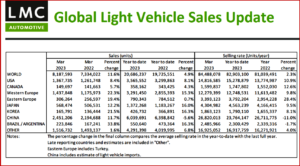

Click for more data.

The Global Light Vehicle (LV) Seasonally Adjusted Annual Rate (SAAR) rose to 84 million units/year in March, compared to February’s 81 million, according to data just released by the respected LMC Automotive consultancy.* Many countries reported an easing of supply shortages, seen in the increased raw monthly registration figure of 8.2 million units – representing growth of ~12% Year-over-Year. (autoinformed.com on: February Global Light Vehicle Sales Up 11% at 6.5 Million)

The month-on-month (MoM) improvement in the SAAR is largely attributed to the rebounding of the China market as customers took advantage of expiring tax incentives before April, in LMC’s view.

Relatedly, both the North American market and the Western Europe markets saw YoY improvements when compared against a very weak 2022. Eastern Europe showed the first positive YoY growth in March since the beginning of the Ukraine conflict in February 2022, LMC noted.

North America

The US Light Vehicle market sales increased by 8.4% YoY, to 1.4 million units. The selling rate braked to 14.8 million units/year in March, down from 15.0 million units/year in February, “but that was still an upbeat result by recent standards. As inventory levels improved and pressure from the semiconductor shortage eased, there was a MoM decline in average transaction price to US$45,837,” LMC said.

Canadian March Light Vehicle raw sales were 150,000 units, up by 5.7% YoY. This increased by more than 40,000 units compared to February, as Spring selling began. “Despite this healthy growth, the selling rate slowed from 1.7 million units/year in February, to 1.6 million units/year in March. Light Vehicle sales in Mexico continued their strong run in 2023 with another robust result of 120k units in March, this up by 25.1% YoY. Preliminary estimates for the selling rate in 2023 showed a decline to 1.2 million units/year, lower than both January and February,” LMC said.

Europe

The West European selling rate dropped from 13.5 million units/year in February to 12.3 million units/year in March. “The general picture remains somewhat more positive than last year. In preliminary raw monthly terms, March registered 1.44 million units, up 22.3% YoY, helped by an easing of supply constraints strengthening the pace of deliveries to customers,” LMC said.

The East European selling rate fell considerably from February to March at 3.4 million units/year. The Ukraine war still encumbers the LV market activity in the region, with preliminary raw registrations at 306,000 units, down 19.4% YoY. Russia’s YTD raw registrations fell more than 43% YoY.

China

After slow-moving January and February, the Chinese market returned in March. “According to preliminary data, the March selling rate reached a 5‐month high of 26.8 million units/year, up 28% from an abnormally weak February. That, however, brought the YTD average selling rate to only 23.8 million units/year. In YoY terms, sales increased by 12% in March, but declined by 5.6% in Q1. Light Commercial Vehicle sales accelerated at a much faster rate than those of Passenger Vehicles, as economic activity normalized after the pandemic and the Chinese New Year,” LMC said.

“Despite many consumers taking a wait‐and‐see approach amidst the price war, they apparently decided to buy vehicles in March before heavy discounts and the provincial governments’ temporary tax incentives expire (some of them will end in April). New Electric Vehicles remain the key market factor, with their sales expanding by about 35% YoY. Yet, it is reported that dealers are still left with a large stock of vehicles that need to be sold before the implementation of the new State VI‐B emission standard on 1 July, LMC observed.

Elsewhere in Asia

In Japan, the selling rate reached 4.3 million units/year in March and averaged a “solid 4.6 million units/year in Q1, even though high inflation and falling real wages eroded consumers’ purchasing power,” LMC said. As component shortages eased “markedly,” makers increased production and hence supply. “Yet, the delivery periods for many models do not appear to be shortening, ranging from 3‐6 months to 3‐4 years. That indicates that the market still has a significant number of pending orders,” LMC said.

In Korea, the March selling rate was 1.86 million units/year, bringing the Q1 average to 1.8 million units/year. Improved supplies of semiconductors allowed normal operation, and makers increased deliveries to dealerships to meet “many backlogged orders. New model launches by Hyundai and Kia boosted sales as well. Sales of EVs were brisk, supported by the recent government BEV subsidies,” LMC said.

South America

Brazilian LV sales are estimated to have increased by 38.1% YoY in March, to 190,0000 units. The selling rate saw another increase to 2.1 million units/year, up from 1.9 million in February. “Inventory levels are continuing to increase as stocks reached 205k units in March, as well as days’ supply increasing from 29 days in February to 31 days in March. Both sales and production increased last month, but there were some issues on the production side with facility stoppages, as well as shift reductions,” LMC said.

In Argentina, Light Vehicle sales are estimated to have increased to 373 000 units, up by 16.1% YoY. The selling rate increased in March to 420,0000 units/year, up from 398,0000 units/year in February. This is the first month this year in which estimates have exceeded 400,000. “Although still below historical levels, for now the market appears resilient in the face of economic headwinds and import restrictions,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s international clients include auto and truck makers, component manufacturers and suppliers, financial and logistics firms, as well as government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector.

The Global Light Vehicle Sales Forecast published in association with Jato Dynamics Ltd. builds on macro‐economic forecasts generated by LMC partner, the renowned Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve‐year forecasts at a global, regional and country levels for Light Vehicle demand in 137 countries. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

March Global Light Vehicles Sales Up 12%

Click for more data.

