Click for more GlobalData.

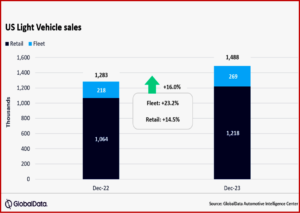

US Light Vehicle (LV) sales grew by 16.0% year-on-year (YoY) in December to 1.49 million units, according to preliminary estimates from the respected GlobalData consultancy.* Although year-ago sales were still relatively weak, December sales exceeded expectations and “indicated that the market was heating up as 2023 ended. For 2023, sales totaled 15.6 million units, a YoY gain of 13.0%, as the market recovered from the chip shortage-induced slump in 2022,” GlobalData said today.

“December has traditionally been a good time of year to buy a vehicle as automakers seek to hit year-end targets, but that had been less true in recent years amid tight inventory levels. However, with stocks now significantly replenished across the industry, discounting was back on the agenda last month. Consumers who have been sitting on the sidelines appear to have been willing to jump back into the new vehicle market again, although it also seems that fleet deliveries accounted for some of the December surge,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

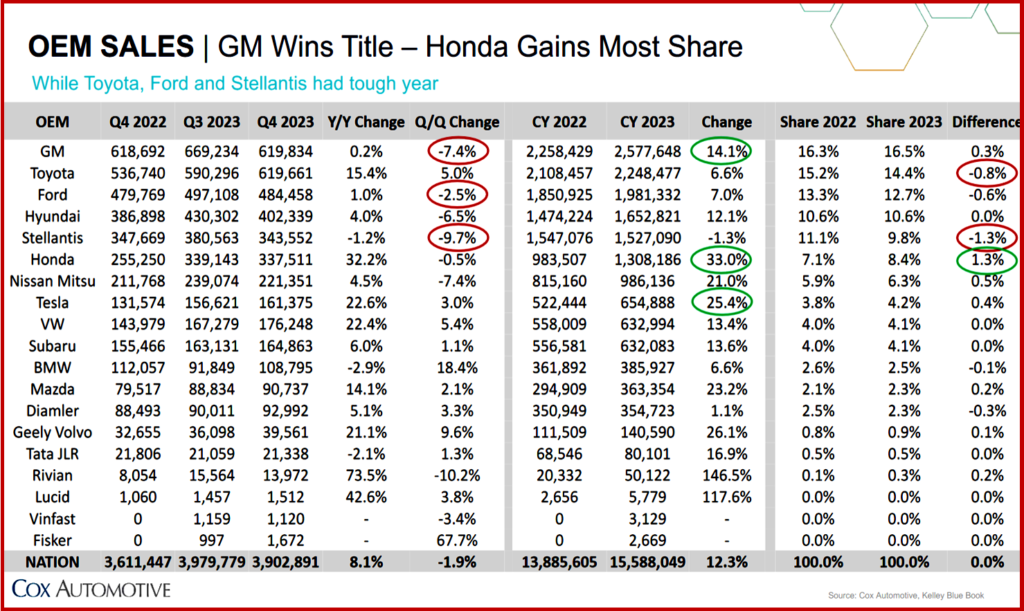

Click to enlarge this Cox Automotive analysis.

“In the strongest years for the market, between 2015 and 2019, it was not unusual to see December sales of 1.5-1.6 million units. While we did not quite get to those levels, last month felt like the closest we have seen to a fully healthy market for some time. With that said, we expect to see dealer margins shrinking this year, even as volumes increase, as supply and demand will be more evenly balanced,” Oakley said.

The annualized selling rate was 16.4 million units/year in December, the highest it has been since May 2021, and up from 15.4 million units/year in November. The daily selling rate was estimated at 57,2oo units/day in December, compared to 49,100 units/day in November. After a slightly disappointing Black Friday, end-of-year deals appeared to lure many more buyers across the country, with automakers willing to offer more significant discounts and, in some cases, divert more volume to fleet sales. According to initial estimates, retail sales totaled 1.22 million units, while fleet sales accounted for approximately 269,000 units, representing ~18.1% of total sales.

