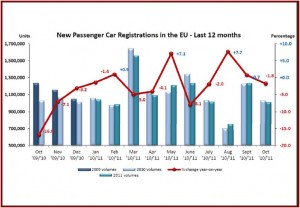

In October, new car registrations in the EU decreased by 1.8%, totaling 1,005,976 units when compared with the year before. From January to October, the 27 countries in the European region posted sales of 11,126,436 new cars, or 1.2% less than in the first ten months of 2010, according to ACEA, the automakers trade organization.

Sales in Germany, the largest EU market, remained stable (+0.6%), while results in Italy (-5.5%) and Spain (-6.7%) were negative, leading to an overall 1.8% decline in new registrations. From January to October, Germany was the only major market to post significant growth (+9.8%). France saw its demand slightly increase by 0.4%, while the UK (-4.5%), Italy (-10.8%) and Spain (-19.7%) all declined.

The ongoing economic decline of Europe is causing problems for the Detroit Three Automakers and hurts returns for U.S. taxpayers.

General Motors in its ongoing ineffective restructuring of Opel said last week that its European subsidiary would not break even for the year as originally promised “due to deteriorating economic conditions,” a five year problem that thus far sees GM doing too little, too late to make Opel profitable for shareholders. GM Group’s EU market share year-to-date is flat at 8.7%, which puts it in fourth place. Simply put, GM needs to drastically cut costs and that means more plant closings and job loses, but its U.S. taxpayer bailout in 2009 bought it time, which is now running out.

The share of Ford Motor in Europe – in fifth place – is also languishing at 8.1% in spite of a completely revised lineup. In the third quarter, Ford Europe reported a pre-tax operating loss of $306 million, compared with a loss of $196 million a year ago. Ford, too, needs to cut costs, but its acceptance of $5.9 billion in subsidized loans from the U.S. Department of Energy is allowing it to retool plants.

Chrysler’s owner Fiat – in sixth place – saw its EU share decline from 8.1% to 7.2% because of the economic turmoil in Italy, the fourth largest car market in the EU after Germany, France and the United Kingdom. Fiat says it won’t recover share in Europe this year. In 2011 Fiat expects losses in Europe -€ 800 million with Italian car sales expected to reach a 30-year low. Fiat earnings are now being improved by results at Chrysler in the U.S., which of course only survived because of a taxpayer bailout.

Volkswagen Group remains the powerhouse of the European auto industry, with a commanding share of 23.2% ytd – up almost 2 percentage points. In second and third places respectively are PSA Group and Renault Group.

See:

- GM Europe President Nick Reilly Retires in March 2012. Karl Stracke Assumes Role in January; Remains Opel/Vauxhall CEO

- GM Q3 Earnings of $1.7 Billion, Most from North America

- Ford Q3 Income, Profits Down as Volume Increases. No Dividend Yet, But Sooner Rather than Later Promised

- Chrysler Group October Sales Up 27%. Comeback Continues

- Chrysler Group Reports Q3 Net Income of $212 Million

- EU Car Sales Still trending Down for Fourth Straight Year