Click to enlarge.

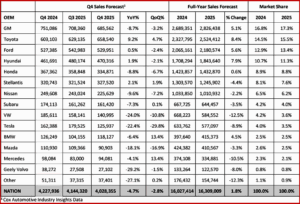

December new-vehicle sales are expected to finish down from last year, but the pace should pick up slightly from previous months and help push total new-vehicle sales in 2025 above year-ago levels, according to the Cox Automotive forecast.* The December seasonally adjusted annual rate of sales (SAAR) is expected to finish near 15.9 million, down from last year’s 16.8 million pace but up from November’s 15.6 million level. Sales volume in December is expected to fall 3.5% from last December. The calendar year 2025 was defined by instability as Trump administration policies fueled insecurity in the automotive market, causing sales to fluctuate sharply.**

“Despite challenges, 2025 has been a good year for new-vehicle sales,” said Charlie Chesbrough, senior economist at Cox Automotive. “The fourth quarter is showing the expected slowdown, as headwinds from tariffs, inflation and reduced EV incentives weigh on the market after nine surprisingly strong months. Still, consumer demand has kept the new-vehicle market healthy throughout 2025.”**

Despite a relatively weak fourth quarter, new-vehicle sales will finish 2025 up 1.8% year over year, according to Kelley Blue Book estimates. New-vehicle sales of 16.3 million will make 2025 the best sales year since 2019. General Motors is expected to end the year as the top-selling automaker in the U.S. for the fourth consecutive year, with a total market share of 17.3%, up from 16.8% in 2024.

“The market winner in 2025 is expected to be General Motors. The market leader is forecast to end the fourth quarter with over 685,000 vehicles sold, and finish the year above 2.8 million, a year-over-year increase of more than 5%. GM’s sales in Q4, however, are forecast to be down from last year and last quarter, suggesting a loss of momentum going into 2026.

“Toyota will finish a strong second in 2025, with gains from both the Toyota and Lexus brands. The company’s sales are expected to increase 8.4% from last year, with market share rising from 14.5% to 15.5%. Toyota’s solid share gain is part of a broader trend in 2025, in which the largest automakers grew larger. Market share for the top four sellers – General Motors, Toyota Motor Corporation, Ford Motor Company, and Hyundai Motor Company – increased 2.6 points in 2025, while nearly all other automakers saw declines in both sales and share,” Cox said.

US Sales Forecast 2026

Cox Automotive’s Economic and Industry Insights team forecasts that the new-vehicle sales pace in 2026 will decline by 2.4% to 15.8 million. Factors such as slower economic growth, less job creation, and the lack of EV tax incentives are expected to affect vehicle sales in the year ahead. While most vehicle sales figures in 2025 exceeded expectations, the outlook for 2026 suggests a slowdown across many important metrics. Earlier this week, the team released its 2026 forecasts for the U.S. automotive market, highlighting five forces set to shape the auto industry in the coming year. (Note: The Cox Automotive 2026 forecast is based on the annual sales pace, which in 2025 is now forecast at 16.2 million. The Kelley Blue Book sales volume numbers, as shown in the chart, include additional heavy trucks sold at retail. The sales volume counted by Kelley Blue Book is slightly higher than the volumes used in the SAAR calculations.)***

*AutoInformed on

**Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 29,000-plus employees on five continents and a family of trusted brands that include Autotrader®, CentralDispatch®, Dealertrack®, FleetNet America® , Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $23 billion in annual revenue.

*** Five Forces Set to Shape the Auto Industry

“The U.S. auto industry is a trillion-dollar industry – an economic engine that is not a single business, but a collection of businesses touching nearly every household and community in the U.S. It’s also an industry deeply influenced by a massive web of economic, policy, social, and technological factors.

“Calendar year 2025 was a perfect example of that reality. Despite countless complications, or perhaps because of the complications, the market delivered better-than-expected results in many metrics. Retail sales beat expectations, fleet demand remained healthy, and wholesale values stayed relatively stable despite tariff-induced volatility.

“The factors influencing the automotive market also became more fragmented in the past year, simultaneously pulling the industry in different directions, creating opportunities for some players while posing risks for others. That fragmentation will likely be even more central to the industry’s narrative in 2026.

