Click for more.

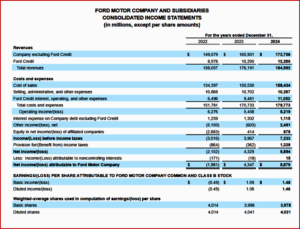

Ford Motor Company (NYSE: F) today posted Q4 full-year 2024 financial results. They were mixed from awful to okay. During 2024, Ford Blue’s revenue was flat at $101.9 billion as positive net pricing offset a 2% decline in wholesale vehicle transactions from what Ford said were the cancellation of low-margin products. The internal combustion engine segment at Ford’s earnings before taxes (EBIT) was $5.3 billion. Ford ModeE reported a full-year EBIT loss of $5.1 billion. The electric vehicle e segment delivered $1.4 billion in cost improvements, net of a $100 million increase in spending to launch new battery plants and next-generation electric vehicles, Ford said. For full-year 2024, revenue climbed 5% to $185 billion; net income was $5.9 billion, and adjusted EBIT was $10.2 billion. For 2025 Ford is predicting a $2 billion profit drop! Bloomberg says that 27% of analysts have a sell recommendation, the highest on record. (read AutoInformed.com on Ford Motor Shuffles Leadership Amid Trump Chaos and Ford Motor Posts 2023 Net Income of $4.3 Billion)

“Ford is becoming a fundamentally stronger company. We finished 2024 with a solid fourth quarter, capping the highest revenue year in Ford’s history,” said President and CEO Jim Farley. “Our product portfolio offers the broadest powertrain choice. And Ford Pro, with its mid-teen margins, leading market position, and growing service and repair revenue, provides unique advantages for continued growth. In 2025, we expect to make significantly more progress on our two biggest areas of opportunity – quality and cost – as we enter the heart of our Ford+ transformation. We control those key profit drivers, and I am confident that we are on the right path to create long-term value for all our stakeholders,” Farley claimed.*

Other Ford Full Year 2024 Results

- Ford Pro generated $9.0 billion in EBIT – a margin of 13.5%, in line with its target of mid-teens. Revenue increased 15% year-over-year to $66.9 billion. Paid software subscriptions increased 27% in 2024 to nearly 650,000 subscribers utilizing new solutions to boost the productivity of their fleets. Telematics grew nearly 100%.

- Ford Credit reported a full-year EBIT of $1.7 billion, an increase of $323 million compared to last year.

Full-Year 2025 Outlook

Ford anticipates full-year adjusted EBIT of $7.0 billion to $8.5 billion and to generate $3.5 billion to $4.5 billion in adjusted free cash flow, with capital expenditures of $8.0 billion to $9.0 billion. This guidance presumes headwinds related to market factors.

Ford Motor expects Q1 2025 adjusted EBIT to be roughly breakeven due to lower wholesales and unfavorable mix, including launch activity at major U.S. assembly plants, including Kentucky Truck and Michigan Assembly Plants. By segment, the outlook is for full-year 2025 EBIT of $7.5 billion to $8.0 billion from Ford Pro and $3.5 billion to $4.0 billion from Ford Blue; an EBIT loss of $5.0 billion to $5.5 billion for Ford Model E; and earnings before taxes of about $2.0 billion from Ford Credit. Ford plans to report Q1 2025 financial results after the close of market on Monday, April 28.

Ford’s Board of Directors today declared a first-quarter regular dividend of $0.15 per share, plus a supplemental dividend of $0.15 per share, payable on 3 March to shareholders of record on 18 February.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Posts Mixed Results for 2024

Click for more.

Ford Motor Company (NYSE: F) today posted Q4 full-year 2024 financial results. They were mixed from awful to okay. During 2024, Ford Blue’s revenue was flat at $101.9 billion as positive net pricing offset a 2% decline in wholesale vehicle transactions from what Ford said were the cancellation of low-margin products. The internal combustion engine segment at Ford’s earnings before taxes (EBIT) was $5.3 billion. Ford ModeE reported a full-year EBIT loss of $5.1 billion. The electric vehicle e segment delivered $1.4 billion in cost improvements, net of a $100 million increase in spending to launch new battery plants and next-generation electric vehicles, Ford said. For full-year 2024, revenue climbed 5% to $185 billion; net income was $5.9 billion, and adjusted EBIT was $10.2 billion. For 2025 Ford is predicting a $2 billion profit drop! Bloomberg says that 27% of analysts have a sell recommendation, the highest on record. (read AutoInformed.com on Ford Motor Shuffles Leadership Amid Trump Chaos and Ford Motor Posts 2023 Net Income of $4.3 Billion)

“Ford is becoming a fundamentally stronger company. We finished 2024 with a solid fourth quarter, capping the highest revenue year in Ford’s history,” said President and CEO Jim Farley. “Our product portfolio offers the broadest powertrain choice. And Ford Pro, with its mid-teen margins, leading market position, and growing service and repair revenue, provides unique advantages for continued growth. In 2025, we expect to make significantly more progress on our two biggest areas of opportunity – quality and cost – as we enter the heart of our Ford+ transformation. We control those key profit drivers, and I am confident that we are on the right path to create long-term value for all our stakeholders,” Farley claimed.*

Other Ford Full Year 2024 Results

Full-Year 2025 Outlook

Ford anticipates full-year adjusted EBIT of $7.0 billion to $8.5 billion and to generate $3.5 billion to $4.5 billion in adjusted free cash flow, with capital expenditures of $8.0 billion to $9.0 billion. This guidance presumes headwinds related to market factors.

Ford Motor expects Q1 2025 adjusted EBIT to be roughly breakeven due to lower wholesales and unfavorable mix, including launch activity at major U.S. assembly plants, including Kentucky Truck and Michigan Assembly Plants. By segment, the outlook is for full-year 2025 EBIT of $7.5 billion to $8.0 billion from Ford Pro and $3.5 billion to $4.0 billion from Ford Blue; an EBIT loss of $5.0 billion to $5.5 billion for Ford Model E; and earnings before taxes of about $2.0 billion from Ford Credit. Ford plans to report Q1 2025 financial results after the close of market on Monday, April 28.

Ford’s Board of Directors today declared a first-quarter regular dividend of $0.15 per share, plus a supplemental dividend of $0.15 per share, payable on 3 March to shareholders of record on 18 February.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.