Click to enlarge.

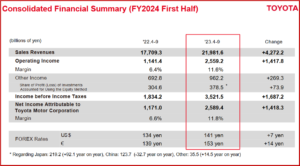

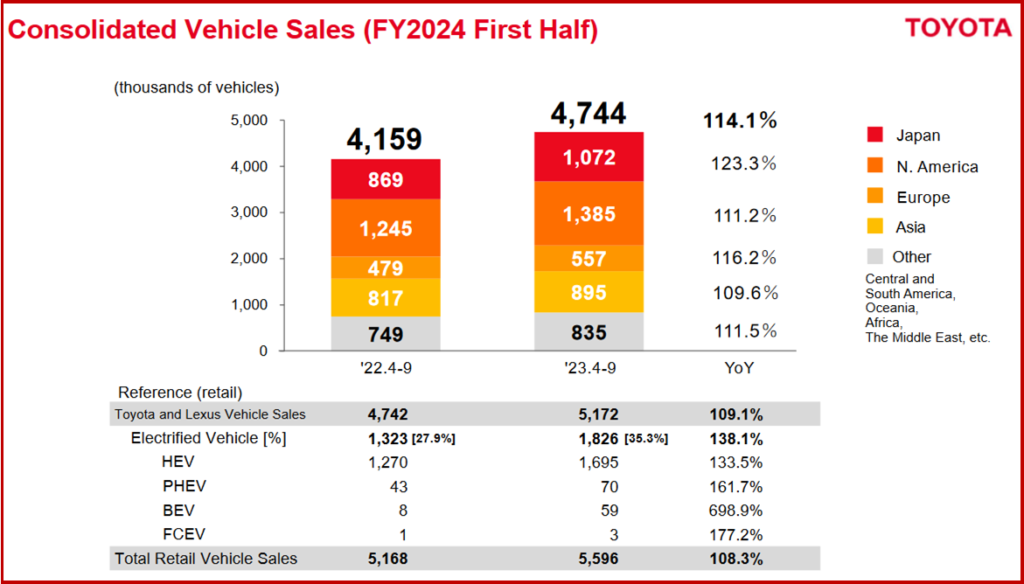

Toyota Motor Corporation (TMC)* said today that net income2 increased from 1.171 trillion yen ($8.7 billion)** to 2.589 trillion yen ($18.4 billion) for the Japanese FY2024 Q2 (April – September 2023) on consolidated vehicle sales of ~4,744,000, an increase of ~585,000 compared to the same period last fiscal year.

“We are grateful for the support of many stakeholders, from production to logistics, sales, and services, including suppliers. As a result of selling each car meticulously at prices that match the product appeal refined through Toyota’s ‘making ever-better cars’ initiative, operating income increased from the same period of the previous fiscal year,” Toyota said.

Click for more.

For the fiscal year ending 31 March 2024, TMC now estimates consolidated vehicles sales will be 9.60 million units. Based on an exchange rate assumption of 141 yen to the U.S. dollar, TMC forecasts consolidated net revenue of 43.0 trillion yen ($305.0 billion), operating income of 4.5 trillion yen ($31.9 billion), income before income taxes of 5.55 trillion yen ($39.4 billion), and net income of 3.95 trillion yen ($28.0 billion).

Regions

North America: Vehicle sales totaled ~1,385,000 units, an increase of 140,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 299.5 billion yen ($2.1 billion) to 362.5 billion yen ($2.5 billion).

Japan: Vehicle sales totaled ~1,072,000 units, an increase of 203,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 725.1 billion yen ($5.1 billion) to 1.584 trillion yen ($11.2 billion).

Europe: Vehicle sales totaled ~557,000 units, an increase of 78,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 245.8 billion yen ($1.7 billion) to 192.2 billion yen ($1.3 billion).

Asia: Vehicle sales totaled ~895,000 units, an increase of 78,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 30.2 billion yen ($214 million) to 411.4 billion yen ($2.9 billion).

Other regions (including Central and South America, Oceania, Africa, and the Middle East): Vehicle sales totaled ~835,000 units, an increase of 86,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 55.7 billion yen ($395 million) to 186.5 billion yen ($1.3 billion).

Financial Services

Financial services operating income decreased by 8.4 billion yen ($60 million) to 328.8 billion yen ($2.3 billion). Including valuation gains/losses, operating income increased by 46.0 billion yen ($326 million) to 244.9 billion yen ($1.7 billion).

1 Income before income taxes and equity in earnings of affiliated companies

2 Net income attributable to Toyota Motor Corporation

* 7203 Prime of the Tokyo Stock Exchange and Premier of the Nagoya Stock Exchange

**FY24 currency translations above are approximate and based on an average 141-yen-to-dollar exchange rate. FY23 is 134-yen-to-dollar exchange rate.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Toyota Posts FY2024 Q2 Net Income of $18.4 Billion

Click to enlarge.

Toyota Motor Corporation (TMC)* said today that net income2 increased from 1.171 trillion yen ($8.7 billion)** to 2.589 trillion yen ($18.4 billion) for the Japanese FY2024 Q2 (April – September 2023) on consolidated vehicle sales of ~4,744,000, an increase of ~585,000 compared to the same period last fiscal year.

“We are grateful for the support of many stakeholders, from production to logistics, sales, and services, including suppliers. As a result of selling each car meticulously at prices that match the product appeal refined through Toyota’s ‘making ever-better cars’ initiative, operating income increased from the same period of the previous fiscal year,” Toyota said.

Click for more.

For the fiscal year ending 31 March 2024, TMC now estimates consolidated vehicles sales will be 9.60 million units. Based on an exchange rate assumption of 141 yen to the U.S. dollar, TMC forecasts consolidated net revenue of 43.0 trillion yen ($305.0 billion), operating income of 4.5 trillion yen ($31.9 billion), income before income taxes of 5.55 trillion yen ($39.4 billion), and net income of 3.95 trillion yen ($28.0 billion).

Regions

North America: Vehicle sales totaled ~1,385,000 units, an increase of 140,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 299.5 billion yen ($2.1 billion) to 362.5 billion yen ($2.5 billion).

Japan: Vehicle sales totaled ~1,072,000 units, an increase of 203,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 725.1 billion yen ($5.1 billion) to 1.584 trillion yen ($11.2 billion).

Europe: Vehicle sales totaled ~557,000 units, an increase of 78,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 245.8 billion yen ($1.7 billion) to 192.2 billion yen ($1.3 billion).

Asia: Vehicle sales totaled ~895,000 units, an increase of 78,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 30.2 billion yen ($214 million) to 411.4 billion yen ($2.9 billion).

Other regions (including Central and South America, Oceania, Africa, and the Middle East): Vehicle sales totaled ~835,000 units, an increase of 86,000 units. Operating income, excluding the impact of valuation gains/losses from interest rate swaps, increased by 55.7 billion yen ($395 million) to 186.5 billion yen ($1.3 billion).

Financial Services

Financial services operating income decreased by 8.4 billion yen ($60 million) to 328.8 billion yen ($2.3 billion). Including valuation gains/losses, operating income increased by 46.0 billion yen ($326 million) to 244.9 billion yen ($1.7 billion).

1 Income before income taxes and equity in earnings of affiliated companies

2 Net income attributable to Toyota Motor Corporation

* 7203 Prime of the Tokyo Stock Exchange and Premier of the Nagoya Stock Exchange

**FY24 currency translations above are approximate and based on an average 141-yen-to-dollar exchange rate. FY23 is 134-yen-to-dollar exchange rate.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.