Click to enlarge.

Ford Motor Company (NYSE: F) posted Q3 2024 of $46 billion; net income of $0.9 billion, including a previously announced $1 billion electric vehicle-related charge, as well as an adjusted EBIT of $2.6 billion. It’s stock is off ~9% in trading today. Cash flow from operations in Q3 was $5.5 billion, and adjusted free cash flow was $3.2 billion. At quarter-end, Ford had nearly $28 billion in cash and $46 billion in liquidity. It’s going to need it: Ford’s profit margin was razor-blade thin at 1.9%. Perhaps worse, full-year 2024 adjusted EBIT is now forecast at ~$10 billion. Nonetheless, Ford declared fourth-quarter regular dividend of 15 cents per share. Head hunters are also on the street looking for a new chief of staff.

“We are in a strong position with Ford+ as our industry undergoes a sweeping transformation,” claimed Ford President and CEO Jim Farley. “We have made strategic decisions and taken the tough actions to create advantages for Ford versus the competition in key areas like Ford Pro, international operations, software and next-generation electric vehicles. Importantly, over time, we have significant financial upside as we bend the curve on cost and quality, a key focus of our team.”

Business Segment Highlights / Lowlights

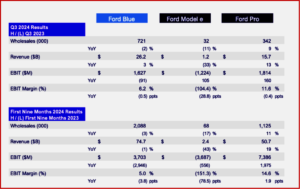

- In Q3 Ford Pro generated $1.8 billion in EBIT – with a margin of 11.6% – on revenue of $15.7 billion, a 13% increase from the same period a year ago. The segment’s consistent delivery of year-over-year revenue growth has been fueled by a fresh product lineup and robust demand for Super Duty trucks and Transit vans.

- Paid subscriptions to Ford Pro Intelligence were up 30% in the quarter to~ 630,000. Repair orders fulfilled by the company’s fleet of ~2400 mobile service vehicles grew by 70%. Ford said it underscores the huge customer demand for digital and remote experiences.

- Q3 revenue for Ford Blue was up 3% to $26.2 billion, despite a 2% decline in global wholesales due to discontinued low margin ICE passenger vehicles.

- North America volume grew by 8%, driven by newly launched trucks and SUVs that helped grow Ford’s market share in the U.S. during the quarter by 40 bps to 12.6%. Ford is essentially out of the car business.

- Ford Blue EBIT of $1.6 billion and margin of 6.2% were both down year-over-year, due to adverse exchange and higher manufacturing costs, offset partially by lower warranty expense and higher net pricing.

- Global hybrid vehicle sales increased 30% in the quarter, and the company’s hybrid mix remains on pace to approach 9% by year end, up over 2 points year-over-year, with more products on the way. Ford had 77% of the U.S. hybrid truck market by its count during the quarter, with hybrid truck sales up 42% in the third quarter.

- Q3 included strong truck sales as well as the launch of the all-new Ford Explorer and Lincoln Aviator in the U.S., with more refreshed and derivative products on the way, such as the Maverick pickup and Bronco Sport SUV in Q4 and the new Expedition and Navigator in early 2025.

- Cash flow from operations in the third quarter was $5.5 billion, and adjusted free cash flow was $3.2 billion. At quarter-end, Ford had nearly $28 billion in cash and $46 billion in liquidity, “providing considerable flexibility in a dynamic environment.”

- Ford Model e reported an EBIT loss of $1.2 billion. The $500 million of year-over-year cost improvements were offset by expected industry-wide pricing pressure. Ford claimed the segment continues to improve its profit trajectory, achieving almost $1 billion in cost improvements year-to-date.

- Ford continues to remove barriers to EV adoption by offering customers greater access to charging both at home, through the Ford Power Promise, and on the road through a growing charger network.

- Nearly 3000 Ford dealers are now able to sell electric vehicles. Ford claimed this as a competitive advantage as Ford reaches new customers in areas of the U.S. that might otherwise be slow to adopt electric vehicles.

- Ford Credit reported third-quarter earnings before taxes (EBT) of $544 million, an increase of $186 million year-over-year.

Full-Year 2024 Outlook

- Ford now expects adjusted EBIT of about $10 billion with adjusted free cash flow between $7.5 billion and $8.5 billion. Capital expenditures are expected to be between $8 – $8.5 billion.

- Full-year EBIT for Ford Pro is now expected to be about $9 billion, Ford Blue about $5 billion, and Model e a full-year loss of , gulp ,~$5 billion. Earnings before taxes from Ford Credit are now expected to be about $1.6 billion.

“We are remaking the company with Ford+ into a higher-growth, higher-margin, more capital-efficient and more durable business,” said Ford Vice Chair and CFO John Lawler. “The work we have done over the past few years to restructure our global business — and tailor our product lineup to segments where we know our customers best — is driving continued growth and generating stronger and more consistent cash flow.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Posts Weak Q3 Results. Stock Dropping on Cut Outlook

Click to enlarge.

Ford Motor Company (NYSE: F) posted Q3 2024 of $46 billion; net income of $0.9 billion, including a previously announced $1 billion electric vehicle-related charge, as well as an adjusted EBIT of $2.6 billion. It’s stock is off ~9% in trading today. Cash flow from operations in Q3 was $5.5 billion, and adjusted free cash flow was $3.2 billion. At quarter-end, Ford had nearly $28 billion in cash and $46 billion in liquidity. It’s going to need it: Ford’s profit margin was razor-blade thin at 1.9%. Perhaps worse, full-year 2024 adjusted EBIT is now forecast at ~$10 billion. Nonetheless, Ford declared fourth-quarter regular dividend of 15 cents per share. Head hunters are also on the street looking for a new chief of staff.

“We are in a strong position with Ford+ as our industry undergoes a sweeping transformation,” claimed Ford President and CEO Jim Farley. “We have made strategic decisions and taken the tough actions to create advantages for Ford versus the competition in key areas like Ford Pro, international operations, software and next-generation electric vehicles. Importantly, over time, we have significant financial upside as we bend the curve on cost and quality, a key focus of our team.”

Business Segment Highlights / Lowlights

Full-Year 2024 Outlook

“We are remaking the company with Ford+ into a higher-growth, higher-margin, more capital-efficient and more durable business,” said Ford Vice Chair and CFO John Lawler. “The work we have done over the past few years to restructure our global business — and tailor our product lineup to segments where we know our customers best — is driving continued growth and generating stronger and more consistent cash flow.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.