Click to enlarge.

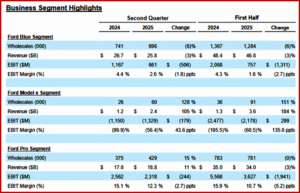

Ford Motor Company (NYSE: F) reported late yesterday its Q2 and H1 2025 financial performance. The now common internally created factors of Ford’s warranty costs,* losses on electric vehicles and the external Trump’s tariff chaos negative effects were in play. Tariffs slashed $800 million from Ford profits during Q2, the Dearborn-based company said. Its latest estimate of $2 billion in tariff costs for the year includes the impact of cost-cutting and other measures Ford is taking in response to President Trump’s trade policies. Ford Motor booked a $1.3 billion loss from repairs of vehicles under warranty, cancellation of plans to build an electric sport utility vehicle and other one-time costs. The Q2 net loss was $36 million. Ford common stock per share has been trading in the $8.44 – $11.97 range during the last year, hovering ~$11 a share recently. Its three-year return of ~5% compares to the S&P 500 at 54%.

“Our second-quarter performance shows the power of the Ford+ plan and continued execution on cost and quality,” claimed Jim Farley, Ford president and CEO. “Ford Pro is a unique competitive advantage driving both top and bottom-line growth while creating new high-margin revenue streams from software and physical services. Ford Blue ( the old internal combustion engine-based businesses) delivered profitable market share gains, and we continue to improve the efficiency of our Ford Model e (EV) business. We have scheduled an event on August 11 in Kentucky where we will share more about our plans to design and build breakthrough electric vehicles in America.”

“I have heard from countless Michiganders alarmed by the way Washington Republicans are handling tariffs,” said Michigan Governor Gretchen Whitmer in a statement that coincided with the reporting of auto company earnings this week. “Tariffs have weakened Michigan supply chains, increased costs for family budgets, and caused major firms to scale back operations in Michigan. While I can’t control tariffs, I can make sure you know how they will affect your life and do everything in my power to help. That’s why I’m signing an executive directive to report the updated impact of these tariffs on Michigan’s economy, so we can protect our economy and lower costs for Michigan families. I’ll continue fighting to grow Michigan’s economy with common-sense trade policies that lower costs for Michiganders.”

Jim Farley on the earnings call said this, “The latest round of tariff policies, especially the deals in Japan and Europe and potentially South Korea makes our strategy even more compelling at Ford. Our bet is not to compete in high-volume generic segments that typically require overseas production for cost competitiveness. Instead, we are doubling down on what we do best: trucks, iconic passion products, Ford Pro and breakthrough technology that you will soon see in our forthcoming EV platform.

“Now on emissions, America’s top brand, we further are investing in giving our customers choice along their low CO2 journey, new investments in ICE, more efficient and performance hybrids and full electric vehicles are all on tap at Ford. We support a single durable national emission standard to ensure sound industry planning. We proposed reforms that are on the table now give us greater powertrain optionality and reduce our need to buy CO2 credits.

“In fact, our commitment to purchase CO2 credits have already been reduced by nearly $1.5 billion. Further changes will balance standards and customer choice and has the potential to unlock a multi-billion-dollar opportunity over the next 2 years, primarily in Ford Blue, which has carried a lot of the compliance burden.,” Farley said.

Ford Motor posted Q2 revenue of $50.2 billion, a 5% increase from the same period a year ago, which it noted outpaced wholesale growth. Net loss was $36 million, which primarily includes special charges related to a field service action and expenses related to a previously announced cancellation of an electric vehicle program; adjusted earnings before interest and taxes was $2.1 billion, including $0.8 billion of adverse net tariff-related impacts. Cash flow from operations in the second quarter was $6.3 billion and adjusted free cash flow was $2.8 billion. At quarter end, Ford had $28.4 billion in cash and $46.6 billion in liquidity. Ford Motor also declared a Q3 regular dividend of 15 cents per share, payable on 2 September 2025 to shareholders of record at the close of business on 11 August.

