Click for more GlobalData.

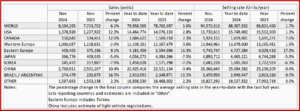

The Global Light Vehicle (LV) selling rate for November* stood at 95 million units/year, according to an analysis released today by the respected GlobalData consultancy.** This was a small improvement on the previous month, and the best result so far in 2024. Market volumes continued to grow in November as YoY sales were up 6% compared to November 2023. YTD sales stood at 80 million units.

“In November, sales saw sustained growth in key markets like the US and China. Chinese consumers are capitalizing on scrappage subsidies and a very competitive pricing environment. In the US, an extra selling day compared to the previous year contributed to increased sales YoY. Sales in Western Europe remain lackluster, mirroring previous trends, as political and economic challenges persist, exacerbated by recent government turmoil in Germany and France,” the Global Light Vehicle Sales Forecast Team said.

GlobalData Commentary, Observations

North America

The US Light Vehicle market saw sales strongly expand YoY in November, “helped in part by an additional selling day compared to the same period last year, while the UAW strikes in November 2023 provided a lower base for sales.” Volumes for November 2024 reached 1.38 million units, growing. by 12.3% YoY. The selling rate jumped to 16.7 million units/year, the highest since May 2021. As 2025 model year vehicles continued to enter the market, average transaction prices saw another bump in November 2024, to US$45,335, up by US$272 MoM. Incentives increased by US$233 MoM, to US$3,350, possibly due to OEMs and dealers offering Black Friday discounts by 12.3% YoY. The selling rate jumped to 16.7 million units/year, the highest since May 2021. As 2025 model year vehicles continued to enter the market, average transaction prices saw another bump in November 2024, to US$45,335, up by US$272 MoM. Incentives increased by US$233 MoM, to US$3,350, possibly due to OEMs and dealers offering Black Friday discounts.

Canadian Light Vehicles sales increased by 12% to 151,000, making this the strongest November result since 2017. “Despite these robust sales, the selling rate slowed to 1.92 million units/year in November, down from 1.98 million units/year in October.”

Mexico sales growth seen throughout the year continued in November, as “sales exploded by 20.5% YoY to 155,000, surpassing initial estimates. The selling rate accelerated to 1.51 million units/year in November, up from 1.45 million units/year in October.”

South America

Brazilian Light Vehicle sales posted another strong month in November. Volumes expanded by 19.6% YoY, reaching 24,000. The selling rate grew to slightly above 3.0 million units/year, from 2.86 million units/year in October, and marking the first time since January 2015 in which the rate surpassed the 3.0 million unit/year level. “Strong consumer spending has been guiding the Brazilian LV market towards pre-pandemic levels, while unemployment continues to fall, credit availability improves, and rental car companies renew their fleets.”

In Argentina, Light Vehicle sales reached 33,300 in November, slowing by 2.0% YoY. “While sales did not improve on a YoY basis, the result is stronger than our preliminary forecast for the month. The selling rate eased to 458,000 units/year in November, down from 504,000 units/year in October, but overall the market appears to be in a healthier state than it has been for most of the post-pandemic period.”

Europe

The Western European LV selling rate stood at 13.9 million units/year in November, the second successive MoM improvement, though still weak by historical standards. YTD sales passed 12 million units, only slightly up on the same period in 2023. “The collapse of the German and French governments, both grappling with high levels of fiscal debt and struggling automotive sectors, has added to the challenges facing the region. We anticipate a positive shift for the market in 2025 with ongoing monetary policy easing and the introduction of more affordable EV models. However, the election of Donald Trump and the potential for increased tariffs is a risk to wider economic growth, as well as the automotive industry specifically,” said GlobalData.

The Eastern Europe LV selling rate remained relatively unchanged in November at 4.7 million units/year, with 409,000 units were sold, which is a solid 9% growth YoY. “While sales in Russia remain strong, there are indications of a slowdown, with a 14% MoM decrease in the selling rate in November. Sales in Türkiye remain strong.”

