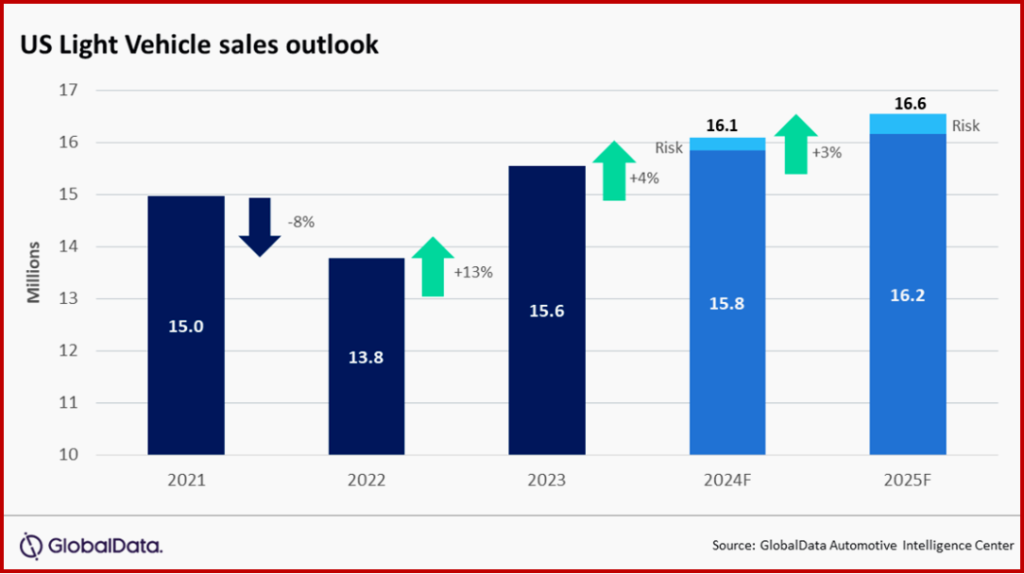

The global LV selling rate in May stood at 87.4 million units/year, a slight improvement from 86.2 million units/year in April. “Sales volumes in May increased by just 0.7% to 7.2 million units, which was weaker than expectations going into the month. Lower demand in China accounted for much of the weak global gain. The country experienced a contraction of3.3% in May, which was noticeably stronger than the 0.4% decline projected; however, the selling rate still improved from April. Japan (-4.5%) and Korea(-7.3%) also contributed to the muted performance in May. A slight pullback in expected demand has trimmed the outlook for 2024 by 200,000 units to 88.9 million units, a 2.5% increase from 2023. China’s trade-in subsidy does not appear to be providing the boost to demand that the government intended. However, globally, risks remain balanced, and the auto market is stable,” GlobalData said.

[1] CDK Cyberattack

“CDK, a global company, is used by ~15,000 automotive dealers and larger dealership groups with so-called dealership management systems ( aka DMS) in the United States. CDK’s products include targeted marketing, as well as systems for sales, financing, insuring, parts supply, repair, as well the maintenance and registration of vehicles. Some estimates have dealership losses at more than $1 billion. Let the lawsuits begin,” – AutoCrat.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

CDK Cyberattacks Wound June US Light Vehicle Sales

Click for more.

The CDK Cyberattack [1] negatively affected the US Light Vehicle Market, according to preliminary estimates just released by the respected GlobalData consultancy.* Light Vehicle (LV) sales fell by 3.8% year-on-year (YoY) in June, to 1.33 million units. The CDK cyberattack has caused significant disruption across the industry, and therefore some brands could potentially see larger revisions than would normally be the case. Still, sales in June are unlikely to change for many of the largest OEMs, while there is a possibility that volumes in July will see a boost instead,” according to GlobalData.**

“Although the industry has become accustomed to dealing with adversity in recent years, the CDK cyberattack was another curve ball that disrupted activity on a number of levels during June. Many dealers that use CDK’s software found it difficult to conduct normal business operations, although reports suggest that workarounds were found in many cases,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

US inventory likely ended June at just above 2.7 million units, on par with the level seen last month, but an increase of nearly 42% from June 2023. Days’ supply is expected to be at 50 days, which is the same as last month. With recovery from the cyberattack expected to be robust in July, inventory will contract more than typical during the month’s summer production shutdown for some of the domestic manufacturers. Production levels are expected to resume some inventory rebuilding in August and will be managed to demand through the remainder of 2024.

“The sales data also supports this idea of resilience, as volumes were certainly not as low as might have been the case, especially given that the attack occurred on June 19th and affected the busiest weeks of the month, as well as a quarter end. Still, there was undoubtedly a negative impact for some OEMs, as we would have expected sales to grow modestly YoY had the cyberattack not happened. Some buyers may have chosen to defer their purchase until the issue was resolved, but with the restoration of systems expected imminently, we anticipate that most of the lost sales will be recovered in July,” said Oakley.

The data problem: It is not possible to provide retail/fleet splits this month due to the CDK cyberattack, said GlobalData. General Motors (GM) once again led the market in June at 227,120. It is leading by ~34,000 units over second-placed Toyota Group at 193,120, which was impacted by stop-sale orders on some models. Ford Group was the third-largest OEM with 160,000 units.

For brands, Toyota continued to lead on 165,000 units despite the recalls, with second-placed Ford seemingly affected by the cyberattack, as its volumes were a modest 153,000 units. Chevrolet was the next closest challenger behind Ford, on144,000 units.

“The first half of 2024 surpassed our high expectations thanks to our teams’ continued focus on customers with even more great products, including electrified vehicles,” said Jack Hollis, executive vice president, Sales, TMNA in the Toyota sales release. “Lexus recorded its best-ever first half in its 35-year history, Toyota remains the number one retail brand in the industry, and our diverse portfolio of 29 electrified vehicle options between the Toyota and Lexus brands made up nearly 40 percent of our total sales volume through June,” said Hollis.

For the first time since March, the Toyota RAV4 returned to the top of the model sales rankings, on 41,700 units, as Toyota reported that the cyberattack had little impact on its sales activity. This bumped the Ford F-150 to the runner-up position, with 37,600 units.

Compact Non-Premium SUVs continued to see an easing in market share in June, accounting for 20.2% of total sales, although this was still 5.1 percentage points ahead of the next largest segment, Midsize Non-Premium SUVs. The Large Pickup segment enjoyed its highest market share since January 2023, at 14.1%.

Click for more.

Global Risk?

The global LV selling rate in May stood at 87.4 million units/year, a slight improvement from 86.2 million units/year in April. “Sales volumes in May increased by just 0.7% to 7.2 million units, which was weaker than expectations going into the month. Lower demand in China accounted for much of the weak global gain. The country experienced a contraction of3.3% in May, which was noticeably stronger than the 0.4% decline projected; however, the selling rate still improved from April. Japan (-4.5%) and Korea(-7.3%) also contributed to the muted performance in May. A slight pullback in expected demand has trimmed the outlook for 2024 by 200,000 units to 88.9 million units, a 2.5% increase from 2023. China’s trade-in subsidy does not appear to be providing the boost to demand that the government intended. However, globally, risks remain balanced, and the auto market is stable,” GlobalData said.

[1] CDK Cyberattack

“CDK, a global company, is used by ~15,000 automotive dealers and larger dealership groups with so-called dealership management systems ( aka DMS) in the United States. CDK’s products include targeted marketing, as well as systems for sales, financing, insuring, parts supply, repair, as well the maintenance and registration of vehicles. Some estimates have dealership losses at more than $1 billion. Let the lawsuits begin,” – AutoCrat.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.