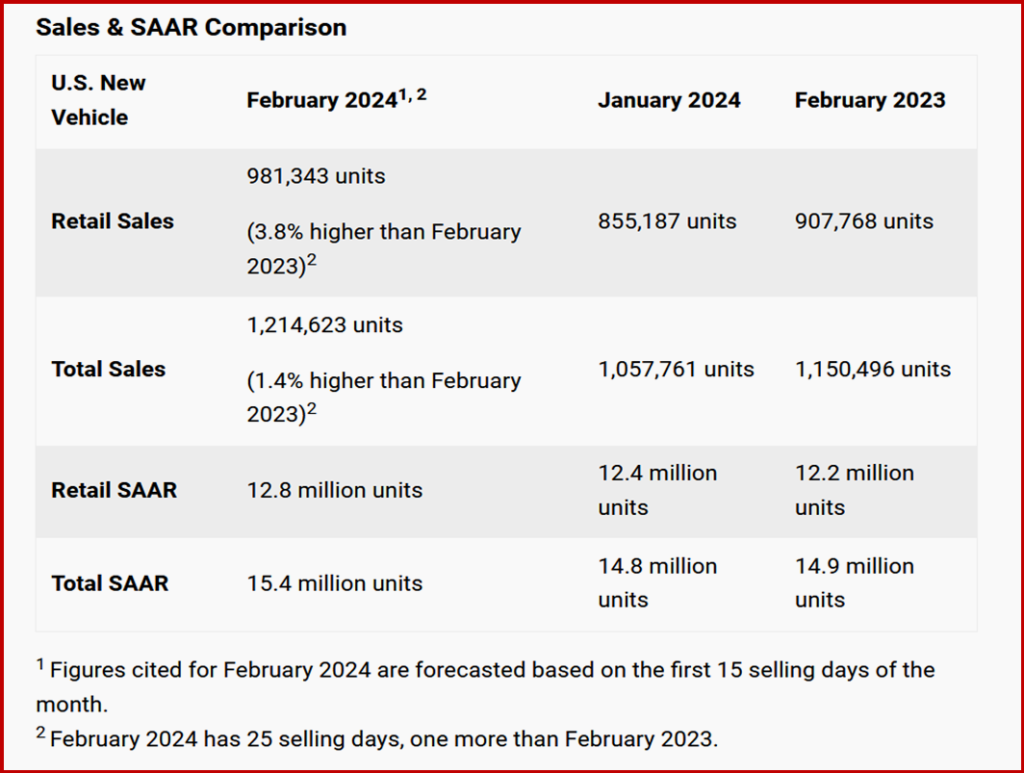

Total new-vehicle sales for February 2024 in the US, including retail and non-retail transactions, are projected to reach 1,214,600 units, a 1.4% increase from February 2023, according to a joint forecast from J.D. Power and GlobalData* issued today. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.4 million units, up 0.4 million units from February 2023 as the Biden Administration economic recovery continues. Consumers are expected to spend ~$40.8 billion on new vehicles this month. This is the highest on record for the month of February, and 4.1% higher than February 2023. (AutoInformed.com on: Slow Sales Start for US Light Vehicles in January 2024)

“This month, the new-vehicle market is poised for volume growth with total sales expected to rise a modest 1.4% and retail sales growing 3.8%, selling day adjusted,” said Thomas King, president of the data and analytics division at J.D. Power.

Click for more GlobalData.

“This volume growth is being driven by higher inventory levels, higher manufacturer incentives and lower retailer profit margins, all of which translate into declining average transaction prices. Despite the landscape shifting towards increased volume with diminished per-unit profits, retail customers will still spend more on new vehicles this month than in any other February on record,” said King. February 2024 has 25 selling days, one more than February 2023. Comparing the same sales volume without adjusting for the number of selling days results in an increase of 5.6% from a year ago.

Observations and Data

- Retail inventory levels are expected to finish around 1.7 million units, a 3.6% increase from January 2024 and a 44.7% increase from February 2023. Fleet mix is projected at 19.2%, down 1.9 percentage points from February 2023.

