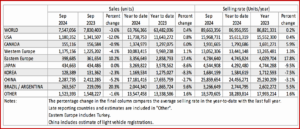

Click to enlarge for more GlobalData.

The Global Light Vehicle (LV) selling rate for September stood at 90 million annually, in line with August’s results, according to an analysis just released by the respected GlobalData consultancy.* Looked at year-over-year (YoY), market volumes are continuing to trend downwards as sales were down ~ 4% versus September 2023. Furthermore, YTD sales are now only up fractionally compared to the same period last year.

“In September, sales were down across most regions. Sales in China fell 5% YoY, as the economy faces headwinds and despite the ongoing scrappage incentive. In the US sales fell YoY for the month, with this September having fewer selling days. Finally, sales in Western Europe remained underwhelming, as a weak economy and high vehicle prices dragged on LV market activity,” said the Global Light Vehicle Sales Forecasting Team.

GlobalData Commentary, Observations

North America

- The US Light Vehicle market saw sales slow YoY in September 2024, the month having fewer selling days this year compared to last year. Sales volumes reached 1.18 million units in September 2024, dropping by 12% YoY. Despite sales slowing YoY, the selling rate saw a strong jump in September 2024 to 16.0 million units/year, up from 15.2 million units/year in August. Incentives reached US $3,125 in September, the highest in the past 12 months, but average transaction prices rose by US $765 MoM, as 2025 model year vehicles reached dealerships in greater numbers.

- Canadian Light Vehicles slowed by 1% YoY last month, bringing the monthly results down to 155k units, marking the first YoY sales decline for 2024. While LV sales slowed on a YoY basis, September’s result was much better than expected given the loss of selling days and a lukewarm economy. For Mexico, sales slowed by a marginal 0.5% YoY, dropping to 117,000 units, making this the first YoY sales decrease since April 2022. Although sales slowed slightly on a YoY basis, this was again due to the unfavorable calendar, with the selling rate growing in September to 1.60 million units/year, up from 1.48 million units/year in August.

Europe

- The Western European LV selling rate fell to 13.1 million units/year in September. In volume terms, 1.2 million units were sold, a 4% decline YoY. Meanwhile, YTD sales passed 10 million units, an improvement of 1.2% from the same period last year. The big picture within the industry remains the same. Strong vehicle pricing, high interest rates, and a lack of incentives, continue to restrict sales. Some improvement is expected moving in 2025 as monetary policy easing supports broad economic expansion along with less expensive EV models being released.

- The LV selling rate for Eastern Europe was 4.8 million units/year in September, an improvement on August. 400k vehicles were sold, a 10% increase YoY. YTD sales remain strong at +17%. Sales in Russia continued to grow in September. This is in line with previous expectations as changes to the disposal fee rates and an increase in interest rates are looming, resulting in sales being pulled forward. Sales in Türkiye began to fall as deflation begins and tighter monetary policy remains in place.

China

- According to advance data, the Chinese domestic market remained lackluster in September, despite the ongoing scrapping subsidy program. The September selling rate is estimated to be 25.9 million units/year, down 3% from August. Sales volume reached almost 2.3 million units, the highest sales year- to-date, but September is historically a relatively strong sales month. In YoY terms, sales declined by 5% in September and almost 3% year-to-date. In contrast, Passenger Vehicle (PV) exports remained robust, expanding by 22% YoY in September, despite the growing trade conflicts with the West.

- It is reported that the share of New Electric Vehicles (NEVs ) in the domestic passenger vehicle market reached almost 55% in September. With the government doubling the scrapping subsidies, the applications for the subsidies have risen sharply over the past month, suggesting that sales will gather momentum before the expiry of the program in December. However, the deep slump in the property sector, a weak job market, and volatile financial markets continue to dampen consumer confidence.

Elsewhere in Asia

- In Japan, the September selling rate was a sluggish 4.5 million units/year, virtually flat from August. Sales continued to be impacted by the supply shortages, especially at Toyota and Daihatsu, that were caused by the vehicle certification issues. Sales were also disrupted by bad weather. A series of major typhoons in late August and heavy rains in many parts of Japan in September disrupted logistics and consumer traffic at dealerships. In the economy, inflation-adjusted real wages started to decline again, squeezing consumers’ purchasing power.

- The Korean market picked up for the second month in a row, with the September selling rate surging to 1.68 million units/year. However, that brought the YTD average selling rate to only 1.58 million units/year, suggesting that the market could possibly finish the year with the lowest sales since 2013. Sales this year have been weak, as PV sales were pulled ahead by last year’s temporary tax cut and dragged by the elevated level of household debt. Light Commercial Vehicle sales were hit by the aging model cycle and high financing rates. Nonetheless, Hyundai, Renault Korea and KG Mobility managed to record positive YoY growth.

South American

- Brazilian Light Vehicle sales continued their strong run throughout 2024, as volumes expanded by 19% YoY, reaching almost 223,000 units. Thanks to these strong volumes, the selling rate surged to 2.71 million units/year in September, up from 2.45 million units/year reported in August, and the highest rate since February 2020, indicating that the market is now touching pre-pandemic levels, at least when looking at one month in isolation. Inventory seems to have reached a kind of plateau, as days’ supply remained unchanged in September at 34 days.

- In Argentina, Light Vehicle sales reached 41,000 units, growing by 30% YoY. Sales have been slowly improving through the second half of the year, as it seems that some of the reforms put in place by the new administration have had time to impact the market. The selling rate saw a strong boost in September, with it above the 400,000 unit mark for the past three consecutive months, which is considered to be a positive sign in the current economic landscape.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

September 2024 Global Light Vehicle Sales Down Slightly

Click to enlarge for more GlobalData.

The Global Light Vehicle (LV) selling rate for September stood at 90 million annually, in line with August’s results, according to an analysis just released by the respected GlobalData consultancy.* Looked at year-over-year (YoY), market volumes are continuing to trend downwards as sales were down ~ 4% versus September 2023. Furthermore, YTD sales are now only up fractionally compared to the same period last year.

“In September, sales were down across most regions. Sales in China fell 5% YoY, as the economy faces headwinds and despite the ongoing scrappage incentive. In the US sales fell YoY for the month, with this September having fewer selling days. Finally, sales in Western Europe remained underwhelming, as a weak economy and high vehicle prices dragged on LV market activity,” said the Global Light Vehicle Sales Forecasting Team.

GlobalData Commentary, Observations

North America

Europe

China

Elsewhere in Asia

South American

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.