“As the Cox Automotive Economic and Industry Insights team looks to the year ahead, five major themes are shaping the automotive forecast. Each reflects conflicting dynamics that will ultimately play out in overall market performance.

- The Bifurcated Consumer: The divide between high-income and low-income households is widening. Wealthier consumers will benefit from wealth effects, lower taxes, and rate cuts, while lower-income households will continue to feel the strain of years of inflation, yet also see higher tax refunds. This divergence accelerates trade-down behavior, making value perception critical across the market. Cox Automotive is expecting an increase in demand for affordable vehicles, lower monthly payments, and used-vehicle options that provide solutions for consumers seeking to stretch their budgets.

- Fragmented Labor: A growing labor market is the foundation for a healthy automotive market, and right now we are in a jobless expansion – GDP is growing through investment and productivity, but employment has stagnated. We are in a no-hire, no-fire environment, where low unemployment numbers mask the reality: Job seekers face challenges, while those in stable roles fare better. Slow job growth dampens household formation critical for vehicle demand and saps the confidence needed for big-ticket purchases like vehicles. This dynamic will weigh on first-time buyers and could limit growth in entry-level segments in the year ahead.

- Inflation and Fed Risk: Inflation appears to be peaking, and rate cuts this fall and into 2026 will help affordability. Yet uncertainty looms with Federal Reserve Chair Jerome Powell’s succession and questions about Fed independence. Lower rates will provide some relief, but long-term rates remain sticky, delaying housing recovery and limiting auto sales. Uncertainty has been a key theme lately, and in 2026, our team is expecting more uncertainty when it comes to inflation and Fed’s decision path. As the Fed works to balance its dual mandate, there is no simple way forward.

- Policy and the EV Shock: As clearly demonstrated in the past year, the White House remains actively engaged in economic and industry policy. For the most part, our team has come to expect the unexpected. The auto industry now has higher material costs, more freedom to produce what consumers want, and the benefit of lower taxes. This doesn’t sound impossible to navigate, but it creates an uneven playing field. Next up: USMCA renegotiation, which could disrupt the outlook even further. And be ready for the next chapter in the electric vehicle story, where new-EV sales are no longer supported by government incentives and off-lease EVs begin to surge into the used-vehicle market. Everyone involved in the automotive business will need to be ready to navigate a shifting policy landscape in the year ahead, while balancing consumer demand and profitability.

- AI’s Inflection Point: AI investments in infrastructure are driving GDP growth and stock market gains, and the associated wealth effect is supporting retail demand. We are also witnessing AI-driven productivity gains, but competitive fragmentation will intensify. For auto dealers, AI promises efficiency and transparency, which is good news for consumers and retailers alike. Cox Automotive expects AI to improve the retail landscape – and as a company, we are actively engaged in that endeavor – with even more pricing transparency, better customer engagement, and enhanced consumer service experiences. Questions remain about long-term ROI, but the path is set. AI will be central to the industry’s story in the year ahead.

2026 Forecast Highlights

Collectively, these five factors are steering the Cox Automotive forecast for 2026. Highlights include:

- New Vehicle Sales: Our new vehicle SAAR estimate of 15.8 million is down 2.4% from 2025 levels. A high-15 million level may be the new norm given global factors and demographic trends. Slower economic growth and job creation – and the expiration of EV tax incentives – will weigh on demand.

- Retail and Fleet: New retail sales are expected to decline about 1.5% year over year, while fleet sales will see sharper drops as slower growth limits commercial demand.

- Leasing: With the expiration of the tax incentive on EVs and plug-in hybrids, and the “leasing loophole” that drove the numbers higher, total leasing will decline in 2026, dropping lease penetration toward 21%, the lowest level in three years.

- Used Market: We expect slightly lower used-vehicle sales versus last year, with total used and used retail sales down roughly 1% year over year. Used retail inventory will remain relatively tight in 2026, but demand should be steady due to affordability concerns pushing consumers toward lower-priced vehicles.

- Wholesale Values: The Manheim Used Vehicle Value Index is projected to rise 2% by year-end 2026, signaling relatively normal depreciation rates. EVs will represent a growing share of wholesale values, adding complexity to pricing trends.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US New-Vehicle Sales Q4 Forecast Down in 2025. Year Up a Tad

Click to enlarge.

