Click to enlarge.

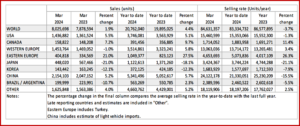

The Global Light Vehicle (LV) selling rate stood at 85 million units/year in March, roughly the same with February 2024, according to numbers and analysis released by the GlobalData* consultancy. Worldwide, 8.0 million vehicles were sold last month, a 2% improvement year-on-year (YoY), with year-to-date (YTD) sales up slightly more than 4%. (Read AutoInformed on: February Global Light Vehicle Sales at 85M Annual Rate)

This was a mixed picture at a regional level in terms of selling rate evolution. “In the US, the selling rate was a little lower month-on-month (MoM), though it remains solid, supported by continued easing of prices and the increasing of incentives. China’s selling rate** accelerated from a weak February, while Europe saw a moderate decline in selling rates,” said the Global Light Vehicle Sales Forecasting Team.

GlobalData Commentary and Observations

- The US Light Vehicle market increased in March 2024 by 5.5% YoY, with sales growing to 1.44 million units. The selling rate slightly slowed in March to 15.5 million units/year, down from the 15.8 million units/year reported in February, according to preliminary results. Growth has been supported by the fact that transaction prices continue to slow, dropping to US$44,209 in March, a decrease $341 on a month-over-month basis. Incentives continued to grow, with March marking the fifth consecutive month of incentives exceeding $2000, at $2836.

- Canadian Light Vehicle sales reached almost 159,000 – up by 7.2% YoY. The selling rate declined in March, to 1.71 million units/year, down from 1.93 million units/year in February.

- Mexican sales grew slightly by 5.5% YoY in March, to 125,000. The Mexican market continues to be buoyant, with the selling rate coming in at 1.46 million units/year in March, in line with its performance in the first two months of the year, but pacing well ahead of the year-ago rate.

Europe

- The Western Europe LV selling rate fell MoM to 13 million units/year in March, with sales down 1% YoY. March’s selling rate remains 20% below pre-pandemic March 2019’s result. Despite a weaker result last month, YTD sales totaled 3.5 million units, an improvement of 5.8% for the same period in 2023. While the economic backdrop remains challenging, the market is still expected to grow for the 2024 full year, supported by some easing of vehicle prices.

- The Eastern Europe LV selling rate fell MoM to 4.7 million units/year in March, although sales increased by 21% YoY. The market finished Q1 strongly, with total sales of more than 1 million units (+28%YoY). This was helped by continued strong performance in Turkey, and robust recovery in Ukraine and Russia.

China

- Preliminary data indicates that China’s domestic automotive market accelerated in March after a slow start to the New Year. The March selling rate was 24.1 million units/year, ~18% increase from a weak February. That, however, brought the Q1 2024 average rate to only 21.3 million units/year, a significant slowdown, compared to the Q4 2023 average of 26 million units/year. YoY domestic Passenger Vehicle sales (wholesales, excluding exports) increased by 5.4% in March and 6.2% in Q1, with growth are exaggerated by depressed year-ago sales.

- Passenger Vehicle exports expanded by 34% YoY in Q1, signaling that China’s automotive industry continued to rely on exports to offset a slack in the domestic market.

- It appears that many consumers are taking a wait-and-see approach amid the intensifying price war. The official consumer confidence index hit a record low in February, suggesting that consumers are tightening spending, too. The central government has instructed local governments to introduce policy and financial support for trading-in consumer goods, including vehicles. Shanghai has already started a cash subsidy program for trade-ins, and other local governments are expected to follow suit. There is a chance that the government will launch more stimulus measures

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**During 2024 GlobalData are excluding exports from the China sales total, where we had previously been including them. We have backdated this adjustment to 2018.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

March 2024 Global Light Vehicle Sales Effectively Flat

Click to enlarge.

The Global Light Vehicle (LV) selling rate stood at 85 million units/year in March, roughly the same with February 2024, according to numbers and analysis released by the GlobalData* consultancy. Worldwide, 8.0 million vehicles were sold last month, a 2% improvement year-on-year (YoY), with year-to-date (YTD) sales up slightly more than 4%. (Read AutoInformed on: February Global Light Vehicle Sales at 85M Annual Rate)

This was a mixed picture at a regional level in terms of selling rate evolution. “In the US, the selling rate was a little lower month-on-month (MoM), though it remains solid, supported by continued easing of prices and the increasing of incentives. China’s selling rate** accelerated from a weak February, while Europe saw a moderate decline in selling rates,” said the Global Light Vehicle Sales Forecasting Team.

GlobalData Commentary and Observations

Europe

China

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**During 2024 GlobalData are excluding exports from the China sales total, where we had previously been including them. We have backdated this adjustment to 2018.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.