Click for more GlobalData.

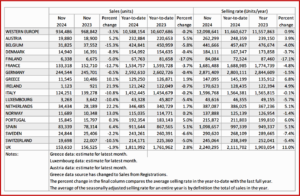

Car sales in Western Europe sold at an annual rate of 12.1 million units/year in November,* a continuation of the improvement seen in October, according to the latest data released today by the respected GlobalData consultancy.** The year-on-year (YoY) comparisons showed sales volumes were down 3.5%. Italy and France were the biggest losers in November as sales were down 10.8% and 12.7% YoY respectively. The UK as well as Germany also saw declines, while growth in Spain remains strong with registrations in November up 6.4% YoY.

“Year-to-date (YTD) sales experienced a slight decline of 0.2% compared to the first eleven months of 2023. The recent collapse of both the German and French governments has heightened political uncertainty in the region. Despite support coming from rate cuts and new model introductions in2025, the combination of political headwinds, high pricing and challenges faced by domestic manufacturers will continue to challenge market activity in the short term,” the GlobalData European Light Vehicle Sales Forecasting Team said.

GlobalData observations

The car (PV or passenger vehicle) selling rate for Western Europe improved to 12.1 million units/year in November; however, YoY comparisons remain unfavorable, and overall sales in 2024 are set to fall short of 2023. We believe that growth should uptick in 2025 with the introduction of new models and more monetary easing. Despite this, ongoing geopolitical tensions, as well as the collapse of the German and French government, bring great uncertainty that is expected to drag on sales.

The German PV market remained broadly flat in November at 245,000 units, a 0.5% decline YoY. The selling rate improved 2.5% MoM to 2.87 million units/year. YTD sales reached 2.59 million units and almost certainly will not surpass 2023’s total sales. EV sales fell once again, down 21.8% YoY, highlighting the clear need for incentives and subsidies to stimulate sales.

Italy’s PV market fell for a fourth consecutive month in November as new car registrations fell nearly 11% YoY to 124,000 units. The selling rate rose to 1.6 million units/year, an increase of 3.8% MoM. There is now an emphasis on shifting the focus of government resources to the supply side and supporting companies as they face an energy transition. EV sales fell by17.5% YoY in November.

The French PV market declined by 12.7% to 133,000 units in November. The selling rate rose by 6.8% MoM to1.68 million units/year. PV sales have now fallen for seven consecutive months YoY. As political uncertainty reaches its peak, consumer confidence has fallen even further.

The UK PV market fell 1.9% YoY to 154,000 units in November. The selling rate improved 5.8% MoM to 2.24 million units/year. YTD sales stand at 1.81 million units, a near 3% improvement from the same period in 2023. However, demand from private buyers continued to decline, down 3.3% YoY.

The Spanish PV market registered 83,000 in November, a growth of 6.4% YoY. YTD sales now stand at 912,000 units, a 5% increase compared to the same period last year. Rental companies continue to drive demand, while purchases by individuals remain stagnant. Furthermore, EV sale remained disappointing as sales were down 7.8% YoY.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

November Western European Car Sales Up

Click for more GlobalData.

Car sales in Western Europe sold at an annual rate of 12.1 million units/year in November,* a continuation of the improvement seen in October, according to the latest data released today by the respected GlobalData consultancy.** The year-on-year (YoY) comparisons showed sales volumes were down 3.5%. Italy and France were the biggest losers in November as sales were down 10.8% and 12.7% YoY respectively. The UK as well as Germany also saw declines, while growth in Spain remains strong with registrations in November up 6.4% YoY.

“Year-to-date (YTD) sales experienced a slight decline of 0.2% compared to the first eleven months of 2023. The recent collapse of both the German and French governments has heightened political uncertainty in the region. Despite support coming from rate cuts and new model introductions in2025, the combination of political headwinds, high pricing and challenges faced by domestic manufacturers will continue to challenge market activity in the short term,” the GlobalData European Light Vehicle Sales Forecasting Team said.

GlobalData observations

The car (PV or passenger vehicle) selling rate for Western Europe improved to 12.1 million units/year in November; however, YoY comparisons remain unfavorable, and overall sales in 2024 are set to fall short of 2023. We believe that growth should uptick in 2025 with the introduction of new models and more monetary easing. Despite this, ongoing geopolitical tensions, as well as the collapse of the German and French government, bring great uncertainty that is expected to drag on sales.

The German PV market remained broadly flat in November at 245,000 units, a 0.5% decline YoY. The selling rate improved 2.5% MoM to 2.87 million units/year. YTD sales reached 2.59 million units and almost certainly will not surpass 2023’s total sales. EV sales fell once again, down 21.8% YoY, highlighting the clear need for incentives and subsidies to stimulate sales.

Italy’s PV market fell for a fourth consecutive month in November as new car registrations fell nearly 11% YoY to 124,000 units. The selling rate rose to 1.6 million units/year, an increase of 3.8% MoM. There is now an emphasis on shifting the focus of government resources to the supply side and supporting companies as they face an energy transition. EV sales fell by17.5% YoY in November.

The French PV market declined by 12.7% to 133,000 units in November. The selling rate rose by 6.8% MoM to1.68 million units/year. PV sales have now fallen for seven consecutive months YoY. As political uncertainty reaches its peak, consumer confidence has fallen even further.

The UK PV market fell 1.9% YoY to 154,000 units in November. The selling rate improved 5.8% MoM to 2.24 million units/year. YTD sales stand at 1.81 million units, a near 3% improvement from the same period in 2023. However, demand from private buyers continued to decline, down 3.3% YoY.

The Spanish PV market registered 83,000 in November, a growth of 6.4% YoY. YTD sales now stand at 912,000 units, a 5% increase compared to the same period last year. Rental companies continue to drive demand, while purchases by individuals remain stagnant. Furthermore, EV sale remained disappointing as sales were down 7.8% YoY.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.