The Global Light Vehicle (LV) Seasonally Adjusted Annual Rate (SAAR) rose to 84 million units/year in March, compared to February’s 81 million, according to data just released by the respected LMC Automotive consultancy.* Many countries reported an easing of supply shortages, seen in the increased raw monthly registration figure of 8.2 million units – representing growth of ~12% Year-over-Year. (autoinformed.com on: February Global Light Vehicle Sales Up 11% at 6.5 Million)

The month-on-month (MoM) improvement in the SAAR is largely attributed to the rebounding of the China market as customers took advantage of expiring tax incentives before April, in LMC’s view.

Relatedly, both the North American market and the Western Europe markets saw YoY improvements when compared against a very weak 2022. Eastern Europe showed the first positive YoY growth in March since the beginning of the Ukraine conflict in February 2022, LMC noted.

North America

The US Light Vehicle market sales increased by 8.4% YoY, to 1.4 million units. The selling rate braked to 14.8 million units/year in March, down from 15.0 million units/year in February, “but that was still an upbeat result by recent standards. As inventory levels improved and pressure from the semiconductor shortage eased, there was a MoM decline in average transaction price to US$45,837,” LMC said.

Canadian March Light Vehicle raw sales were 150,000 units, up by 5.7% YoY. This increased by more than 40,000 units compared to February, as Spring selling began. “Despite this healthy growth, the selling rate slowed from 1.7 million units/year in February, to 1.6 million units/year in March. Light Vehicle sales in Mexico continued their strong run in 2023 with another robust result of 120k units in March, this up by 25.1% YoY. Preliminary estimates for the selling rate in 2023 showed a decline to 1.2 million units/year, lower than both January and February,” LMC said.

Europe

The West European selling rate dropped from 13.5 million units/year in February to 12.3 million units/year in March. “The general picture remains somewhat more positive than last year. In preliminary raw monthly terms, March registered 1.44 million units, up 22.3% YoY, helped by an easing of supply constraints strengthening the pace of deliveries to customers,” LMC said.

The East European selling rate fell considerably from February to March at 3.4 million units/year. The Ukraine war still encumbers the LV market activity in the region, with preliminary raw registrations at 306,000 units, down 19.4% YoY. Russia’s YTD raw registrations fell more than 43% YoY.

China

After slow-moving January and February, the Chinese market returned in March. “According to preliminary data, the March selling rate reached a 5‐month high of 26.8 million units/year, up 28% from an abnormally weak February. That, however, brought the YTD average selling rate to only 23.8 million units/year. In YoY terms, sales increased by 12% in March, but declined by 5.6% in Q1. Light Commercial Vehicle sales accelerated at a much faster rate than those of Passenger Vehicles, as economic activity normalized after the pandemic and the Chinese New Year,” LMC said.

“Despite many consumers taking a wait‐and‐see approach amidst the price war, they apparently decided to buy vehicles in March before heavy discounts and the provincial governments’ temporary tax incentives expire (some of them will end in April). New Electric Vehicles remain the key market factor, with their sales expanding by about 35% YoY. Yet, it is reported that dealers are still left with a large stock of vehicles that need to be sold before the implementation of the new State VI‐B emission standard on 1 July, LMC observed.

Elsewhere in Asia

In Japan, the selling rate reached 4.3 million units/year in March and averaged a “solid 4.6 million units/year in Q1, even though high inflation and falling real wages eroded consumers’ purchasing power,” LMC said. As component shortages eased “markedly,” makers increased production and hence supply. “Yet, the delivery periods for many models do not appear to be shortening, ranging from 3‐6 months to 3‐4 years. That indicates that the market still has a significant number of pending orders,” LMC said.

In Korea, the March selling rate was 1.86 million units/year, bringing the Q1 average to 1.8 million units/year. Improved supplies of semiconductors allowed normal operation, and makers increased deliveries to dealerships to meet “many backlogged orders. New model launches by Hyundai and Kia boosted sales as well. Sales of EVs were brisk, supported by the recent government BEV subsidies,” LMC said.

South America

Brazilian LV sales are estimated to have increased by 38.1% YoY in March, to 190,0000 units. The selling rate saw another increase to 2.1 million units/year, up from 1.9 million in February. “Inventory levels are continuing to increase as stocks reached 205k units in March, as well as days’ supply increasing from 29 days in February to 31 days in March. Both sales and production increased last month, but there were some issues on the production side with facility stoppages, as well as shift reductions,” LMC said.

In Argentina, Light Vehicle sales are estimated to have increased to 373 000 units, up by 16.1% YoY. The selling rate increased in March to 420,0000 units/year, up from 398,0000 units/year in February. This is the first month this year in which estimates have exceeded 400,000. “Although still below historical levels, for now the market appears resilient in the face of economic headwinds and import restrictions,” LMC said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s international clients include auto and truck makers, component manufacturers and suppliers, financial and logistics firms, as well as government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector.

The Global Light Vehicle Sales Forecast published in association with Jato Dynamics Ltd. builds on macro‐economic forecasts generated by LMC partner, the renowned Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve‐year forecasts at a global, regional and country levels for Light Vehicle demand in 137 countries. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.