Click to enlarge.

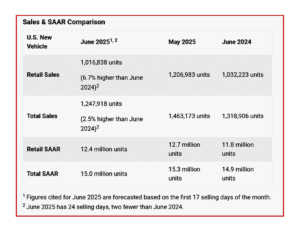

Total U.S. new-vehicle sales during June 2025, including retail and non-retail transactions, are projected to reach 1,247,900, a slight 2.5% increase from June 2024 according to a joint forecast from J.D. Power and GlobalData released today.* June 2025 has 24 selling days, two fewer than June 2024. Comparing the same sales volume without adjusting for the number of selling days translates to a decrease of 5.4% from 2024.The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.0 million units, up 0.2 million units from June 2024.

“June sales are subdued, with the sales pace falling to its lowest level in the past 12 months. However, care needs to be taken when interpreting June results, as they are not fully indicative of the underlying demand for new vehicles” said Thomas King, president of the data and analytics division at J.D. Power.

“There are three critical factors to understand when evaluating June results. The first is that year-over-year comparisons are affected by a large dealer software outage event that limited many dealers’ ability to sell vehicles in June 2024. This event reduced retail sales by approximately 85,000 vehicles, meaning that year-over-year sales results appear considerably more favorable than they actually are.

“The second factor is payback from the tariff-related rush to showrooms in March and April of this year. In those months, approximately 173,000 extra vehicles were sold as buyers pulled purchases forward in anticipation of future tariff-driven price hikes. That pull-ahead effect has now become a payback effect, deflating June sales below the actual level of vehicle demand.**

“The third factor is that while pre-tariff expectations were that discounts would rise during the course of 2025, they have actually fallen. Specifically, incentive spending expressed as a percentage of MSRP has declined from 6.1% in January 2025 to just 5% in June. This reflects the cost-pressure tariffs are creating for manufacturers, but it is also causing some shoppers looking for affordable vehicles to remain on the sidelines,” King said.

Executive Summary (edited for space)

- The average new-vehicle retail transaction price in June is expected to reach $46,233, up $1,400 or 3.1% from June 2024, but up only $77 or 0.2% from May.

- The average manufacturer incentive per vehicle is on track to reach $2,727, an increase of $93 from May, and an increase of $39 from a year ago. However, expressed as a percentage of MSRP, incentive spending is currently at 5.4%, a decrease of 0.1 percentage point from a year ago.

- Total retailer profit per unit, which includes vehicle gross plus finance and insurance income, is expected to be $2380, up $45 from June 2024, but down $32 from May. Total aggregate retailer profit from new-vehicle sales for this month is projected to be $2.3 billion, up 3.1% from June 2024.

- Higher prices translate to higher monthly loan payments. Average monthly finance payments in June are on track to reach $747, an increase of $22 from June 2024, and the highest on record for the month of June.

- The average interest rate for new-vehicle loans is 6.89%, a nominal decrease of 8 basis points from a year ago. Finance loans with terms greater than or equal to 84 months are expected to reach 12.0% of finance sales this month, up 3.0 percentage points from June 2024.

- Fleet sales are projected to decline 12.7% from a year ago, as manufacturers continue to prioritize retail buyers over the historically less profitable fleet channel.

“The average used-vehicle price is trending towards $29,440, up $674 from a year ago. This reflects the combination of reduced supply of recent model-year used vehicles—due to lower new-vehicle production during the pandemic—fewer lease maturities and manufacturers moderating discounts. An increase in used-vehicle prices means that average trade-in equity is rising, up $480 year over year to $8,384. despite higher used-vehicle prices, the number of new-vehicle buyers with negative equity on their trade-in is expected to reach 25.1%—an increase of 1.6 percentage points from June 2024,” Power said.

Global Sales Outlook

“Global light-vehicle sales in May increased 4.6% year over year to 7.6 million units, with most regions showing growth. The selling rate for May finished at 90.1 million units, down from 91.8 million units in April,” said David Oakley, manager, Americas vehicle sales forecasts at GlobalData.

“China, North America and South America were the regions that contributed the most to year-over-year sales increases in May. In China, the fact that the government has extended its scrappage incentives through the end of 2025 helped sales, as did continued tax breaks on new energy vehicles. Meanwhile, North America’s gains were largely fueled by favorable calendar effects, with additional selling days compared with May 2024. On a selling-day-adjusted basis, sales would have declined year over year. In South America, the liberalization of the Argentine market to imported vehicles, combined with falling inflation and reduced taxes, caused sales to surge.

“June sales are expected to decrease 1.2% from June 2024. North America is likely to see a slowdown in sales, as the pull-forward effect of consumers bringing forward purchases to avoid tariffs turns into a payback effect, and manufacturers lower incentives as a means of reducing costs while keeping MSRPs unchanged in many cases. Western Europe is also expected to see year-over-year declines in sales, as weak consumer confidence and a stuttering economy take a toll. On a more positive note, Japan is expected to deliver a strong result, as manufacturers increase vehicle supply to meet a backlog in orders. The global selling rate is projected to reach 89.8 million units, up from a rate of 89.4 million units in June 2024.