- Consumers are expected to spend~ $40.8 billion on new vehicles this month. This is the highest on record for the month of February, and 4.1% higher than February 2023.

- The average new-vehicle retail transaction price is declining due to rising manufacturer incentives, falling retailer profit margins and increased availability of lower-priced vehicles.

- Transaction prices in February are trending towards $44,045, down $1919 or -4.2% from February 2023.

- Trucks/SUVs are forecast to account for 79% of new-vehicle retail sales in February.

- Fleet sales are expected to total 233,279 units in February, down 7.7% from February 2023 on a selling day adjusted basis. Fleet volume is expected to account for 19.2% of total light-vehicle sales, down 1.9 percentage points from a year ago.

- Average interest rates for new-vehicle loans are expected to increase to 6.9%, 17 basis points higher than a year ago.

EV Outlook

“In 2023, EV sales and leases accounted for a larger percentage of retail auto industry growth than gas-powered vehicles. Industry-wide, automobile sales and lease volumes rose 8% in 2023 from 2022, reaching a total of approximately 13 million units. With approximately one million in total volume for the year, EV sales and leases grew 50%, while gas-powered vehicles grew 2%” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. (AutoInformed.com on: Do Media Have the Electric Vehicle Market Collapse Wrong?)

“But 2024 has started with slowing EV sales. In January, battery electric vehicle sales fell 1.6 percentage points from 9.2% in December 2023. Further, upper-funnel EV shopper interest declined for a fourth consecutive month. New-vehicle shoppers who are ‘very likely’ to consider purchasing an EV for their next vehicle dropped to 25.6%, a full percentage point lower than in December. Shoppers cite a lack of charging station availability as the main reason for rejecting EVs.

“That said, some good news is on the way. Infrastructure scores have improved 5 percentage points, marking the most significant increase in the three years of EV history tracked by J.D. Power. The improvement is driven largely by non-Tesla charging installations at higher power levels and upgrades to the existing networks. Infrastructure scores are expected to continue increasing this year as the Tesla Supercharger network is opened to non-Tesla EVs. But this alone is not enough to move the needle. Improvement is needed in terms of the availability of affordable EVs for mainstream customers,” said Krear.

Global Sales Forecast

“The global light-vehicle sales selling rate cooled in January, as expected, from the strong finish to 2023. The selling rate was 81.5 million units, which is down from the 90-million-unit selling rate in December. [It should be noted that, beginning this month, we are reporting domestic sales in China and excluding Chinese exports that were previously included.] Global sales volume was up 16% year over year, which is strong, but January usually faces some distortions,” said Jeff Schuster, group head and executive vice president, automotive at GlobalData.

“As has been the story for several months, China domestic sales have outperformed most markets, but the near 50% increase in January is due to abnormal weakness a year ago caused by the expiration of tax incentives and timing of the Lunar New Year. Europe increased 11%, with recovery in Eastern Europe boosting sales across the region. North America grew just 2% as volume in January was pulled down by the weaker start to the year in the United States.

“Global light-vehicle volume in February is projected to be flat vs. February 2023, but again, distortions are affecting the year-over-year comparison. The selling rate is expected to increase to 86 million units. Base effect in China is the main cause for the weaker volume expectation as China domestic sales are expected to fall 13% from February 2023.

“Global light-vehicle sales in 2024 are projected to be 89.1 million units (adjusted for China exports), an increase of 3% from 2023. This maintains our view that growth will slow as natural demand – at current pricing – is now being met. Global inventory is expected to build slightly in 2024 as production returns to predictable levels and outpaces demand. This year remains on target to return to a more normalized pattern of demand, but the market will not be without challenges from an economic slowdown and from external factors, like the Red Sea shipping attacks and the potential for military escalation in the Middle East.”