Ford Pro during Q2 generated $2.3 billion in EBIT with a margin of 12.3% on $18.8 billion in revenue. Software and physical services contributed 17% of Ford Pro’s EBIT on a trailing 12-month basis. In the quarter, Ford Pro paid subscriptions grew 24% year-over-year to 757,000.

Ford Model e reported a Q2 EBIT loss of $1.3 billion, a $179 million greater loss than Q2 a year ago. “Second quarter results reflect net tariff-related cost, strategic investments in next-generation electric vehicles and expenses related to the launch of Ford’s new battery plant in Marshall, Mich. The segment doubled revenue to $2.4 billion; EBIT performance for first-generation products, Mustang Mach-E and F-150 Lightning, was essentially flat year-over-year, excluding the impact of tariffs, underscoring gains in operating leverage and cost reduction,” Ford said.

Ford Blue posted a Q2 result of $661 million in EBIT, “which reflected profitable market share gains, higher net pricing and cost improvement. This was more than offset by the non-recurrence of last year’s F-150 stock build following the new model launch and tariff-related headwinds. Segment revenue declined 3% to $25.8 billion.” Ford said.Ford Credit reported second-quarter earnings before taxes (EBT) of $645 million, an 88% increase compared to a year ago.

Full-Year 2025 Outlook

Ford now foresees full-year adjusted EBIT of $6.5 billion to $7.5 billion, which includes a net tariff-related headwind of about $2 billion. Ford said it will produce $3.5 billion to $4.5 billion in adjusted free cash flow, with capital expenditures of ~$9 billion. In February, Ford Motor initially provided adjusted EBIT guidance for the year of $7.0 billion to $8.5 billion and then withdrew that guidance in May due to tariff-related uncertainty.

“The company’s updated guidance reflects the strong underlying first half performance across Ford Blue, Ford Model e, Ford Pro and Ford Credit, and continued improvement in cost. The net tariff-related headwind of about $2 billion reflects a $3 billion gross adverse adjusted EBIT impact, offset partially by $1 billion of recovery actions. The company is only providing a Total Company outlook for the remainder of the year,” Ford said in its earnings release.

*“We are not satisfied with the current level of recalls or the number of vehicles impacted. We are working to reduce the cost of these recalls,” said Kumar Galhotra. chief operating officer of Ford Motor Company. Warranty is the largest component of our competitive cost gap. This is a major cost opportunity for us. There are 2 warranty costs investors should focus on. The first is warranty coverage. This is the expected cost to cover our bumper-to-bumper and powertrain warranties. Coverages make up about 60% of our total warranty costs. As the quality of our vehicles improves, the cost of coverage per vehicle should come down. In fact, we are already seeing this improvement. Our latest 0 and 3 months in service metrics are tracking towards our strongest performance in over 10 years.

“The second part of warranty costs are FSAs; costs associated with recalls and customer satisfaction items. “Roughly 1/3 of our recalls over the past 3 years have been software related, and we are addressing this head on. We are using Over-The-Air or OTA updates to reduce customer inconvenience of having to take the recall units in for service. OTAs are a game changer. OTAs cost over 95% less than physical repairs. While OTAs and other process improvements are helping us make meaningful cost improvement, most of our recent FSA costs are tied to vehicles engineered several years ago, before we made all the robust process changes across our industrial system. As a result, the expected FSA cost improvement will not impact the bottom line as quickly as improvement in coverage costs. There is a lag effect until the majority of our car park reflects vehicles designed and built under the strengthened processes, but there are early indicators that are encouraging. For example, the FSA costs for ’24 and ’25 model year vehicles are at least 50% better than ’20 and ’22 model year at similar time and service,” said Galhotra.

“We recorded our fourth consecutive quarter of year-over-year cost improvement, excluding the impact of tariffs, building on progress we made last year when we closed roughly $1.5 billion of our competitive cost gap in material cost. Our balance sheet keeps getting stronger, further enabling our ability to invest in areas of strength. We are remaking Ford into a higher-growth, higher-margin, and more durable business – and allocating capital where we can compete, win and grow,” claimed Ford CFO Sherry House.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Says Trump Tariffs Will Slash Earnings by $2B

Click to enlarge.