Global Data Observations and Opinions

- General Motors returned to the top of the sales rankings with 234,000units, finishing ~8000 units ahead of Toyota Group after the Japanese OEM led the market in the previous two months.

- Ford Group was in third on 186,000 units and, at 12.5%, its market share was the highest since July.

- Toyota brand led at 188,000 units, ahead of Ford at 176,000 units.

- Ford was only marginally ahead of Chevrolet in November, in December the difference widened to 23,000 units.

- Toyota RAV4 was the bestselling model, 47,000 units, for a third consecutive month, but the gap to the Ford F-150 was smaller than in November, at 3000. The RAV4 appears to have continued to benefit from an abnormally high level of imports, but this is understood to be a temporary situation.

- Compact Non-Premium SUV was comfortably the leading segment once again, although its market share eased slightly from November levels to 20.7%.

- Mid-size Non-Premium SUV saw its highest share since May at 16.2%, followed by Large Pickup on 13.6%.

“While one month’s results should not be interpreted as necessarily heralding a return to previous highs, consumers in December showed a willingness to purchase if the price was right. Continued discounting or moderating pricing could bring a more pronounced lift to demand in 2024. That said, we expect a slight January hangover in demand, given the likely pull forward, and there remains economic risk that needs to be factored in as we start the new year. The overall state of the economy and pricing trends will be the dominant drivers in auto demand for 2024,” said Jeff Schuster, Vice President Research and Analysis, Automotive.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Bidenomics – Sales Soaring as US Auto Market Ends 2023

Click for more GlobalData.

US Light Vehicle (LV) sales grew by 16.0% year-on-year (YoY) in December to 1.49 million units, according to preliminary estimates from the respected GlobalData consultancy.* Although year-ago sales were still relatively weak, December sales exceeded expectations and “indicated that the market was heating up as 2023 ended. For 2023, sales totaled 15.6 million units, a YoY gain of 13.0%, as the market recovered from the chip shortage-induced slump in 2022,” GlobalData said today.

“December has traditionally been a good time of year to buy a vehicle as automakers seek to hit year-end targets, but that had been less true in recent years amid tight inventory levels. However, with stocks now significantly replenished across the industry, discounting was back on the agenda last month. Consumers who have been sitting on the sidelines appear to have been willing to jump back into the new vehicle market again, although it also seems that fleet deliveries accounted for some of the December surge,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

Click to enlarge this Cox Automotive analysis.

“In the strongest years for the market, between 2015 and 2019, it was not unusual to see December sales of 1.5-1.6 million units. While we did not quite get to those levels, last month felt like the closest we have seen to a fully healthy market for some time. With that said, we expect to see dealer margins shrinking this year, even as volumes increase, as supply and demand will be more evenly balanced,” Oakley said.

The annualized selling rate was 16.4 million units/year in December, the highest it has been since May 2021, and up from 15.4 million units/year in November. The daily selling rate was estimated at 57,2oo units/day in December, compared to 49,100 units/day in November. After a slightly disappointing Black Friday, end-of-year deals appeared to lure many more buyers across the country, with automakers willing to offer more significant discounts and, in some cases, divert more volume to fleet sales. According to initial estimates, retail sales totaled 1.22 million units, while fleet sales accounted for approximately 269,000 units, representing ~18.1% of total sales.

Global Data Observations and Opinions

“While one month’s results should not be interpreted as necessarily heralding a return to previous highs, consumers in December showed a willingness to purchase if the price was right. Continued discounting or moderating pricing could bring a more pronounced lift to demand in 2024. That said, we expect a slight January hangover in demand, given the likely pull forward, and there remains economic risk that needs to be factored in as we start the new year. The overall state of the economy and pricing trends will be the dominant drivers in auto demand for 2024,” said Jeff Schuster, Vice President Research and Analysis, Automotive.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.