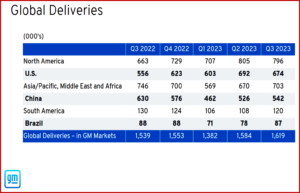

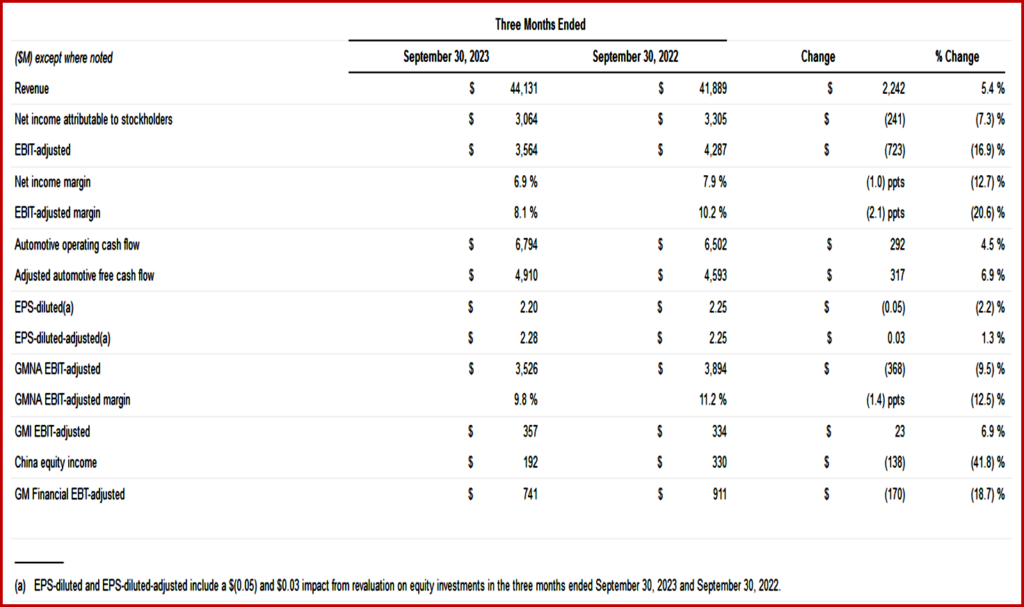

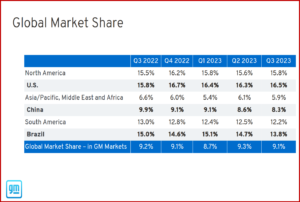

General Motors (NYSE: GM) today reported third-quarter 2023 revenue of $44.1 billion, net income attributable to stockholders of $3.1 billion and EBIT-adjusted of $3.6 billion on global sales of 981,000 vehicles.* The $3.6 billion includes ~$(0.2) billion of labor disruption impact, which was before the UAW struck GM’s most profitable plant this morning. The losses could be or evolve into a much higher number. At the moment GM is leading the Large SUV segment with more than 60% market share year-to-date, more than 3X nearest competitor. Moreover the Cadillac Escalade number one selling Large Luxury SUV and will add the all-electric Escalade IQ in 2024. GM’s US market share is up 0.7 percentage points year-over-year. (AutoInformed: UAW Strike at Arlington – GM’s Biggest, Most Profitable Plant)

“Our supply chain team and logistics partners in North America have done great work improving the flow of vehicles from our assembly plants to our dealers,” said GM CEO Mary Barra. “Our U.S. dealers helped us outperform the market with strong pricing and essentially flat incentives. We were profitable in every region, including China. And GM International excluding China is on track to deliver significantly higher EBIT-adjusted in 2023 compared to a year ago.

“Because we are in a highly competitive, cyclical industry, we have been laser focused on four fundamentals to further strengthen our position:

- Delivering vehicles that customers love and are willing to pay for.

- A competitive cost structure.

- Marketing efficiency and incentive discipline.

- Matching production to demand,” Barra said.

GM is the leader in sales of full-size pickups and large SUVs with Chevrolet Silverado and GMC Sierra combined sales up 29% YoY. This makes for 7 consecutive quarters of industry leadership. GMC Sierra sales up 46% YoY for best-ever third quarter and year-to-date sales.

GM also dominates the Large SUV segment with more than 60% market share year-to-date, which is more than 3X nearest competitor. GM generated $4.9 billion in Adjusted Automotive Free Cash Flow during Q3. The average transaction price Americans paid for a new vehicle in September was below $48,000 for the first time in more than a year. Higher inventory levels and increased incentives continued to put downward pressure on pricing, according to Kelley Blue Book.