December new-vehicle sales are expected to finish down from last year, but the pace should pick up slightly from previous months and help push total new-vehicle sales in 2025 above year-ago levels, according to the Cox Automotive forecast.* The December seasonally adjusted annual rate of sales (SAAR) is expected to finish near 15.9 million, down from last year’s 16.8 million pace but up from November’s 15.6 million level. Sales volume in December is expected to fall 3.5% from last December. The calendar year 2025 was defined by instability as Trump administration policies fueled insecurity in the automotive market, causing sales to fluctuate sharply.**

“Despite challenges, 2025 has been a good year for new-vehicle sales,” said Charlie Chesbrough, senior economist at Cox Automotive. “The fourth quarter is showing the expected slowdown, as headwinds from tariffs, inflation and reduced EV incentives weigh on the market after nine surprisingly strong months. Still, consumer demand has kept the new-vehicle market healthy throughout 2025.”**

Despite a relatively weak fourth quarter, new-vehicle sales will finish 2025 up 1.8% year over year, according to Kelley Blue Book estimates. New-vehicle sales of 16.3 million will make 2025 the best sales year since 2019. General Motors is expected to end the year as the top-selling automaker in the U.S. for the fourth consecutive year, with a total market share of 17.3%, up from 16.8% in 2024.

“The market winner in 2025 is expected to be General Motors. The market leader is forecast to end the fourth quarter with over 685,000 vehicles sold, and finish the year above 2.8 million, a year-over-year increase of more than 5%. GM’s sales in Q4, however, are forecast to be down from last year and last quarter, suggesting a loss of momentum going into 2026.

“Toyota will finish a strong second in 2025, with gains from both the Toyota and Lexus brands. The company’s sales are expected to increase 8.4% from last year, with market share rising from 14.5% to 15.5%. Toyota’s solid share gain is part of a broader trend in 2025, in which the largest automakers grew larger. Market share for the top four sellers – General Motors, Toyota Motor Corporation, Ford Motor Company, and Hyundai Motor Company – increased 2.6 points in 2025, while nearly all other automakers saw declines in both sales and share,” Cox said.

US Sales Forecast 2026

Cox Automotive’s Economic and Industry Insights team forecasts that the new-vehicle sales pace in 2026 will decline by 2.4% to 15.8 million. Factors such as slower economic growth, less job creation, and the lack of EV tax incentives are expected to affect vehicle sales in the year ahead. While most vehicle sales figures in 2025 exceeded expectations, the outlook for 2026 suggests a slowdown across many important metrics. Earlier this week, the team released its 2026 forecasts for the U.S. automotive market, highlighting five forces set to shape the auto industry in the coming year. (Note: The Cox Automotive 2026 forecast is based on the annual sales pace, which in 2025 is now forecast at 16.2 million. The Kelley Blue Book sales volume numbers, as shown in the chart, include additional heavy trucks sold at retail. The sales volume counted by Kelley Blue Book is slightly higher than the volumes used in the SAAR calculations.)***

*AutoInformed on

**Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 29,000-plus employees on five continents and a family of trusted brands that include Autotrader®, CentralDispatch®, Dealertrack®, FleetNet America® , Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $23 billion in annual revenue.

*** Five Forces Set to Shape the Auto Industry

“The U.S. auto industry is a trillion-dollar industry – an economic engine that is not a single business, but a collection of businesses touching nearly every household and community in the U.S. It’s also an industry deeply influenced by a massive web of economic, policy, social, and technological factors.

“Calendar year 2025 was a perfect example of that reality. Despite countless complications, or perhaps because of the complications, the market delivered better-than-expected results in many metrics. Retail sales beat expectations, fleet demand remained healthy, and wholesale values stayed relatively stable despite tariff-induced volatility.

“The factors influencing the automotive market also became more fragmented in the past year, simultaneously pulling the industry in different directions, creating opportunities for some players while posing risks for others. That fragmentation will likely be even more central to the industry’s narrative in 2026.

“As the Cox Automotive Economic and Industry Insights team looks to the year ahead, five major themes are shaping the automotive forecast. Each reflects conflicting dynamics that will ultimately play out in overall market performance.

2026 Forecast Highlights

Collectively, these five factors are steering the Cox Automotive forecast for 2026. Highlights include:

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.