Click to enlarge.

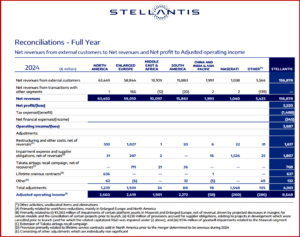

Stellantis (NYSE: STLA)* said today that full year 2024 results were net revenues of €156.9 billion, down 17% compared to 2023. Net profit was €5.5 billion, down 70%. Adjusted operating income of €8.6 billion fell 64%. Industrial free cash flows were negative €6 billion reflecting the decline in income and temporary enlarged working capital impact due to production cuts. However, despite the almost total car wreck, the dividend to common shareholders is proposed at €0.68 per share, representing a 5% yield, pending shareholder approval.

“While 2024 was a year of stark contrasts for the Company, with results falling short of our potential, we achieved important strategic milestones. Notably, we began the rollout of new multi-energy platforms and products, which continues in 2025, started production of EV batteries through our JVs, and launched the Leapmotor International partnership. Stellantis’ dedicated and talented people are driving forward with energy and determination, engaging with key stakeholders and moving decision-making closer to our customers. We are firmly focused on gaining market share and improving financial performance as 2025 progresses,” said John Elkann, Chairman, a large shareholder and the scion of the Fiat family.**

Highlights and Lowlights

- So-called generational product portfolio transition was initiated in 2024 with the first products launched on STLA Medium and STLA Large platforms, and scaled globalization of Smart Car platform through the European launch of Citroën C3/ë-C3.

- Total industrial available liquidity ended 2024 at €49.5 billion, with Industrial net financial position at €15.1 billion.

- 2025 financial guidance of “Positive” Net Revenue Growth, “Mid-Single Digits” AOI margin and “Positive” industrial free cash flows, reflecting both the early stage of the commercial recovery as well as elevated industry uncertainties

- The process to appoint the new permanent Chief Executive Officer is underway and it’s claimed will be concluded within the first half of 2025.

- STLA Medium: The first models to hit the roads on the new multi-energy BEV-centric platform are Peugeot E-3008 and E-5008 and new Opel Grandland. They offer customers the choice of electric, hybrid and plug-in hybrid variants. The new flagship DS N8 presented in December, offers a best-in class BEV range of up to 750 km (466 miles) in the WLTP combined cycle.

- STLA Large: This adaptable multi-energy platform supports new models such as the Dodge Charger Daytona, Jeep® Wagoneer S, Jeep® Cherokee replacement and Jeep® Recon, along with future Alfa Romeo, Chrysler and Maserati vehicles. The first Dodge and Jeep vehicles are now arriving at dealerships. The platform also supports hybrid and internal combustion propulsion systems without compromising key vehicle capabilities it’s claimed.

- STLA Frame: Designed for full-size, body-on-frame trucks and SUVs, this platform will debut in 2025 with the Ram 1500Ramcharger followed by Jeep brand vehicles with range-extending hybrid technology.

- Smart Car: Stellantis launched European products on the global multi-energy Smart Car platform, including the affordable Citroën C3/ë-C3 and new C3 Aircross, Opel Frontera and Fiat Grande Panda. Citroën Basalt was also launched in India and South America

*AutoInformed on

**Inevitable Stellantis Footnotes

(1) Adjusted operating income/(loss) excludes from Net profit/(loss) from continuing operations adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit). Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.

(2) Adjusted operating income/(loss) margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

(3) Industrial free cash flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities; (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition, Industrial free cash flows is one of the metrics used in the determination of the annual performance bonus for eligible employees, including members of the Senior Management.

(4) Combined shipments include shipments by Company’s consolidated subsidiaries and unconsolidated joint ventures, whereas Consolidated shipments only include shipments by Company’s consolidated subsidiaries. This includes the vehicles produced by our joint ventures and associates (including Leapmotor) which are distributed by our consolidated subsidiaries. In addition to the volumes included in consolidated shipments, combined shipments also includes the vehicles distributed by our joint ventures (such as Tofas). Figures by segments may not add up due to rounding. China shipments from DPCA are no longer included in Combined shipments as of November 2023; prior periods have not been restated.