Ford Motor Company (NYSE: F) reported late yesterday its Q2 and H1 2025 financial performance. The now common internally created factors of Ford’s warranty costs,* losses on electric vehicles and the external Trump’s tariff chaos negative effects were in play. Tariffs slashed $800 million from Ford profits during Q2, the Dearborn-based company said. Its latest estimate of $2 billion in tariff costs for the year includes the impact of cost-cutting and other measures Ford is taking in response to President Trump’s trade policies. Ford Motor booked a $1.3 billion loss from repairs of vehicles under warranty, cancellation of plans to build an electric sport utility vehicle and other one-time costs. The Q2 net loss was $36 million. Ford common stock per share has been trading in the $8.44 – $11.97 range during the last year, hovering ~$11 a share recently. Its three-year return of ~5% compares to the S&P 500 at 54%.

“Our second-quarter performance shows the power of the Ford+ plan and continued execution on cost and quality,” claimed Jim Farley, Ford president and CEO. “Ford Pro is a unique competitive advantage driving both top and bottom-line growth while creating new high-margin revenue streams from software and physical services. Ford Blue ( the old internal combustion engine-based businesses) delivered profitable market share gains, and we continue to improve the efficiency of our Ford Model e (EV) business. We have scheduled an event on August 11 in Kentucky where we will share more about our plans to design and build breakthrough electric vehicles in America.”

“I have heard from countless Michiganders alarmed by the way Washington Republicans are handling tariffs,” said Michigan Governor Gretchen Whitmer in a statement that coincided with the reporting of auto company earnings this week. “Tariffs have weakened Michigan supply chains, increased costs for family budgets, and caused major firms to scale back operations in Michigan. While I can’t control tariffs, I can make sure you know how they will affect your life and do everything in my power to help. That’s why I’m signing an executive directive to report the updated impact of these tariffs on Michigan’s economy, so we can protect our economy and lower costs for Michigan families. I’ll continue fighting to grow Michigan’s economy with common-sense trade policies that lower costs for Michiganders.”

Jim Farley on the earnings call said this, “The latest round of tariff policies, especially the deals in Japan and Europe and potentially South Korea makes our strategy even more compelling at Ford. Our bet is not to compete in high-volume generic segments that typically require overseas production for cost competitiveness. Instead, we are doubling down on what we do best: trucks, iconic passion products, Ford Pro and breakthrough technology that you will soon see in our forthcoming EV platform.

“Now on emissions, America’s top brand, we further are investing in giving our customers choice along their low CO2 journey, new investments in ICE, more efficient and performance hybrids and full electric vehicles are all on tap at Ford. We support a single durable national emission standard to ensure sound industry planning. We proposed reforms that are on the table now give us greater powertrain optionality and reduce our need to buy CO2 credits.

“In fact, our commitment to purchase CO2 credits have already been reduced by nearly $1.5 billion. Further changes will balance standards and customer choice and has the potential to unlock a multi-billion-dollar opportunity over the next 2 years, primarily in Ford Blue, which has carried a lot of the compliance burden.,” Farley said.

Ford Motor posted Q2 revenue of $50.2 billion, a 5% increase from the same period a year ago, which it noted outpaced wholesale growth. Net loss was $36 million, which primarily includes special charges related to a field service action and expenses related to a previously announced cancellation of an electric vehicle program; adjusted earnings before interest and taxes was $2.1 billion, including $0.8 billion of adverse net tariff-related impacts. Cash flow from operations in the second quarter was $6.3 billion and adjusted free cash flow was $2.8 billion. At quarter end, Ford had $28.4 billion in cash and $46.6 billion in liquidity. Ford Motor also declared a Q3 regular dividend of 15 cents per share, payable on 2 September 2025 to shareholders of record at the close of business on 11 August.