“With trade negotiations ongoing between the United States and various countries, there remains a great deal of uncertainty over what the result will be, and how quickly we will start to see deals being made. In the meantime, several regions are likely to see sales slow amid rising prices. Our 2025 global sales forecast stands at 89.7 million units, up 1.1% on 2024 volumes,” said Oakley.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**News Update: From April 2024 to March 2025, the U.S. economy created 911,000 fewer jobs than initially reported, according to revisions released 9 September 2025 by the Bureau of Labor Statistics. This averages to 76,000 fewer jobs per month and an overall downward revision of 0.6%, compared with an average revision of 0.2% in recent years. The update is largely based on data from state unemployment insurance records, The BLS is scheduled to release its final revision in February 2026. Who knows how many more hard-working government employees will be fired by King Trump by then – AutoCrat.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Trump Tariff Legacy – U.S. June Auto Sales Soft

Click to enlarge.

Total U.S. new-vehicle sales during June 2025, including retail and non-retail transactions, are projected to reach 1,247,900, a slight 2.5% increase from June 2024 according to a joint forecast from J.D. Power and GlobalData released today.* June 2025 has 24 selling days, two fewer than June 2024. Comparing the same sales volume without adjusting for the number of selling days translates to a decrease of 5.4% from 2024.The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.0 million units, up 0.2 million units from June 2024.

“June sales are subdued, with the sales pace falling to its lowest level in the past 12 months. However, care needs to be taken when interpreting June results, as they are not fully indicative of the underlying demand for new vehicles” said Thomas King, president of the data and analytics division at J.D. Power.

“There are three critical factors to understand when evaluating June results. The first is that year-over-year comparisons are affected by a large dealer software outage event that limited many dealers’ ability to sell vehicles in June 2024. This event reduced retail sales by approximately 85,000 vehicles, meaning that year-over-year sales results appear considerably more favorable than they actually are.

“The second factor is payback from the tariff-related rush to showrooms in March and April of this year. In those months, approximately 173,000 extra vehicles were sold as buyers pulled purchases forward in anticipation of future tariff-driven price hikes. That pull-ahead effect has now become a payback effect, deflating June sales below the actual level of vehicle demand.**

“The third factor is that while pre-tariff expectations were that discounts would rise during the course of 2025, they have actually fallen. Specifically, incentive spending expressed as a percentage of MSRP has declined from 6.1% in January 2025 to just 5% in June. This reflects the cost-pressure tariffs are creating for manufacturers, but it is also causing some shoppers looking for affordable vehicles to remain on the sidelines,” King said.

Executive Summary (edited for space)

“The average used-vehicle price is trending towards $29,440, up $674 from a year ago. This reflects the combination of reduced supply of recent model-year used vehicles—due to lower new-vehicle production during the pandemic—fewer lease maturities and manufacturers moderating discounts. An increase in used-vehicle prices means that average trade-in equity is rising, up $480 year over year to $8,384. despite higher used-vehicle prices, the number of new-vehicle buyers with negative equity on their trade-in is expected to reach 25.1%—an increase of 1.6 percentage points from June 2024,” Power said.

Global Sales Outlook

“Global light-vehicle sales in May increased 4.6% year over year to 7.6 million units, with most regions showing growth. The selling rate for May finished at 90.1 million units, down from 91.8 million units in April,” said David Oakley, manager, Americas vehicle sales forecasts at GlobalData.

“China, North America and South America were the regions that contributed the most to year-over-year sales increases in May. In China, the fact that the government has extended its scrappage incentives through the end of 2025 helped sales, as did continued tax breaks on new energy vehicles. Meanwhile, North America’s gains were largely fueled by favorable calendar effects, with additional selling days compared with May 2024. On a selling-day-adjusted basis, sales would have declined year over year. In South America, the liberalization of the Argentine market to imported vehicles, combined with falling inflation and reduced taxes, caused sales to surge.

“June sales are expected to decrease 1.2% from June 2024. North America is likely to see a slowdown in sales, as the pull-forward effect of consumers bringing forward purchases to avoid tariffs turns into a payback effect, and manufacturers lower incentives as a means of reducing costs while keeping MSRPs unchanged in many cases. Western Europe is also expected to see year-over-year declines in sales, as weak consumer confidence and a stuttering economy take a toll. On a more positive note, Japan is expected to deliver a strong result, as manufacturers increase vehicle supply to meet a backlog in orders. The global selling rate is projected to reach 89.8 million units, up from a rate of 89.4 million units in June 2024.

“With trade negotiations ongoing between the United States and various countries, there remains a great deal of uncertainty over what the result will be, and how quickly we will start to see deals being made. In the meantime, several regions are likely to see sales slow amid rising prices. Our 2025 global sales forecast stands at 89.7 million units, up 1.1% on 2024 volumes,” said Oakley.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**News Update: From April 2024 to March 2025, the U.S. economy created 911,000 fewer jobs than initially reported, according to revisions released 9 September 2025 by the Bureau of Labor Statistics. This averages to 76,000 fewer jobs per month and an overall downward revision of 0.6%, compared with an average revision of 0.2% in recent years. The update is largely based on data from state unemployment insurance records, The BLS is scheduled to release its final revision in February 2026. Who knows how many more hard-working government employees will be fired by King Trump by then – AutoCrat.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.