Click to enlarge.

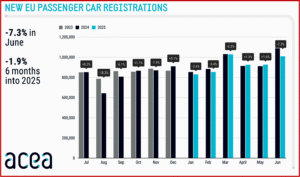

During the first half of 2025 (H1 2025), new EU car registrations dropped by 1.9% compared to the same period last year, with a large -7.3% year-on-year (YOY) decline for June, according to data released today by the European Automobile Manufacturers’ Association, aka ACEA at AutoInformed after its original French name.**

The lobbying group of 15 major European automakers said that “the battery-electric car market share for H1 2025 stood at 15.6%, still far from where it needs to be at this point in the transition. Hybrid-electric models continue to grow in popularity, retaining their place as the most popular power type amongst buyers.”

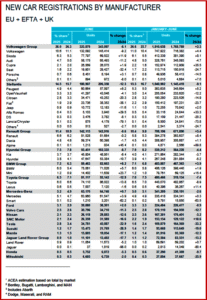

Click to enlarge. Tesla sales drop -33%.

Up until June 2025, battery-electric cars accounted for 15.6% of the EU market share, an increase from the low baseline of 12.5% in H1 2024. Hybrid-electric car registrations continue to surge, capturing 34.8% of the market, remaining the preferred choice among EU consumers. Meanwhile, the combined market share of petrol and diesel cars fell to 37.8%, down from 48.2% during the same period in 2024.

Electric cars

During the first half of 2025, new battery-electric car sales reached 869,271 units, capturing 15.6% of the EU market share. Three of the four largest markets in the EU, accounting for over 60% of battery-electric car registrations saw gains: Germany (+35.1%), Belgium (+19.5%), and the Netherlands (+6.1%). This contrasted with France, which saw a decline of 6.4%. Notably the Tesla backlash continues as sales were chainsawed off -33%.

H1 2025 figures also showed new EU registrations of hybrid-electric cars rose to 1,942,762 units, driven by growth in the four biggest markets: France (+34.1%), Spain (+32.8%), Italy (+10%), and Germany (+9.9%). Hybrid-electric models now account for 34.8% of the total EU market share.

Registrations of plug-in-hybrid electric cars in H1 2025 reached 469,410 units. This was driven by increases in volume for key markets such as Germany (+55.1%) and Spain (+82.5%), but also Italy (+56.3%). As a result, plug-in-hybrid electric cars now represent 8.4% of total car registrations in the EU, up from 6.9% in June 2024 YTD.

Moreover, the YOY variation in June 2025 showed a rise of only 7.8% for battery-electric and 6.1% for hybrid-electric cars, while plug-in-hybrid electric recorded its fourth consecutive month of robust growth with a 41.6% increase.

Petrol and Diesel cars

By the end of June 2025, petrol car registrations had declined by 21.2%, with all major markets experiencing decreases. France experienced the steepest drop, with registrations plummeting by 33.7%, followed by Germany (-27.8%), Italy (-17.2%), and Spain (-13.4%). With 1,585,357 new cars registered so far, the market share for petrol dropped to 28.4%, down from 35.4%. Similarly, the diesel car market declined by 28.1%, resulting in a 9.4% share for diesel vehicles in June 2025 YTD. The June 2025 YOY variation showed a decline of 25.4% for petrol and 34.1% for diesel.

**ACEA

The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

ACEA – June and H1 EU Sales Dropping

Click to enlarge.

During the first half of 2025 (H1 2025), new EU car registrations dropped by 1.9% compared to the same period last year, with a large -7.3% year-on-year (YOY) decline for June, according to data released today by the European Automobile Manufacturers’ Association, aka ACEA at AutoInformed after its original French name.**

The lobbying group of 15 major European automakers said that “the battery-electric car market share for H1 2025 stood at 15.6%, still far from where it needs to be at this point in the transition. Hybrid-electric models continue to grow in popularity, retaining their place as the most popular power type amongst buyers.”

Click to enlarge. Tesla sales drop -33%.

Up until June 2025, battery-electric cars accounted for 15.6% of the EU market share, an increase from the low baseline of 12.5% in H1 2024. Hybrid-electric car registrations continue to surge, capturing 34.8% of the market, remaining the preferred choice among EU consumers. Meanwhile, the combined market share of petrol and diesel cars fell to 37.8%, down from 48.2% during the same period in 2024.

Electric cars

During the first half of 2025, new battery-electric car sales reached 869,271 units, capturing 15.6% of the EU market share. Three of the four largest markets in the EU, accounting for over 60% of battery-electric car registrations saw gains: Germany (+35.1%), Belgium (+19.5%), and the Netherlands (+6.1%). This contrasted with France, which saw a decline of 6.4%. Notably the Tesla backlash continues as sales were chainsawed off -33%.

H1 2025 figures also showed new EU registrations of hybrid-electric cars rose to 1,942,762 units, driven by growth in the four biggest markets: France (+34.1%), Spain (+32.8%), Italy (+10%), and Germany (+9.9%). Hybrid-electric models now account for 34.8% of the total EU market share.

Registrations of plug-in-hybrid electric cars in H1 2025 reached 469,410 units. This was driven by increases in volume for key markets such as Germany (+55.1%) and Spain (+82.5%), but also Italy (+56.3%). As a result, plug-in-hybrid electric cars now represent 8.4% of total car registrations in the EU, up from 6.9% in June 2024 YTD.

Moreover, the YOY variation in June 2025 showed a rise of only 7.8% for battery-electric and 6.1% for hybrid-electric cars, while plug-in-hybrid electric recorded its fourth consecutive month of robust growth with a 41.6% increase.

Petrol and Diesel cars

By the end of June 2025, petrol car registrations had declined by 21.2%, with all major markets experiencing decreases. France experienced the steepest drop, with registrations plummeting by 33.7%, followed by Germany (-27.8%), Italy (-17.2%), and Spain (-13.4%). With 1,585,357 new cars registered so far, the market share for petrol dropped to 28.4%, down from 35.4%. Similarly, the diesel car market declined by 28.1%, resulting in a 9.4% share for diesel vehicles in June 2025 YTD. The June 2025 YOY variation showed a decline of 25.4% for petrol and 34.1% for diesel.

**ACEA

The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.