Ford Pro during Q2 generated $2.3 billion in EBIT with a margin of 12.3% on $18.8 billion in revenue. Software and physical services contributed 17% of Ford Pro’s EBIT on a trailing 12-month basis. In the quarter, Ford Pro paid subscriptions grew 24% year-over-year to 757,000.

Ford Model e reported a Q2 EBIT loss of $1.3 billion, a $179 million greater loss than Q2 a year ago. “Second quarter results reflect net tariff-related cost, strategic investments in next-generation electric vehicles and expenses related to the launch of Ford’s new battery plant in Marshall, Mich. The segment doubled revenue to $2.4 billion; EBIT performance for first-generation products, Mustang Mach-E and F-150 Lightning, was essentially flat year-over-year, excluding the impact of tariffs, underscoring gains in operating leverage and cost reduction,” Ford said.

Ford Blue posted a Q2 result of $661 million in EBIT, “which reflected profitable market share gains, higher net pricing and cost improvement. This was more than offset by the non-recurrence of last year’s F-150 stock build following the new model launch and tariff-related headwinds. Segment revenue declined 3% to $25.8 billion.” Ford said.Ford Credit reported second-quarter earnings before taxes (EBT) of $645 million, an 88% increase compared to a year ago.

Full-Year 2025 Outlook

Ford now foresees full-year adjusted EBIT of $6.5 billion to $7.5 billion, which includes a net tariff-related headwind of about $2 billion. Ford said it will produce $3.5 billion to $4.5 billion in adjusted free cash flow, with capital expenditures of ~$9 billion. In February, Ford Motor initially provided adjusted EBIT guidance for the year of $7.0 billion to $8.5 billion and then withdrew that guidance in May due to tariff-related uncertainty.

“The company’s updated guidance reflects the strong underlying first half performance across Ford Blue, Ford Model e, Ford Pro and Ford Credit, and continued improvement in cost. The net tariff-related headwind of about $2 billion reflects a $3 billion gross adverse adjusted EBIT impact, offset partially by $1 billion of recovery actions. The company is only providing a Total Company outlook for the remainder of the year,” Ford said in its earnings release.

*“We are not satisfied with the current level of recalls or the number of vehicles impacted. We are working to reduce the cost of these recalls,” said Kumar Galhotra. chief operating officer of Ford Motor Company. Warranty is the largest component of our competitive cost gap. This is a major cost opportunity for us. There are 2 warranty costs investors should focus on. The first is warranty coverage. This is the expected cost to cover our bumper-to-bumper and powertrain warranties. Coverages make up about 60% of our total warranty costs. As the quality of our vehicles improves, the cost of coverage per vehicle should come down. In fact, we are already seeing this improvement. Our latest 0 and 3 months in service metrics are tracking towards our strongest performance in over 10 years.

“The second part of warranty costs are FSAs; costs associated with recalls and customer satisfaction items. “Roughly 1/3 of our recalls over the past 3 years have been software related, and we are addressing this head on. We are using Over-The-Air or OTA updates to reduce customer inconvenience of having to take the recall units in for service. OTAs are a game changer. OTAs cost over 95% less than physical repairs. While OTAs and other process improvements are helping us make meaningful cost improvement, most of our recent FSA costs are tied to vehicles engineered several years ago, before we made all the robust process changes across our industrial system. As a result, the expected FSA cost improvement will not impact the bottom line as quickly as improvement in coverage costs. There is a lag effect until the majority of our car park reflects vehicles designed and built under the strengthened processes, but there are early indicators that are encouraging. For example, the FSA costs for ’24 and ’25 model year vehicles are at least 50% better than ’20 and ’22 model year at similar time and service,” said Galhotra.

“We recorded our fourth consecutive quarter of year-over-year cost improvement, excluding the impact of tariffs, building on progress we made last year when we closed roughly $1.5 billion of our competitive cost gap in material cost. Our balance sheet keeps getting stronger, further enabling our ability to invest in areas of strength. We are remaking Ford into a higher-growth, higher-margin, and more durable business – and allocating capital where we can compete, win and grow,” claimed Ford CFO Sherry House.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.