Click to Enlarge.

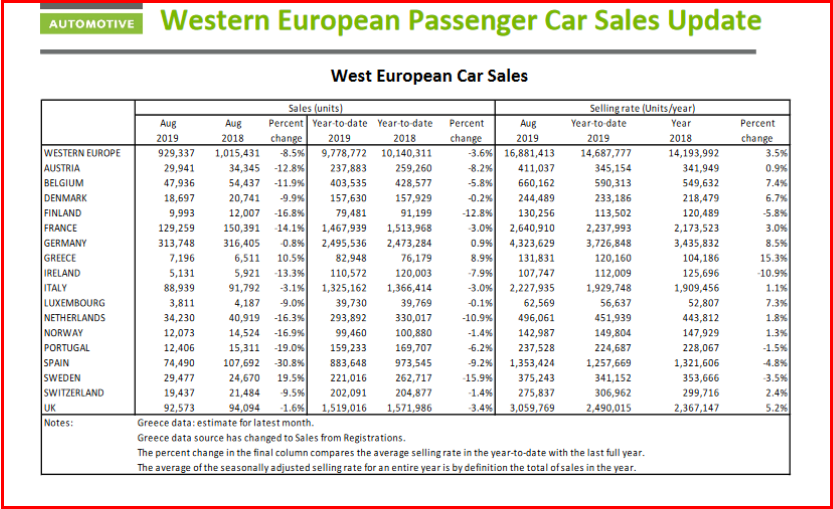

Western European car registrations fell by 8.5% year-on-year (YoY) in August. The YoY contraction was “inevitable” claims consultancy LMC due to the distortion in the market in August 2018 caused by sales being pulled forward ahead of the 1 September 2018 implementation of WLTP emission tests after the German automaker diesel emissions scandal. (WLTP How Does It Work? Will it Work?) However, the selling rate jumped to 16.9 million units/year in July, from 14.3 million units/year in July.

The introduction of WLTP in September 2018 distorted the market in August last year (the selling rate for that month was 18.4 million units/year), providing a very high base effect which was never likely to be matched this year. In addition, August has historically provided the lowest sales volumes in the year, meaning that relatively small changes in sales can have an exaggerated effect on the selling rate.

Click to Enlarge.

“We suspect that last month’s strong sales may have been the result of an increased use of self-registrations by dealers and OEMs, ahead of further changes to WLTP regulations which came into effect on 1 September, and we may therefore see some payback in selling rates in the coming months,” says LMC.

They advise it would be prudent to treat August’s uptick in selling rates “with caution, especially given a macroeconomic environment which seems unsupportive of big-ticket purchases at the present time.” Germany’s August figures were strong by any measure though. Registrations were only 0.8% below last year’s WLTP-distorted numbers exceeded expectations, while the selling rate of 4.3 million units/year almost matched last August’s exceptional rate.

The UK’s August volumes are always low in absolute terms, but a fall of only 1.6% YoY was a good result as the selling rate accelerated towards 3.1 million units/year. “However, in the UK and elsewhere, we may simply be seeing another distortion in sales that tells us little about the underlying health of the market,” says LMC.

This same caveat applies to the remaining major West European markets.

- The French selling rate jumped from 2.2 million units/year in July to 2.6 mn units/year in August, although sales declined14.1% YoY. The elevated selling rate may be a result of a pull-forward effect, as the rules around a scrappage scheme were tightened from 1 September, in addition to WLTP effects.

- Italy’s selling rate increased from 1.9 million units/year in July to 2.2 mn units/year in August; the market contracted by 3.1% YoY.

- In Spain, the selling rate rose towards 1.4 million units/year in August, despite the 30.8% YoY decline in sales. For the YTD, Spanish registrations are down 9.2% YoY; a deficit which seems unlikely to be wiped out by the end of the year.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Western European Car Registrations Fall by -8.5%

Click to Enlarge.

Western European car registrations fell by 8.5% year-on-year (YoY) in August. The YoY contraction was “inevitable” claims consultancy LMC due to the distortion in the market in August 2018 caused by sales being pulled forward ahead of the 1 September 2018 implementation of WLTP emission tests after the German automaker diesel emissions scandal. (WLTP How Does It Work? Will it Work?) However, the selling rate jumped to 16.9 million units/year in July, from 14.3 million units/year in July.

The introduction of WLTP in September 2018 distorted the market in August last year (the selling rate for that month was 18.4 million units/year), providing a very high base effect which was never likely to be matched this year. In addition, August has historically provided the lowest sales volumes in the year, meaning that relatively small changes in sales can have an exaggerated effect on the selling rate.

Click to Enlarge.

“We suspect that last month’s strong sales may have been the result of an increased use of self-registrations by dealers and OEMs, ahead of further changes to WLTP regulations which came into effect on 1 September, and we may therefore see some payback in selling rates in the coming months,” says LMC.

They advise it would be prudent to treat August’s uptick in selling rates “with caution, especially given a macroeconomic environment which seems unsupportive of big-ticket purchases at the present time.” Germany’s August figures were strong by any measure though. Registrations were only 0.8% below last year’s WLTP-distorted numbers exceeded expectations, while the selling rate of 4.3 million units/year almost matched last August’s exceptional rate.

The UK’s August volumes are always low in absolute terms, but a fall of only 1.6% YoY was a good result as the selling rate accelerated towards 3.1 million units/year. “However, in the UK and elsewhere, we may simply be seeing another distortion in sales that tells us little about the underlying health of the market,” says LMC.

This same caveat applies to the remaining major West European markets.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.