China

According to advance data, China’s domestic market accelerated for the second straight month in November, boosted by the government’s temporary scrapping subsidy program. “The November selling rate is estimated to have reached 28.4 million units/year, the highest rate so far this year, although that was still lower than the 29 to 30 million units/year in summer 2023. In YoY terms, sales (i.e., domestic wholesales) increased by 10% in November, thanks to robust Passenger Vehicle (PV) sales — but declined marginally (-0.4%) YTD, dragged by continuing double-digit declines in Light Commercial Vehicle sales.”

“YoY growth in retail sales of PVs continued to exceed that of wholesales, suggesting that the underlying momentum in the market is perhaps stronger than the wholesale data indicates. Consumers are apparently taking advantage of not only the scrapping subsidies, but also the massive price cuts, as the price war, which once appeared to have been winding down, has regained momentum. For example, it is reported that BMW has rejoined the price war, after declaring the exit from the price competition, and BYD is asking suppliers to cut prices further. The brutal price war will likely intensify next year, while there is rumor that the government will extend the temporary scrapping subsidy program.”

Elsewhere in Asia

After a strong October, the Japanese market “lost some steam, but the November selling rate still reached a robust 4.89 million units/year. In 2024, the vehicle certification issues caused a few weeks to a few months of temporary suspension in production and/or delivery at five OEMs, and the shortage of new vehicles disrupted sales significantly. However, with the normalization of production and supply (with a notable exception of Daihatsu), sales have started to improve markedly. Nonetheless, the market is expected to finish the year with a 7% decline in sales. Sticky inflation, slow wage growth and growing global uncertainty are dampening consumer and business confidence as well.”

The Korean market is set to end the year with the lowest sales since 2013. “The November selling rate was 1.68 million units/year, a solid result, but that brought the YTD average selling rate to only 1.61 million units/year. Sales in 2024 have been impacted by: 1) the pull-ahead effect of the temporary tax cut on Passenger Vehicles (which expired in June 2023), 2) slowdown of local brands’ BEV sales, and 3) high financing rates. Light Commercial Vehicle sales were particularly weak, falling by 23% YoY, year- to-date, due to the aging model cycle – and subdued business confidence amid global uncertainty,” GlobalData said.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

November Global Light Vehicle Sales Rate 93 Million

Click for more GlobalData.

The Global Light Vehicle (LV) selling rate for November* stood at 95 million units/year, according to an analysis released today by the respected GlobalData consultancy.** This was a small improvement on the previous month, and the best result so far in 2024. Market volumes continued to grow in November as YoY sales were up 6% compared to November 2023. YTD sales stood at 80 million units.

“In November, sales saw sustained growth in key markets like the US and China. Chinese consumers are capitalizing on scrappage subsidies and a very competitive pricing environment. In the US, an extra selling day compared to the previous year contributed to increased sales YoY. Sales in Western Europe remain lackluster, mirroring previous trends, as political and economic challenges persist, exacerbated by recent government turmoil in Germany and France,” the Global Light Vehicle Sales Forecast Team said.

GlobalData Commentary, Observations

North America

The US Light Vehicle market saw sales strongly expand YoY in November, “helped in part by an additional selling day compared to the same period last year, while the UAW strikes in November 2023 provided a lower base for sales.” Volumes for November 2024 reached 1.38 million units, growing. by 12.3% YoY. The selling rate jumped to 16.7 million units/year, the highest since May 2021. As 2025 model year vehicles continued to enter the market, average transaction prices saw another bump in November 2024, to US$45,335, up by US$272 MoM. Incentives increased by US$233 MoM, to US$3,350, possibly due to OEMs and dealers offering Black Friday discounts by 12.3% YoY. The selling rate jumped to 16.7 million units/year, the highest since May 2021. As 2025 model year vehicles continued to enter the market, average transaction prices saw another bump in November 2024, to US$45,335, up by US$272 MoM. Incentives increased by US$233 MoM, to US$3,350, possibly due to OEMs and dealers offering Black Friday discounts.

Canadian Light Vehicles sales increased by 12% to 151,000, making this the strongest November result since 2017. “Despite these robust sales, the selling rate slowed to 1.92 million units/year in November, down from 1.98 million units/year in October.”

