Click for more Data.

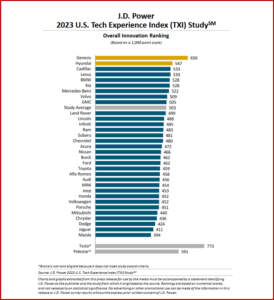

Battery-electric vehicle (BEV) owners have more problems with advanced technology than do owners of internal combustion engine (ICE) vehicles, according to the J.D. Power 2023 U.S. Tech Experience Index (TXI) Study,SM released today. The study focuses on the user experience with advanced vehicle technology as it first comes to market and is an early measure of problems encountered by vehicle owners. (AutoInformed: Tech-Aches – J.D. Power 2023 U.S. Vehicle Dependability Study)

“Innovation through a strong advanced tech strategy is crucial for all vehicle manufacturers, especially those working to build their reputation in the electric vehicle space,” said Kathleen Rizk, senior director of user experience benchmarking and technology at J.D. Power. “The perception in the industry is that most BEVs should offer many advanced technologies to compete with high-tech entrants like Tesla. Success will be dependent on those manufacturers that can execute flawlessly, while ensuring the user experience is the same for those who are tech savvy and those who are not.”

Seventeen of the 21 advanced features offered on both fuel versions have more quality problems per 100 vehicles (PP100) for BEVs (excluding Tesla – not ranked) than for ICE vehicles. In addition, satisfaction is lower for BEVs across 86% of the advanced technologies compared with those on ICE vehicles. Systems such as remote parking assistance (27.4 PP100 among BEVs vs. 10.7 PP100 among ICE vehicles) and interior gesture controls (49.6 PP100 among BEVs vs. 31.2 PP100 among ICE vehicles) have some of the largest gaps between the two fuel versions.

These study findings also are consistent across the J.D. Power 2023 Initial Quality StudySM (IQS) and 2023 Automotive Performance, Execution and Layout (APEAL) Study.SM The total vehicle problems in the IQS is 46% higher among BEVs (excluding Tesla) than ICE vehicles and satisfaction is lower among owners of BEVs across nine of 10 APEAL categories than among owners of ICE vehicles. (AutoInformed: Fasten Your Safety Belt – Quality Problems at Record High; APEAL Study of New Vehicle Owner Satisfaction Down Again )

Potentially Significant Data in the 2023 Study

- Warning bells – disruptors are coming: New manufacturers (e.g., Tesla, Rivian, Lucid and Polestar) are making a very strong debut in the U.S. market in terms of their advanced tech offerings. While some brands have small sample sizes and state registration restrictions prohibit ranking, most of the innovation of these newer brands far exceeds that of traditional manufacturers—except for Genesis—and significantly outpace the Innovation Index premium average (588 on a 1000-point scale). Innovation and tech offerings are high for new manufacturers, but they are not providing a problem-free experience. Average problem levels for advanced technologies among new manufacturers, except for Polestar, are well above the premium average of 24.3 PP100 and are among the highest in the industry.

- Owners don’t see eye-to-eye with biometrics: In terms of accuracy, biometrics that monitor behavioral characteristics (eye movement) are less problematic than those that monitor physiological characteristics (facial recognition) but are more annoying. Regardless of the biometric type, owners say they do not consider them to be useful (fingerprint reader rating of 7.24 (on a 10-point scale); facial recognition 7.48; and direct driver monitoring 7.75). Despite continued usage, biometric technologies have low desirability in terms of owners wanting them in their next vehicle compared with other advanced technologies.

- Owners charged up about plug and charge: Owners well like the plug-and-charge technology. After plugging into a public charger, the charger identifies the vehicle, validates the charge and starts the charging process. Payment and billing occur automatically upon completion of the charge. Nearly three-fourths (72%) of owners say they want the technology on their next vehicle. With just 6.0 PP100 and overall satisfaction of 8.89 (on a 10-point scale) across the industry, plug and charge is well executed across most manufacturers and vehicle owners say that it is a much-appreciated feature.

- Waning ADAS usage: Among owners who say they use specific technologies all the time, many safety and advanced driver assist systems (ADAS) technologies have declined slightly year over year, most notably reverse automatic emergency braking (-4 percentage points); safe exit assist (-3); and automatic emergency steering (-3). While usage rates are still relatively high, small declines across several technologies is a worrying sign that reinforces the need for automakers to remain diligent on providing a positive customer experience so that trust and perceived feature usefulness are not negatively affected, Power claimed.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

EV Tech-aches 2023 – More Problems than ICE Vehicles

Click for more Data.

Battery-electric vehicle (BEV) owners have more problems with advanced technology than do owners of internal combustion engine (ICE) vehicles, according to the J.D. Power 2023 U.S. Tech Experience Index (TXI) Study,SM released today. The study focuses on the user experience with advanced vehicle technology as it first comes to market and is an early measure of problems encountered by vehicle owners. (AutoInformed: Tech-Aches – J.D. Power 2023 U.S. Vehicle Dependability Study)

“Innovation through a strong advanced tech strategy is crucial for all vehicle manufacturers, especially those working to build their reputation in the electric vehicle space,” said Kathleen Rizk, senior director of user experience benchmarking and technology at J.D. Power. “The perception in the industry is that most BEVs should offer many advanced technologies to compete with high-tech entrants like Tesla. Success will be dependent on those manufacturers that can execute flawlessly, while ensuring the user experience is the same for those who are tech savvy and those who are not.”

Seventeen of the 21 advanced features offered on both fuel versions have more quality problems per 100 vehicles (PP100) for BEVs (excluding Tesla – not ranked) than for ICE vehicles. In addition, satisfaction is lower for BEVs across 86% of the advanced technologies compared with those on ICE vehicles. Systems such as remote parking assistance (27.4 PP100 among BEVs vs. 10.7 PP100 among ICE vehicles) and interior gesture controls (49.6 PP100 among BEVs vs. 31.2 PP100 among ICE vehicles) have some of the largest gaps between the two fuel versions.

These study findings also are consistent across the J.D. Power 2023 Initial Quality StudySM (IQS) and 2023 Automotive Performance, Execution and Layout (APEAL) Study.SM The total vehicle problems in the IQS is 46% higher among BEVs (excluding Tesla) than ICE vehicles and satisfaction is lower among owners of BEVs across nine of 10 APEAL categories than among owners of ICE vehicles. (AutoInformed: Fasten Your Safety Belt – Quality Problems at Record High; APEAL Study of New Vehicle Owner Satisfaction Down Again )

Potentially Significant Data in the 2023 Study

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.