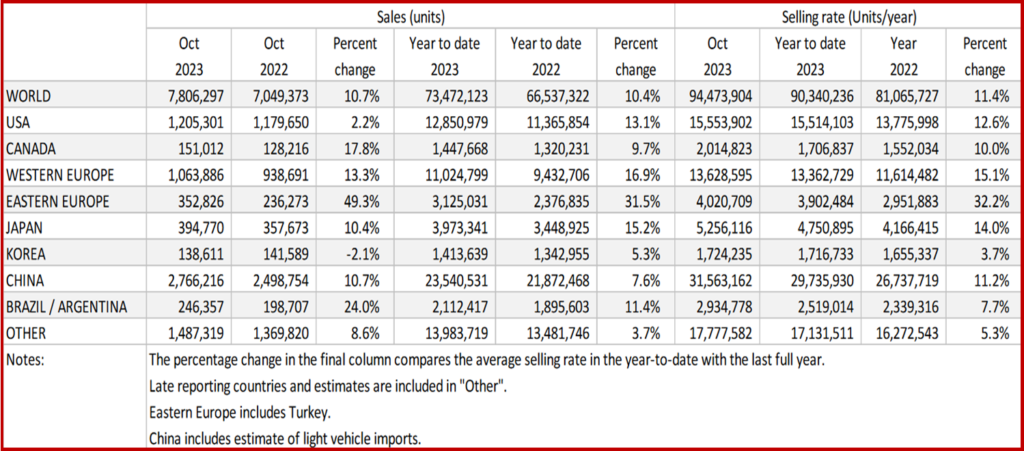

The Global Light Vehicle (LV) selling rate for October was largely in line with an upwardly adjusted September figure, at 94 million units annually. Year-over Year (YoY) the market was up nearly ~11% last month, and up more than 10% YTD, according to data just released by the GlobalData Light Vehicle Sales Forecasting Team.

“While growth in the US was impacted by the UAW strikes through October, other key markets saw double-digit growth, although this is partly due to 2022 being a weak base for comparison,” GlobalData said.

Click for more GlobalData.

GlobalData Observations

North America

The US LV market grew by 2.2% YoY in October to 1.2 million units, while the selling rate decelerated slightly, to 15.6 million units/year, down from the 15.8 million units/year recorded in September. As the UAW strikes were ongoing throughout October, there was some impact on the Detroit 3 OEMs, preventing more substantial growth.

In addition, transaction prices remain extremely high, though the figure declined slightly in October, by US$120 to US$45,644. Meanwhile, incentives barely increased last month, up by a mere US$10 MoM, to $1,847. Dealers had little reason to entice customers as the strikes reduced inventory in some cases.

In October Canadian LV sales reached 151,000 units, an increase of 17.8% YoY, as well as marking the third month in a row where sales have been above the 150k unit level. The selling rate in October was 2.0 million units/year, the highest monthly rate since September 2020, up from the 1.8 million units/year reported in September.

In Mexico, sales increased by 24.8% YoY, to 113.2k units. The selling rate dropped to 1.38 million units/year in October, down from the 1.48 million units/year reported in September.

Europe

The Western Europe LV selling rate rose to 13.6 million units/year in October from 13.1 million units/year in September, following a raw monthly registration figure of 1.1 million units (+13.3% YoY). The region continues to exhibit double-digit YoY growth as supply constraints fade and deliveries recover. Growth is expected to continue through 2024, albeit at a slower rate. YTD the region has grown 16.9% YoY with total sales at 11 million units.

The East European LV selling rate rose to 4.0 million units/year in October from an upwardly adjusted September figure of 3.9 million units/year. The raw monthly registration figure saw growth of 49.3% YoY to reach 353k units, helped largely by strong recovery in Russia, surpassing 101k units (+109% YoY). The YTD figure is up 31.5% YoY with 3.1 million in sales.

China

The Chinese market remains strong. Advance data indicates that the October selling rate reached 31.6 million units/year, the fifth consecutive month that the rate exceeded the 30-million-unit mark. That brought the YTD average selling rate to 29.7 million units/year, compared to last year’s total Light Vehicle sales of 26.7 million units. In YoY terms, sales (i.e., wholesales that include exports) expanded by nearly 11% in October and 7.6% YTD. • Robust exports continued to lead growth. Export of PV expanded by 43% YoY in October and 66% YTD, with Russia accounting for over 20% of PV exports so far this year.

However, domestic sales gathered momentum as well. Domestic sales of PVs increased by 5.5% YoY in October, despite a high year-ago base, aided by the recent personal income tax, the NEV subsidies, and steep discounts by automakers.

Elsewhere in Asia

Sales in Japan surprised on the upside again. The October selling rate reached a robust 5.3 million units/year in October, up 17% from a solid September. After some slowdown in June and July, the market regained strong momentum, thanks to an increased supply of semiconductors and thus new vehicles. Yet, supply constraints continue to linger for some models and demand appears to be losing steam. There is a report that orders started to slow, due to rising vehicle prices and falling real wages. •

The Korean market appears to be entering a down-cycle amid higher interest rates and weak consumer confidence. In YoY terms, sales declined for the fourth consecutive month in October, impacted by the temporary tax cut in June 2023 and a slowing economy. Not only ICE models, but also sales of BEVs have lost momentum, as the government’s EV subsidy for trucks has almost dried up. The EV subsidy for Passenger Vehicles has not run out yet, but consumers are resisting buying an EV, as EV prices are still high even after the subsidy. Most local dedicated BEVs are mid-sized or larger.