Mexico sales growth seen throughout the year continued in November, as “sales exploded by 20.5% YoY to 155,000, surpassing initial estimates. The selling rate accelerated to 1.51 million units/year in November, up from 1.45 million units/year in October.”

South America

Brazilian Light Vehicle sales posted another strong month in November. Volumes expanded by 19.6% YoY, reaching 24,000. The selling rate grew to slightly above 3.0 million units/year, from 2.86 million units/year in October, and marking the first time since January 2015 in which the rate surpassed the 3.0 million unit/year level. “Strong consumer spending has been guiding the Brazilian LV market towards pre-pandemic levels, while unemployment continues to fall, credit availability improves, and rental car companies renew their fleets.”

In Argentina, Light Vehicle sales reached 33,300 in November, slowing by 2.0% YoY. “While sales did not improve on a YoY basis, the result is stronger than our preliminary forecast for the month. The selling rate eased to 458,000 units/year in November, down from 504,000 units/year in October, but overall the market appears to be in a healthier state than it has been for most of the post-pandemic period.”

Europe

The Western European LV selling rate stood at 13.9 million units/year in November, the second successive MoM improvement, though still weak by historical standards. YTD sales passed 12 million units, only slightly up on the same period in 2023. “The collapse of the German and French governments, both grappling with high levels of fiscal debt and struggling automotive sectors, has added to the challenges facing the region. We anticipate a positive shift for the market in 2025 with ongoing monetary policy easing and the introduction of more affordable EV models. However, the election of Donald Trump and the potential for increased tariffs is a risk to wider economic growth, as well as the automotive industry specifically,” said GlobalData.

The Eastern Europe LV selling rate remained relatively unchanged in November at 4.7 million units/year, with 409,000 units were sold, which is a solid 9% growth YoY. “While sales in Russia remain strong, there are indications of a slowdown, with a 14% MoM decrease in the selling rate in November. Sales in Türkiye remain strong.”

China

According to advance data, China’s domestic market accelerated for the second straight month in November, boosted by the government’s temporary scrapping subsidy program. “The November selling rate is estimated to have reached 28.4 million units/year, the highest rate so far this year, although that was still lower than the 29 to 30 million units/year in summer 2023. In YoY terms, sales (i.e., domestic wholesales) increased by 10% in November, thanks to robust Passenger Vehicle (PV) sales — but declined marginally (-0.4%) YTD, dragged by continuing double-digit declines in Light Commercial Vehicle sales.”

“YoY growth in retail sales of PVs continued to exceed that of wholesales, suggesting that the underlying momentum in the market is perhaps stronger than the wholesale data indicates. Consumers are apparently taking advantage of not only the scrapping subsidies, but also the massive price cuts, as the price war, which once appeared to have been winding down, has regained momentum. For example, it is reported that BMW has rejoined the price war, after declaring the exit from the price competition, and BYD is asking suppliers to cut prices further. The brutal price war will likely intensify next year, while there is rumor that the government will extend the temporary scrapping subsidy program.”

Elsewhere in Asia

After a strong October, the Japanese market “lost some steam, but the November selling rate still reached a robust 4.89 million units/year. In 2024, the vehicle certification issues caused a few weeks to a few months of temporary suspension in production and/or delivery at five OEMs, and the shortage of new vehicles disrupted sales significantly. However, with the normalization of production and supply (with a notable exception of Daihatsu), sales have started to improve markedly. Nonetheless, the market is expected to finish the year with a 7% decline in sales. Sticky inflation, slow wage growth and growing global uncertainty are dampening consumer and business confidence as well.”

The Korean market is set to end the year with the lowest sales since 2013. “The November selling rate was 1.68 million units/year, a solid result, but that brought the YTD average selling rate to only 1.61 million units/year. Sales in 2024 have been impacted by: 1) the pull-ahead effect of the temporary tax cut on Passenger Vehicles (which expired in June 2023), 2) slowdown of local brands’ BEV sales, and 3) high financing rates. Light Commercial Vehicle sales were particularly weak, falling by 23% YoY, year- to-date, due to the aging model cycle – and subdued business confidence amid global uncertainty,” GlobalData said.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.