General Motors (NYSE: GM) today posted flat Q3 net earnings ($3.1 billion), but with pretax earnings up ~16%. GM’s adjusted earnings before interest and taxes were $4.1 billion in the quarter. Global revenue ~11% to $48.8 billion. North American pretax earnings rose 13% to ~$4 billion. Moreover, GM raised its earnings guidance for the third straight time this year. GM’s 2024 financial guidance includes anticipated capital spending of $10.5 billion – $11.5 billion, inclusive of investments in the company’s battery cell manufacturing joint ventures.

“In the third quarter, we grew U.S. retail market share with above-average pricing, well-managed inventories and below-average incentives. In China, sales improved from the second quarter, and dealer inventory fell sharply. In addition, we remain on track to reach our 2024 EV production and profitability targets,” said Mary Barra, GM Chair and CEO.

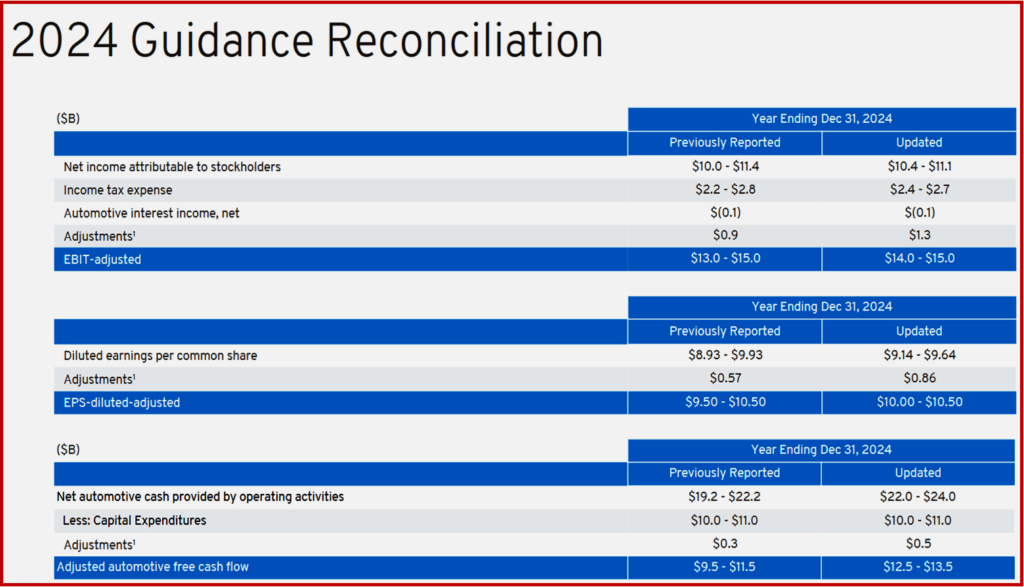

“This is a function of our investments in a dedicated EV platform, U.S. battery cell manufacturing and flexible assembly capacity. Most of our competitors lack these advantages. And no one can match the depth and breadth of our strategic EV portfolio. With our strong third quarter results, we now expect our full-year EBIT-adjusted to be in a range of $14 billion – $15 billion and we are raising our guidance for adjusted automotive free cash flow and earnings per share,” Barra said.

Executive Summary Q3 2024 Results

- Ongoing strength of core auto business driving consistent financial performance. Number 1 in total U.S. sales, #1 in full size Pickups and #1 in full-size SUVs, with incentives more than 2 full points below industry average.

- EBIT-Adj. guidance updated to $14-15 billion for the full-year with expected EPS diluted adjusted in the $10.00-10.50 range and Adj. Auto FCF $12.5-13.5B

- GMNA best quarterly revenue on record, $41.2 billion with 9.7% EBIT adj. margin, within our 8-10% target range.

- Reached Number 2 in U.S. EV sales for the quarter with ~32,000 deliveries, ~10% market share and incentives ~11ppts lower than the industry avg.

- GMF EBT of $0.7B, tracking in the range of $2.75-3.00 billion for the full year.

- Reduced diluted share count 19% YoY through ASR and open market repurchases.

GMNA Performance Q3 2024

- Best Quarter Revenue on record.

- Best Q3 YTD EBIT Adj. $12.3 billion.

- ~$50,000 U.S. ATP (average transaction price). With incentives ~2.4 ppts below U.S. industry average.

- ~0.5 ppts of U.S. Retail Market Share Gain YoY. Driven by robust customer demand for our enhanced vehicle portfolio.

- GMNA Strong EBIT-Adj. Margin of 9.7%, within our target range.

Management Expectations

- Remain disciplined on inventory management and incentive spend, supported by our strategic portfolio of products.

- Continue to introduce compelling and appealing vehicles that are more profitable than the outgoing models, including our most affordable entries.

- Targeting to produce and wholesale ~200,000 EVs in 2024.

- Expect positive EV variable profit in Q4 2024.

- On track to achieve our net $2 billion fixed-cost reduction program by the end of this year.

- Expect to drive consistently strong results in 2024 – 2025 to be in a similar range.

- Expect $2-4 billion EV profitability tailwind in 2025.

- Continue to consistently return excess free cash flow to shareholders, expect to be under 1 billion shares in early 2025.

Click to enlarge.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

General Motors Q3 2024 Earnings Up. Guidance Raised Again

General Motors (NYSE: GM) today posted flat Q3 net earnings ($3.1 billion), but with pretax earnings up ~16%. GM’s adjusted earnings before interest and taxes were $4.1 billion in the quarter. Global revenue ~11% to $48.8 billion. North American pretax earnings rose 13% to ~$4 billion. Moreover, GM raised its earnings guidance for the third straight time this year. GM’s 2024 financial guidance includes anticipated capital spending of $10.5 billion – $11.5 billion, inclusive of investments in the company’s battery cell manufacturing joint ventures.

“In the third quarter, we grew U.S. retail market share with above-average pricing, well-managed inventories and below-average incentives. In China, sales improved from the second quarter, and dealer inventory fell sharply. In addition, we remain on track to reach our 2024 EV production and profitability targets,” said Mary Barra, GM Chair and CEO.

“This is a function of our investments in a dedicated EV platform, U.S. battery cell manufacturing and flexible assembly capacity. Most of our competitors lack these advantages. And no one can match the depth and breadth of our strategic EV portfolio. With our strong third quarter results, we now expect our full-year EBIT-adjusted to be in a range of $14 billion – $15 billion and we are raising our guidance for adjusted automotive free cash flow and earnings per share,” Barra said.

Executive Summary Q3 2024 Results

GMNA Performance Q3 2024

Management Expectations

Click to enlarge.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.