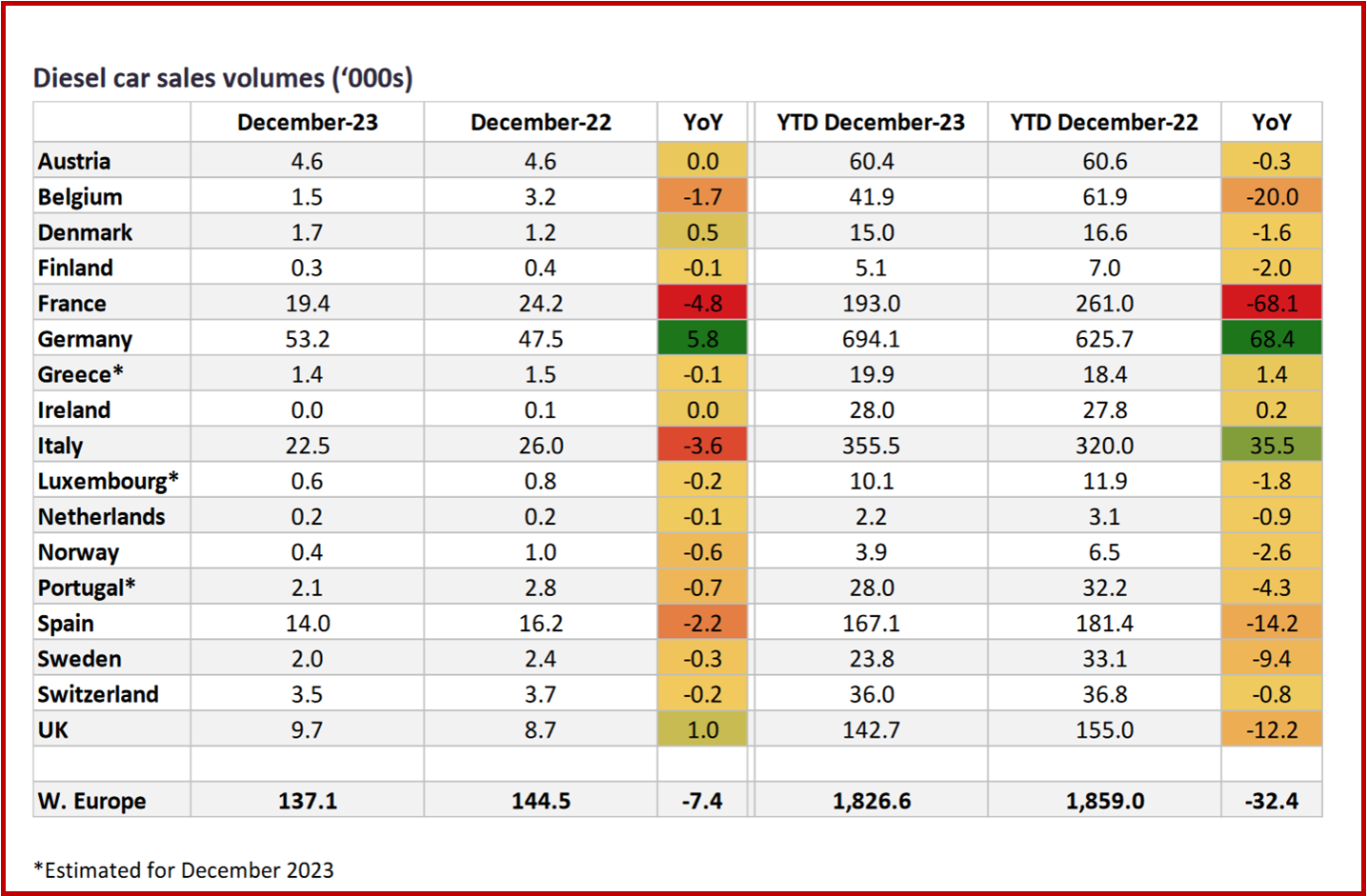

Full-year 2023 data show that the diesel share of new car sales in the western European region was just below 16% with December’s result being the same as that of November at 14.4%, according to the GlobalData*consultancy European Light Vehicle Powertrain Forecasting Team. This is close to December 2022, with monthly year-over-year (YoY) declines diminishing recently.

“The slowdown in BEV growth will no doubt have boosted the internal combustion engine (ICE) sector to some degree and perhaps fed into the relatively buoyant end to the year as far as diesel is concerned,” said GlobalData. “All markets ended 2023 with a smaller diesel share than seen in 2022 except one. Our figures indicate that Germany, with a diesel share of 24.4% for 2023 saw a rise from the 2022 value of 23.6%. Diesel demand has held up well in the country, supported by plenty of product from the dominant domestic brands and driving patterns that highlight the value available from diesel versus alternatives very well.”

Click for more GlobalData.

“We’ve mentioned it before, but it’s worth restating that as well as a slight rise in share, diesel sales in Germany rose YoY in 2023. The actual increase was 68,000 units, which exactly offset the fall seen in France. No other markets saw shifts of this magnitude. Italy, though seeing diesel share fall marginally in 2023, also saw sales rise (by 36,000) contributing to a net regional diesel car sales decline of just 32,000 units for the year,” GlobalData said.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Western European Market Diesel Car Sales Down in 2023

Full-year 2023 data show that the diesel share of new car sales in the western European region was just below 16% with December’s result being the same as that of November at 14.4%, according to the GlobalData*consultancy European Light Vehicle Powertrain Forecasting Team. This is close to December 2022, with monthly year-over-year (YoY) declines diminishing recently.

“The slowdown in BEV growth will no doubt have boosted the internal combustion engine (ICE) sector to some degree and perhaps fed into the relatively buoyant end to the year as far as diesel is concerned,” said GlobalData. “All markets ended 2023 with a smaller diesel share than seen in 2022 except one. Our figures indicate that Germany, with a diesel share of 24.4% for 2023 saw a rise from the 2022 value of 23.6%. Diesel demand has held up well in the country, supported by plenty of product from the dominant domestic brands and driving patterns that highlight the value available from diesel versus alternatives very well.”

Click for more GlobalData.

“We’ve mentioned it before, but it’s worth restating that as well as a slight rise in share, diesel sales in Germany rose YoY in 2023. The actual increase was 68,000 units, which exactly offset the fall seen in France. No other markets saw shifts of this magnitude. Italy, though seeing diesel share fall marginally in 2023, also saw sales rise (by 36,000) contributing to a net regional diesel car sales decline of just 32,000 units for the year,” GlobalData said.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.