Click to enlarge.

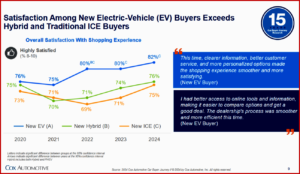

The 2024 Car Buyer Journey (CBJ) Study by Cox Automotive* published today shows record highs in new-car buyer satisfaction, driven by advancements in digital tools helping seamlessly integrate online and in-dealership activities. This seamless integration – an omnichannel buying experience in industry jargon – saves time, reduces repetition and ultimately improves satisfaction with the overall car-buying journey. The 2024 CBJ also highlights the growing satisfaction among electric vehicle (EV) buyers, who are once again leading the way in satisfaction during the car-buying process.

“With the launch of the 15th Anniversary edition of the Car Buyer Journey, we are reminded again just how important it is to have an efficient vehicle buying process,” said Isabelle Helms, vice president of Research and Market Intelligence. “Auto dealers who embrace the latest technology and engage in a transparent, easy-to-navigate process have consistently delivered the highest levels of satisfaction. That was true 15 years ago and remains true as ever today.”

Satisfaction Reaches a Record High for New-Car Buyers

New-vehicle buyers reported a record 75% satisfaction rate with the overall shopping experience, the highest in the CBJ study’s history. This is largely attributed by Cox to advancements in digital tools, pricing transparency and a balance between online and in-person dealership experiences. During 2024, improving sales incentives and a wider selection of new-vehicle inventory contributed to increased satisfaction as well. Notably, 42% of new-car buyers stated their experience was better than their prior purchase, with dealership satisfaction reaching a historic high of 81%.

Satisfaction among all vehicle buyers, however, declined slightly in 2024 compared to the prior year, pulled lower by a decline in satisfaction among used-vehicle buyers. Looking at satisfaction across the industry, among both new and used buyers, 67% were highly satisfied with the journey, down from 69% in the previous study.

The overall decline in 2024 was likely driven by several factors Cox said, including elevated auto loan rates, which hit a 20-year high in 2024. Used-vehicle inventory remained tight throughout 2024 as well, and used-vehicle buyers are less likely than new-car buyers to encounter improved digital tools that support that “seamless, efficient, omnichannel vehicle-buying process.”

Nonetheless, a 64% satisfaction rate among used-vehicle buyers was higher than at any time before the global COVID pandemic. Research suggests that many automobile dealers, both franchised and independent, invested in improved processes to deliver a more digital buying experience during the pandemic, resulting in changes that have boosted overall satisfaction with vehicle buying.

*About Cox Automotive

Cox Automotive says with justification that it is the world’s largest automotive services and technology provider. It gathers data based on 2.3 billion online interactions annually. Cox Automotive can help car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of brands that include: Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

EV Market Stays as Customer Satisfaction Leader

Click to enlarge.

The 2024 Car Buyer Journey (CBJ) Study by Cox Automotive* published today shows record highs in new-car buyer satisfaction, driven by advancements in digital tools helping seamlessly integrate online and in-dealership activities. This seamless integration – an omnichannel buying experience in industry jargon – saves time, reduces repetition and ultimately improves satisfaction with the overall car-buying journey. The 2024 CBJ also highlights the growing satisfaction among electric vehicle (EV) buyers, who are once again leading the way in satisfaction during the car-buying process.

“With the launch of the 15th Anniversary edition of the Car Buyer Journey, we are reminded again just how important it is to have an efficient vehicle buying process,” said Isabelle Helms, vice president of Research and Market Intelligence. “Auto dealers who embrace the latest technology and engage in a transparent, easy-to-navigate process have consistently delivered the highest levels of satisfaction. That was true 15 years ago and remains true as ever today.”

Satisfaction Reaches a Record High for New-Car Buyers

New-vehicle buyers reported a record 75% satisfaction rate with the overall shopping experience, the highest in the CBJ study’s history. This is largely attributed by Cox to advancements in digital tools, pricing transparency and a balance between online and in-person dealership experiences. During 2024, improving sales incentives and a wider selection of new-vehicle inventory contributed to increased satisfaction as well. Notably, 42% of new-car buyers stated their experience was better than their prior purchase, with dealership satisfaction reaching a historic high of 81%.

Satisfaction among all vehicle buyers, however, declined slightly in 2024 compared to the prior year, pulled lower by a decline in satisfaction among used-vehicle buyers. Looking at satisfaction across the industry, among both new and used buyers, 67% were highly satisfied with the journey, down from 69% in the previous study.

The overall decline in 2024 was likely driven by several factors Cox said, including elevated auto loan rates, which hit a 20-year high in 2024. Used-vehicle inventory remained tight throughout 2024 as well, and used-vehicle buyers are less likely than new-car buyers to encounter improved digital tools that support that “seamless, efficient, omnichannel vehicle-buying process.”

Nonetheless, a 64% satisfaction rate among used-vehicle buyers was higher than at any time before the global COVID pandemic. Research suggests that many automobile dealers, both franchised and independent, invested in improved processes to deliver a more digital buying experience during the pandemic, resulting in changes that have boosted overall satisfaction with vehicle buying.

*About Cox Automotive

Cox Automotive says with justification that it is the world’s largest automotive services and technology provider. It gathers data based on 2.3 billion online interactions annually. Cox Automotive can help car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of brands that include: Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.