On 22 May the U.S. House of Representatives passed its budget reconciliation bill. The bill – among other economic disasters for U.S. inhabitants and businesses – includes proposals to alter existing federal energy tax credits, from fast elimination of several credits, to new phase-down schedules, and adding new requirements, including provisions related to foreign entities of concern. Are any of our representatives paying attention to Chinese state-owned and directed capitalism? Take a look at the Chinese lead in new energy vehicles, the adoption of solar energy, the making of 21st century industrial goods and above all the funding of University research in advanced transportation products, manufacturing technologies and medical drugs. AutoInformed notes that Trump’s falsely named big, beautiful bill, along with his obsession with job destroying and inflation creating tariffs – among other things – adds up to negative numbers for our economy. Republicans flunk math.

“Existing energy tax credits have enjoyed decades of bipartisan support and are key to driving America’s energy expansion as we face unprecedented energy demand. Our coalition is urging the Senate to protect American jobs, boost competitiveness, bolster energy security, and support domestic manufacturing and energy development,” said Business Council for Sustainable Energy (BCSE) President Lisa Jacobson.

During the past few years, BCSE claims these energy tax credits have spurred:

- More than 400,000 new energy jobs across 48 states and Puerto Rico.

- 260+ new manufacturing facilities.

- $133 billion invested in private sector solar, wind, storage, clean vehicle, and grid/electrification projects.

As the legislation moves to the Senate, BCSE made the following comments on specific provisions of the bill. (Caveat as a diverse business coalition, not all BCSE members support or take a position on the recommendations outlined below.)

- “BCSE is pleased to see the continuation or extension of tax credits supporting energy efficiency in commercial buildings (179D), carbon capture and storage (45Q), and clean fuels production (45Z). Our coalition also supports the continuation of direct pay provisions.

- “As Congress moves forward in the reconciliation process, our coalition advocates for reinstating longstanding bipartisan credits that support energy efficiency (25C and 45L), residential solar (25D), and hydrogen (45V), among others.

- “The loss of the residential energy efficiency and solar credits is detrimental to millions of homeowners, families, and individuals nationwide. 25C, 45L, and 25D are the only residential tax credits available and empower families directly by reducing waste and lowering energy bills. For example, according to Treasury Department data, more than 2.3 million American households took advantage of the 25C homeowner efficiency improvement credit in 2023, taking an average credit of nearly $900. Eliminating 25D would cost 9.5 GW of power over five years and cut 75,000 – 85,000 jobs by 2026 and up to 250,000 by 2028.

- “Hydrogen has bipartisan support. Eliminating Section 45V will strand investment, halt project development, and cede America’s leadership in a competitive industry. On May 13, BCSE joined the Fuel Cell & Hydrogen Energy Association and more than 100 businesses in urging Congressional leadership to reinstate the 45V tax credit for production of clean hydrogen and recognize its vital role in securing America’s energy future.

“BCSE also offers suggestions to protect long term business certainty in the tax code and avoid market disruption:

- Transferability: Transferability brings additional private investment to energy generation and manufacturing, maximizes the value of every tax credit, and supports cutting-edge technologies like enhanced geothermal and long-duration storage. It should be available for the lifetime of each credit, not ended prematurely.

- Foreign entity of concern language: The “foreign entity of concern” language is overly complex, uncertain, and proscriptive and can be clarified and streamlined. In practice, the requirements would be difficult for the IRS to implement. As written, these FEOC restrictions will undermine American competitiveness – particularly against China – by restricting energy production and undercutting domestic advanced energy manufacturing.

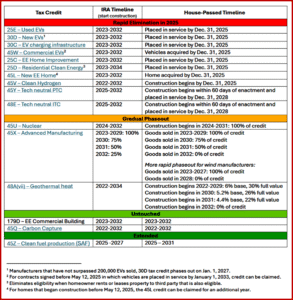

- Technology-neutral credits: The House-passed bill terminates the credits unless a project has started construction within a time period of 60 days after the bill’s enactment and is placed in service by December 31, 2028. This timeline will cause significant disruption to projects under development and will stop vital energy sector investments and job creation needed to win the global energy race.

As the Senate now considers changes to the tax code through budget reconciliation, BCSE looks forward to providing practical industry expertise to policymakers and refining the proposals to ensure a smoother transition for businesses currently utilizing the energy tax credits.” BCSE said.