South America

Preliminary estimates indicate that Brazilian LV sales increased by 22.7% YoY in October, to 206.7k units. This was only the second month in 2023 to break past the 200k unit mark, and the selling rate increased to 2.46 million units/year in October, up from 2.17 million units/year in September. Sales were unusually strong at the end of October, thanks in part to a surge of fleet sales. Perhaps for this reason, as well as strikes at GM plants, inventory slightly dropped in October to 263.4k units, down from 265.7k units reported in September, as the days’ supply figure declined by 1 day, to 36 days. • I

Argentina LV sales are estimated to have increased by 30.8% YoY in October, to 39.7k units. LV sales increased on a MoM basis, and this pushed the selling rate to 478.1k units/year, up from 349.6k units/year in September. October marks the second-highest level the selling rate has been in 2023, but this hides underlying issues as the country grapples with economic crises and an uncertain political outlook ahead of the presidential election run-off vote later in November.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

October Global Light Vehicle Sales at 94 Million Annually

The Global Light Vehicle (LV) selling rate for October was largely in line with an upwardly adjusted September figure, at 94 million units annually. Year-over Year (YoY) the market was up nearly ~11% last month, and up more than 10% YTD, according to data just released by the GlobalData Light Vehicle Sales Forecasting Team.

“While growth in the US was impacted by the UAW strikes through October, other key markets saw double-digit growth, although this is partly due to 2022 being a weak base for comparison,” GlobalData said.

Click for more GlobalData.

GlobalData Observations

North America

The US LV market grew by 2.2% YoY in October to 1.2 million units, while the selling rate decelerated slightly, to 15.6 million units/year, down from the 15.8 million units/year recorded in September. As the UAW strikes were ongoing throughout October, there was some impact on the Detroit 3 OEMs, preventing more substantial growth.

In addition, transaction prices remain extremely high, though the figure declined slightly in October, by US$120 to US$45,644. Meanwhile, incentives barely increased last month, up by a mere US$10 MoM, to $1,847. Dealers had little reason to entice customers as the strikes reduced inventory in some cases.

In October Canadian LV sales reached 151,000 units, an increase of 17.8% YoY, as well as marking the third month in a row where sales have been above the 150k unit level. The selling rate in October was 2.0 million units/year, the highest monthly rate since September 2020, up from the 1.8 million units/year reported in September.

In Mexico, sales increased by 24.8% YoY, to 113.2k units. The selling rate dropped to 1.38 million units/year in October, down from the 1.48 million units/year reported in September.

Europe

The Western Europe LV selling rate rose to 13.6 million units/year in October from 13.1 million units/year in September, following a raw monthly registration figure of 1.1 million units (+13.3% YoY). The region continues to exhibit double-digit YoY growth as supply constraints fade and deliveries recover. Growth is expected to continue through 2024, albeit at a slower rate. YTD the region has grown 16.9% YoY with total sales at 11 million units.

The East European LV selling rate rose to 4.0 million units/year in October from an upwardly adjusted September figure of 3.9 million units/year. The raw monthly registration figure saw growth of 49.3% YoY to reach 353k units, helped largely by strong recovery in Russia, surpassing 101k units (+109% YoY). The YTD figure is up 31.5% YoY with 3.1 million in sales.

China

The Chinese market remains strong. Advance data indicates that the October selling rate reached 31.6 million units/year, the fifth consecutive month that the rate exceeded the 30-million-unit mark. That brought the YTD average selling rate to 29.7 million units/year, compared to last year’s total Light Vehicle sales of 26.7 million units. In YoY terms, sales (i.e., wholesales that include exports) expanded by nearly 11% in October and 7.6% YTD. • Robust exports continued to lead growth. Export of PV expanded by 43% YoY in October and 66% YTD, with Russia accounting for over 20% of PV exports so far this year.

However, domestic sales gathered momentum as well. Domestic sales of PVs increased by 5.5% YoY in October, despite a high year-ago base, aided by the recent personal income tax, the NEV subsidies, and steep discounts by automakers.

Elsewhere in Asia

Sales in Japan surprised on the upside again. The October selling rate reached a robust 5.3 million units/year in October, up 17% from a solid September. After some slowdown in June and July, the market regained strong momentum, thanks to an increased supply of semiconductors and thus new vehicles. Yet, supply constraints continue to linger for some models and demand appears to be losing steam. There is a report that orders started to slow, due to rising vehicle prices and falling real wages. •

The Korean market appears to be entering a down-cycle amid higher interest rates and weak consumer confidence. In YoY terms, sales declined for the fourth consecutive month in October, impacted by the temporary tax cut in June 2023 and a slowing economy. Not only ICE models, but also sales of BEVs have lost momentum, as the government’s EV subsidy for trucks has almost dried up. The EV subsidy for Passenger Vehicles has not run out yet, but consumers are resisting buying an EV, as EV prices are still high even after the subsidy. Most local dedicated BEVs are mid-sized or larger.

South America

Preliminary estimates indicate that Brazilian LV sales increased by 22.7% YoY in October, to 206.7k units. This was only the second month in 2023 to break past the 200k unit mark, and the selling rate increased to 2.46 million units/year in October, up from 2.17 million units/year in September. Sales were unusually strong at the end of October, thanks in part to a surge of fleet sales. Perhaps for this reason, as well as strikes at GM plants, inventory slightly dropped in October to 263.4k units, down from 265.7k units reported in September, as the days’ supply figure declined by 1 day, to 36 days. • I

Argentina LV sales are estimated to have increased by 30.8% YoY in October, to 39.7k units. LV sales increased on a MoM basis, and this pushed the selling rate to 478.1k units/year, up from 349.6k units/year in September. October marks the second-highest level the selling rate has been in 2023, but this hides underlying issues as the country grapples with economic crises and an uncertain political outlook ahead of the presidential election run-off vote later in November.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.