Magna (TSX: MG. NYSE: MGA) today posted Q3 2025 earnings of U.S. $613 million (EBIT) compared to $594 million in the third quarter of 2024. Subject to the approval by the Toronto Stock Exchange, the Magna Board of Directors approved a new Normal Course Issuer Bid (NCIB) to purchase up to ~25.3 million of Magna Common Shares, representing 10% of the public float. This NCIB is expected to be effective on 7 November 2025 and will terminate no later than 6 November 2026.

“Our strong third quarter performance exceeded our expectations and underscores the resilience of our business amid dynamic operating conditions and evolving macroeconomic trends. These results reflect the strength of our global team and the effectiveness of our strategic execution,” said Swamy Kotagiri, Magna Chief Executive Officer.

Magna Q3 2025 at a Glance

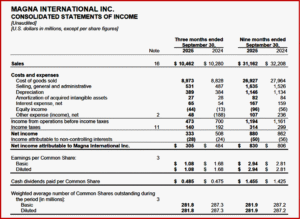

Magna posted sales of U.S. $10.5 billion for the third quarter of 2025, an increase of 2% from the third quarter of 2024. The higher sales largely reflects:

- The launch of new programs.

- The net strengthening of foreign currencies against the U.S. dollar.

- 3% higher global light vehicle production.

These elements were partially offset by:

- The end of production of certain programs.

- Lower complete vehicle assembly volumes, substantially due to the end of production of the Jaguar I-Pace and E-Pace.

- Net customer price concessions subsequent to the third quarter of 2024.

- Lower production on certain programs.

Adjusted EBIT increased to $613 million in the third quarter of 2025 compared to $594 million in the third quarter of 2024. This mainly reflects:

- Continued productivity and efficiency improvements, including the benefit of our operational excellence initiatives and recent restructuring activities.

- Higher equity income.

These were partially offset by:

- Commercial items in the third quarters of 2025 and 2024, which had a net unfavorable impact on a year-over-year basis.

- Higher tariff costs.

Income from operations before income taxes decreased to $473 million for the third quarter of 2025 compared to $700 million in the third quarter of 2024, which includes Other expense (income), net items and Amortization of acquired intangibles totaling $75 million and ($160) million in the third quarters of 2025 and 2024, respectively. The most significant item in Other expense (income) in either period was the positive impact of recognizing $196 million of Fisker deferred revenue in the third quarter of 2024 as the associated agreements were cancelled. Excluding Other expense (income), net and Amortization of acquired intangibles from both periods, income from operations before income taxes increased $8 million in the third quarter of 2025 compared to the third quarter of 2024, largely reflecting the increase in Adjusted EBIT.

Net income attributable to Magna International Inc. was $305 million for the third quarter of 2025 compared to $484 million in the third quarter of 2024. Excluding Other expense (income), net, after tax and Amortization of acquired intangibles from both periods, net income attributable to Magna International Inc. increased $6 million in the third quarter of 2025 compared to the third quarter of 2024.

Diluted earnings per share were $1.08 in the third quarter of 2025, compared to $1.68 in the comparable period. Adjusted diluted earnings per share were $1.33, compared to $1.28 for the third quarter of 2024, an increase of 4%. The increase in adjusted diluted earnings per share reflects the impacts of higher adjusted EBIT and a lower share count resulting from share repurchases over the past 12 months.

In the third quarter of 2025, we generated cash from operations before changes in operating assets and liabilities of $787 million and $125 million in operating assets and liabilities. Investment activities for the third quarter of 2025 included $267 million in fixed asset additions, a $100 million increase in investments, other assets and intangible assets, and $2 million in private equity investments.

Other expense (income), net is comprised of restructuring activities, loss (gain) on sales of public equity investments, revaluations of certain public and private equity investments and public company warrants, asset impairments, Fisker Inc. [“Fisker”] related impacts (recognition of previously deferred revenue, restructuring, impairment of Fisker. And gain on business combination during the three and nine months ended September 30, 2025 & 2024.

*AutoInformed on

Magna International Inc. (TSX: MG; NYSE: MGA) announced on 5 Nov. 2025 “that the Toronto Stock Exchange’s (the “TSX”) acceptance of its notice of intention to renew its normal course issuer bid (the “Notice”). Pursuant to the Notice, Magna may now purchase up to 25,300,000 Magna Common Shares (the “NCIB”), representing approximately 10% of its public float. As at 31 October 2025, Magna had 281,814,257 issued and outstanding Common Shares, including a public float of 253,107,846 Common Shares.

“The primary purposes of the NCIB are to facilitate purchases for cancellation, as well as purchases to fund Magna’s stock-based compensation awards and programs. Magna may purchase its Common Shares for cancellation, from time to time, if it believes that the market price of its Common Shares is attractive and that the purchase would be an appropriate use of corporate funds and in the best interests of the Corporation. Magna may elect to modify, suspend or discontinue the NCIB, and purchases.”