Click to enlarge.

The latest research from Cox Automotive published today – Future of Fleets: Path to EV Adoption – shows that among other things that, compared to vehicles powered by internal-combustion engines (ICE), fleet owners operating both electric vehicles (EVs) and their traditional, fuel-burning counterparts have higher levels of satisfaction with their EVs. This despite higher acquisition costs as well as more frequent service and maintenance. Conducted in Q1 2024, the survey collected data from fleet decision-makers in various regions and across differing fleet sizes. “Data show that 14% of fleets presently operate EVs, with a significant trend toward EV adoption expected in the next five years,” Cox said.

“The electric-vehicle story is much larger than just the retail story,” said Zo Rahim, senior analyst of Research and Market Intelligence at Cox Automotive. “In many ways, electric vehicles can be an ideal solution for many fleet operations, which often have set routes of known distances, vehicles that routinely overnight in the same location, and operations that prioritize the cost of ownership. The fleet business is significant in the U.S. market, and we expect the EV share of the fleet market to expand in the coming years.”

Fleet operators that currently use EVs, the new study reveals, have a striking 90% likelihood of acquiring additional EVs in the next acquisition cycle. Among the total sample of fleets owners (those with and without EVs), a super majority – 87% – expect EVs to be added to their fleets in the next five years.

When asked, fleet owners forecast that the EV share of the average fleet in five years would be 43%. Among operators currently managing EVs, the projected share of EVs was even higher, at 58%, suggesting those with the most experience with EVs expect more rapid growth.

The research indicates that awareness of fleet EV incentives ,– can significantly lower acquisition costs, is high among operators and viewed more favorably compared to the retail market.

However, Cox noted that as in the retail business, barriers to greater EV adoption in the fleet business continue. Acquisition cost is a primary concern among fleet buyers, particularly for those considering EVs. Existing EV owners express concern about the lack of charging stations and supporting infrastructure. High prices, low mileage range and battery replacement costs were other reported barriers to further adoption.

Future of Fleets: Path to EV Adoption Key Findings

- EVs are Coming: While only 14% of fleets operate EVs today, most fleets expect to own an EV in the next five years. The greatest adoption will come from fleets that already own and operate EVs.

- Costs – Challenges to Consider: Current factors around cost are reasons many fleets are not considering an EV. However, fleet EV incentive awareness is high and viewed favorably compared to the retail market.

- Charging Infrastructure Top of Mind: Faster charge times and longer driving range is needed to improve EV consideration. Charging station availability is a key concern for many fleets.

- Service & Maintenance Opportunities: EVs see maintenance services – including emergency service – performed slightly more often than ICE vehicles.

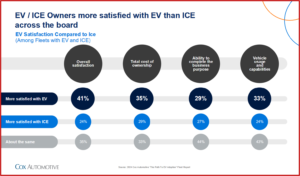

- Satisfaction with EVs: Generally speaking, fleet owners are more satisfied with EVs, including in total cost of ownership and capabilities.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Fleet Owners with EVs and Traditional Vehicles Favor EVs

Click to enlarge.

The latest research from Cox Automotive published today – Future of Fleets: Path to EV Adoption – shows that among other things that, compared to vehicles powered by internal-combustion engines (ICE), fleet owners operating both electric vehicles (EVs) and their traditional, fuel-burning counterparts have higher levels of satisfaction with their EVs. This despite higher acquisition costs as well as more frequent service and maintenance. Conducted in Q1 2024, the survey collected data from fleet decision-makers in various regions and across differing fleet sizes. “Data show that 14% of fleets presently operate EVs, with a significant trend toward EV adoption expected in the next five years,” Cox said.

“The electric-vehicle story is much larger than just the retail story,” said Zo Rahim, senior analyst of Research and Market Intelligence at Cox Automotive. “In many ways, electric vehicles can be an ideal solution for many fleet operations, which often have set routes of known distances, vehicles that routinely overnight in the same location, and operations that prioritize the cost of ownership. The fleet business is significant in the U.S. market, and we expect the EV share of the fleet market to expand in the coming years.”

Fleet operators that currently use EVs, the new study reveals, have a striking 90% likelihood of acquiring additional EVs in the next acquisition cycle. Among the total sample of fleets owners (those with and without EVs), a super majority – 87% – expect EVs to be added to their fleets in the next five years.

When asked, fleet owners forecast that the EV share of the average fleet in five years would be 43%. Among operators currently managing EVs, the projected share of EVs was even higher, at 58%, suggesting those with the most experience with EVs expect more rapid growth.

The research indicates that awareness of fleet EV incentives ,– can significantly lower acquisition costs, is high among operators and viewed more favorably compared to the retail market.

However, Cox noted that as in the retail business, barriers to greater EV adoption in the fleet business continue. Acquisition cost is a primary concern among fleet buyers, particularly for those considering EVs. Existing EV owners express concern about the lack of charging stations and supporting infrastructure. High prices, low mileage range and battery replacement costs were other reported barriers to further adoption.

Future of Fleets: Path to EV Adoption Key Findings

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.