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Record Consumer Spending Forecast for US February Sales

Total new-vehicle sales for February 2024 in the US, including retail and non-retail transactions, are projected to reach 1,214,600 units, a 1.4% increase from February 2023, according to a joint forecast from J.D. Power and GlobalData* issued today. The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.4 million units, up 0.4 million units from February 2023 as the Biden Administration economic recovery continues. Consumers are expected to spend ~$40.8 billion on new vehicles this month. This is the highest on record for the month of February, and 4.1% higher than February 2023. (AutoInformed.com on: Slow Sales Start for US Light Vehicles in January 2024)

“This month, the new-vehicle market is poised for volume growth with total sales expected to rise a modest 1.4% and retail sales growing 3.8%, selling day adjusted,” said Thomas King, president of the data and analytics division at J.D. Power.

Click for more GlobalData.

“This volume growth is being driven by higher inventory levels, higher manufacturer incentives and lower retailer profit margins, all of which translate into declining average transaction prices. Despite the landscape shifting towards increased volume with diminished per-unit profits, retail customers will still spend more on new vehicles this month than in any other February on record,” said King. February 2024 has 25 selling days, one more than February 2023. Comparing the same sales volume without adjusting for the number of selling days results in an increase of 5.6% from a year ago.

Observations and Data

EV Outlook

“In 2023, EV sales and leases accounted for a larger percentage of retail auto industry growth than gas-powered vehicles. Industry-wide, automobile sales and lease volumes rose 8% in 2023 from 2022, reaching a total of approximately 13 million units. With approximately one million in total volume for the year, EV sales and leases grew 50%, while gas-powered vehicles grew 2%” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. (AutoInformed.com on: Do Media Have the Electric Vehicle Market Collapse Wrong?)

“But 2024 has started with slowing EV sales. In January, battery electric vehicle sales fell 1.6 percentage points from 9.2% in December 2023. Further, upper-funnel EV shopper interest declined for a fourth consecutive month. New-vehicle shoppers who are ‘very likely’ to consider purchasing an EV for their next vehicle dropped to 25.6%, a full percentage point lower than in December. Shoppers cite a lack of charging station availability as the main reason for rejecting EVs.

“That said, some good news is on the way. Infrastructure scores have improved 5 percentage points, marking the most significant increase in the three years of EV history tracked by J.D. Power. The improvement is driven largely by non-Tesla charging installations at higher power levels and upgrades to the existing networks. Infrastructure scores are expected to continue increasing this year as the Tesla Supercharger network is opened to non-Tesla EVs. But this alone is not enough to move the needle. Improvement is needed in terms of the availability of affordable EVs for mainstream customers,” said Krear.

Global Sales Forecast

“The global light-vehicle sales selling rate cooled in January, as expected, from the strong finish to 2023. The selling rate was 81.5 million units, which is down from the 90-million-unit selling rate in December. [It should be noted that, beginning this month, we are reporting domestic sales in China and excluding Chinese exports that were previously included.] Global sales volume was up 16% year over year, which is strong, but January usually faces some distortions,” said Jeff Schuster, group head and executive vice president, automotive at GlobalData.

“As has been the story for several months, China domestic sales have outperformed most markets, but the near 50% increase in January is due to abnormal weakness a year ago caused by the expiration of tax incentives and timing of the Lunar New Year. Europe increased 11%, with recovery in Eastern Europe boosting sales across the region. North America grew just 2% as volume in January was pulled down by the weaker start to the year in the United States.

“Global light-vehicle volume in February is projected to be flat vs. February 2023, but again, distortions are affecting the year-over-year comparison. The selling rate is expected to increase to 86 million units. Base effect in China is the main cause for the weaker volume expectation as China domestic sales are expected to fall 13% from February 2023.

“Global light-vehicle sales in 2024 are projected to be 89.1 million units (adjusted for China exports), an increase of 3% from 2023. This maintains our view that growth will slow as natural demand – at current pricing – is now being met. Global inventory is expected to build slightly in 2024 as production returns to predictable levels and outpaces demand. This year remains on target to return to a more normalized pattern of demand, but the market will not be without challenges from an economic slowdown and from external factors, like the Red Sea shipping attacks and the potential for military escalation in the Middle East.”

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.