(5) Adjusted diluted earnings per share (“EPS”) is calculated by adjusting Diluted earnings per share for the post-tax impact per share of the same items excluded from Adjusted operating income as well as tax expense/(benefit) items that are considered rare or infrequent, or whose nature would distort the presentation of the ongoing tax charge of the Company. We believe this non-GAAP measure is useful because it also excludes items that we do not believe are indicative of the Company’s ongoing operating performance and provides investors with a more meaningful comparison of the Company’s ongoing quality of earnings. Adjusted diluted EPS should not be considered as a substitute for Basic earnings per share, Diluted earnings per share from operations or other methods of analyzing our quality of earnings as reported under IFRS.

(6) Industrial net financial position is calculated as Debt plus derivative financial liabilities related to industrial activities less (i) cash and cash equivalents, (ii) financial securities that are considered liquid, (iii) current financial receivables from the Company or its jointly controlled financial services entities and (iv) derivative financial assets and collateral deposits. Therefore, debt, cash and cash equivalents and other financial assets/ liabilities pertaining to Stellantis’ financial services entities are excluded from the computation of the Industrial net financial position. Industrial net financial position includes the Industrial net financial position classified as held for sale.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis Net Profit Down 70% in 2024

Click to enlarge.

Stellantis (NYSE: STLA)* said today that full year 2024 results were net revenues of €156.9 billion, down 17% compared to 2023. Net profit was €5.5 billion, down 70%. Adjusted operating income of €8.6 billion fell 64%. Industrial free cash flows were negative €6 billion reflecting the decline in income and temporary enlarged working capital impact due to production cuts. However, despite the almost total car wreck, the dividend to common shareholders is proposed at €0.68 per share, representing a 5% yield, pending shareholder approval.

“While 2024 was a year of stark contrasts for the Company, with results falling short of our potential, we achieved important strategic milestones. Notably, we began the rollout of new multi-energy platforms and products, which continues in 2025, started production of EV batteries through our JVs, and launched the Leapmotor International partnership. Stellantis’ dedicated and talented people are driving forward with energy and determination, engaging with key stakeholders and moving decision-making closer to our customers. We are firmly focused on gaining market share and improving financial performance as 2025 progresses,” said John Elkann, Chairman, a large shareholder and the scion of the Fiat family.**

Highlights and Lowlights

*AutoInformed on

**Inevitable Stellantis Footnotes

(1) Adjusted operating income/(loss) excludes from Net profit/(loss) from continuing operations adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit). Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.

(2) Adjusted operating income/(loss) margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

(3) Industrial free cash flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities; (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition, Industrial free cash flows is one of the metrics used in the determination of the annual performance bonus for eligible employees, including members of the Senior Management.

(4) Combined shipments include shipments by Company’s consolidated subsidiaries and unconsolidated joint ventures, whereas Consolidated shipments only include shipments by Company’s consolidated subsidiaries. This includes the vehicles produced by our joint ventures and associates (including Leapmotor) which are distributed by our consolidated subsidiaries. In addition to the volumes included in consolidated shipments, combined shipments also includes the vehicles distributed by our joint ventures (such as Tofas). Figures by segments may not add up due to rounding. China shipments from DPCA are no longer included in Combined shipments as of November 2023; prior periods have not been restated.

(5) Adjusted diluted earnings per share (“EPS”) is calculated by adjusting Diluted earnings per share for the post-tax impact per share of the same items excluded from Adjusted operating income as well as tax expense/(benefit) items that are considered rare or infrequent, or whose nature would distort the presentation of the ongoing tax charge of the Company. We believe this non-GAAP measure is useful because it also excludes items that we do not believe are indicative of the Company’s ongoing operating performance and provides investors with a more meaningful comparison of the Company’s ongoing quality of earnings. Adjusted diluted EPS should not be considered as a substitute for Basic earnings per share, Diluted earnings per share from operations or other methods of analyzing our quality of earnings as reported under IFRS.

(6) Industrial net financial position is calculated as Debt plus derivative financial liabilities related to industrial activities less (i) cash and cash equivalents, (ii) financial securities that are considered liquid, (iii) current financial receivables from the Company or its jointly controlled financial services entities and (iv) derivative financial assets and collateral deposits. Therefore, debt, cash and cash equivalents and other financial assets/ liabilities pertaining to Stellantis’ financial services entities are excluded from the computation of the Industrial net financial position. Industrial net financial position includes the Industrial net financial position classified as held for sale.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.