Barra on the UAW Contract Dispute

“Regarding the ongoing strikes at some of our US. facilities: I know many of you are concerned about the impact of higher labor costs on our business in the United States. Let me address this head on. It’s been clear coming out of COVID that wages and benefits across the U.S. economy would need to increase because of inflation and other factors. “I believe that the offer we have on the table with the UAW is better than the contracts that employees at companies like Caterpillar, UPS, and Kaiser Permanente have ratified. The current offer is the most significant that GM has ever proposed to the UAW, and the majority of our workforce will make $40.39 per hour, or roughly $84,000 a year by the end of this agreement’s term,” Barra said.

“It also includes the cost of living reinstatement, a 25% increase to the company’s 401(k) contributions, world-class healthcare with no out-of-pocket premiums or deductibles for our senior members, and enhanced paid time off, and several other benefits,” said Barra. (AutoInformed: GM Increases Contract Offer for UAW Members)

“Since negotiations started this summer, we’ve been available to bargain 24/7 on behalf of our represented team members and our company. They’ve demanded a record contract – and that’s exactly what we’ve offered for weeks now: a historic contract with record wage increases, record job security and world-class healthcare.

“It’s an offer that rewards our team members but does not put our company and their jobs at risk. Accepting unsustainably high costs would put our future and GM team member jobs at risk, and jeopardizing our future is something I will not do.

“Clearly, given the industry’s changing pricing and demand outlook and higher labor costs, we have work to do to ensure we achieve low to mid-single-digit EBIT EV margin targets in 2025, and grow our revenue and sustain strong 8-10% EBIT margins in North America. The work has already begun and I’m confident we will achieve our targets and grow from there,” Barra said. However, Barra said the launches of Chevrolet Equinox EV, the Silverado EV RST, and the GMC Sierra EV Denali will be delayed by a “few months each” as GM continues to work on cost cutting.

AutoInformed notes here that GM has retracted its full year earnings guidance pending further updates. “When we do reach an agreement, we will schedule an event shortly thereafter to discuss the economics and our strategy for managing them,” Barra said.

During Q3 GM Financial posted net income of $558 million for the quarter ended September 30, 2023, compared to $571 million for the quarter ended June 30, 2023, and $688 million for the quarter ended September 30, 2022. Net income for the nine months ended September 30, 2023 was $1.7 billion, compared to $2.5 billion for the nine months ended September 30, 2022.

Retail loan originations were $9.5 billion for the quarter ended September 30, 2023, compared to $9.1 billion for the quarter ended June 30, 2023, and $9.4 billion for the quarter ended September 30, 2022.

Retail loan originations for the nine months ended September 30, 2023 were $27.7 billion, compared to $26.4 billion for the nine months ended September 30, 2022. The outstanding balance of retail finance receivables, net of fees was $71.7 billion at September 30, 2023, compared to $69.7 billion at June 30, 2023 and $63.5 billion at September 30, 2022.

*General Motors Company’s (GM) non-GAAP measures include: earnings before interest and taxes (EBIT)-adjusted, presented net of non-controlling interests; earnings before income taxes (EBT)-adjusted for our General Motors Financial Company, Inc. (GM Financial) segment; earnings per share (EPS)-diluted-adjusted; effective tax rate-adjusted (ETR-adjusted); return on invested capital-adjusted (ROIC-adjusted) and adjusted automotive free cash flow. GM’s calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related U.S. GAAP measures, according to GM.

“Thank you, Mary, and good morning, everyone. I would like to start by thanking our team members for once again delivering strong results in the face of several challenges. To those employees that continue to build vehicles through the uncertainties of the UAW strike, thank you for your focus, your commitment to quality, and passion to deliver great products to our customers. In Q3, the UAW strike had a roughly $200 million EBIT impact, and so far in Q4, we estimate the lost production has had an incremental $600 million EBIT impact.

“Moving forward, we estimate that the impact of the UAW strike to be approximately $200 million per week based on the facilities impacted as of yesterday. We’re not going to speculate on the duration and the extent of the UAW strike, and because of this uncertainty, we’ve chosen to withdraw our 2023 full-year guidance metrics even though our strong underlying business fundamentals were pushing us toward the upper half of the range prior to any strike impacts. After we have a ratified contract, we will provide an investor update to quantify the final impact of the strike, as well as labor costs moving forward. Despite these challenges, we’re already working to offset the incremental costs,” said Paul Jacobson.

Paul Jacobson is Executive Vice President; Chief Financial Officer at General Motors. He made these remarks on the earnings call this morning – AutoCrat.