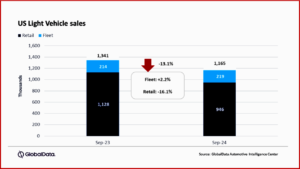

U.S. Light Vehicle sales totaled 1.17 million units in September, according to a preliminary analysis just released by the respected GlobalData* consultancy. The annualized selling rate for the month was 15.8 million units/year, up from 15.2 million units/year in August. The daily selling rate was estimated at 50,700 units/day in September, down from 50,900 in August.** Light Vehicle (LV) sales fell by 13.1% year-on-year (YoY). September lacked the Labor Day holiday weekend this year, and “with only 23 selling days in the month compared to 26 in 2023, the month was always likely to be weak in terms of an adjusted YoY comparison,” GlobalData said.

“September sales were in line with our forecast, although our expectations were modest for what was always penciled in to be a quieter month. Even though the Federal Reserve cut interest rates by 50 basis points – above the expectations of many analysts – it is likely to take some time for lower borrowing costs to feed through to the auto industry. Generally, high vehicle pricing is keeping monthly payments elevated, and therefore some consumers are still sitting on the sidelines,” said David Oakley, Manager, Americas Sales Forecasts at GlobalData.

“However, leasing deals and heavier discounting for certain Electric Vehicles (EVs) provide the opportunity for buyers to find a bargain, depending on their vehicle needs. Hurricane Helene struck a large swath of the southeastern United States right before the closing weekend of the month, and quarter. Volumes likely would have been marginally stronger without Helene’s destructive presence,” said Oakley.

GlobalData Observations

- General Motors comfortably retained its position as the leading OEM in September, on 206,000 units.

- Toyota Group continues to be held back by stop sales orders on the Toyota Grand Highlander and Lexus TX, as well as low inventory levels for the Toyota RAV4. Therefore, Toyota Group’s sales were modest at 163,000.

- Ford Group stood in third place with 143000 units.

- Despite the aforementioned challenges, Toyota was still the leading brand in September with140,000 units but was only 6000 ahead of Ford. In addition, Chevrolet trailed Ford by fewer than 3000 units, the closest it has come to surpassing Ford’s volumes since August 2023, when Chevrolet last finished ahead of its rival.

- The Ford F-150 was once again the leading LV in September with 34,000 units, ahead of the Toyota RAV4 at 31,300. Even though the RAV4 is being hampered by a lack of inventory, it still beat the Honda CR-V at 29,200, which had overtaken theRAV4 in August.

- After several months in which demand appeared to be easing, Compact Non-Premium SUVs have seen a slight uptick in market share over the past two months, reaching 20.7% in September – its highest since April.

- In contrast, Mid-size Non-Premium SUVs, which had enjoyed a spike in August, fell back to just a 14.5% share in September, the segment’s lowest since December 2019.

- Large Pickups were not far behind Mid-size Non-Premium SUVs in September, holding a 14.3% market share, the best performance for the segment since December 2022.

Global Outlook

The global LV sales rate in August remained steady at 89.5 million units, about 300,000 lower than July, but indicated a stable overall market. The year-to-date (YTD) selling rate has improved to 86.6 million units/year, but volumes are now up just 1% from the same period in 2023.

- August saw a decline in sales across major markets, with the exception of Brazil and Russia.

- While volumes in China and North America have remained stable, they are not showing signs of returning to the anticipated growth rate for the second half of 2024.

- Therefore, the 2024 forecast for global LV sales has been revised down for the fourth time this year, from 89.3 million units at the beginning of the year to 88.5 million units currently. Growth from 2023 has now settled at 2%, driven by elevated pricing, geopolitical risks, and economic performance.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

** AutoInformed on

Toyota said on 4 November 2024 that the 2025 Grand Highlander will have starting Manufacturer’s Suggested Retail Prices** (MSRP’s) of $40,860 for the gas engine models (LE FWD grade), $44,210 for the Hybrid models (LE grade), and $54,690 for the Hybrid MAX powertrain (Limited grade). XLE, Limited, Hybrid Nightshade, and Platinum models are expected to start arriving at Toyota dealerships in late December of 2024. LE models are expected in the first half of 2025.

**MSRP Excludes Dealer Processing and Handling Fee (DPH). Latest click here