Click for more GlobalData.

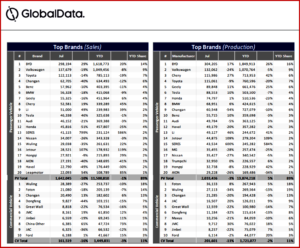

The Chinese automotive industry’s economic operations remained fundamentally stable in July, with just a minor dip in monthly production and sales, according to an analysis of the world’s largest auto market just released by the respected GlobalData* consultancy. Domestic light vehicle (LV) sales, excluding exports, totaled 1.8 million units, reflecting a significant year-on-year (YoY) decrease of 10.4% and a month-on-month (MoM) decline of 12.5%, affected by the high comparative base of the same month last year.

“The passenger vehicle (PV) segment saw a total volume reduction to 1.6 million units, with a 9.8% YoY decline and a substantial MoM decrease of 10.9%. Light commercial vehicle (LCV) sales also contracted to 162,000 units, recording a significant YoY decline of 15.6% and a 25.8% MoM decrease. From January to July of this year, LV sales reached 13.0 million units, experiencing a slight YoY decrease of 0.9%. Within this, PV sales accounted for a total volume of 11.5 million units, with a 0.7% YoY decrease. LCV sales, despite being a significant market segment, experienced a slight YoY downturn of 2.5%, at 1.4 million units,” according to the GlobalData Asia-Pacific Light Vehicle Sales Forecasting Team.**

“China’s domestic market sustained a steady tempo in July, with the selling rate for the month reaching 27.4 million units per year, a slight uptick from the robust June figures. However, the year-to-date (YTD) selling rate averaged only 23.9 million units per year, weighed down by sluggish sales in earlier months. In terms of YoY performance, July sales (domestic wholesale volumes) fell by 10%, partly due to the unusually high levels a year ago and were effectively flat (-0.9%) for the YTD period. A notable milestone was achieved in July, as the share of new energy vehicles (NEVs) among PV sales surpassed 50% for the first time,” GlobalData said.

GlobalData Commentary, Observations

- During July 2024, the automotive market in China transitioned into its customary off-season, with several manufacturers halting production due to the intense summer heat. As a result, production and sales declined, leading to a generally stable market with both monthly and annual declines.

- A positive development occurred on 26 July, when the government declared an enhancement to the old-for-new vehicle subsidy policy. With subsidies potentially reaching CNY20k, the market is anticipated to experience a revival as this financial incentive stimulates consumer demand and invigorates sales.

- In July 2024, LV production dipped slightly to 2.2 million units, indicating a modest YoY reduction of 4.1% and a more pronounced MoM decline of 7.8%. Despite these decreases, the cumulative output for the year remains strong at an impressive 15.6 million units, “a commendable YoY growth of 3.9%. Within this overall performance, PV production held steady in July at 2 million units, with a minor YoY decrease of 3.1%. The accumulated volume of PV production YTD has reached 12.9 million units, maintaining its growth trajectory with a 4.6% YoY increase.”

- LCV production volumes for July were recorded at 202,000 units, showing a modest YoY decrease of 12.9%. Looking at the first seven months of 2024, the YTD volume for LCVs stands at 1.7 million units, reflecting a slight decrease of 1.6%.

- Automotive exports continued to diverge from domestic production and sales trends, playing a pivotal role in bolstering overall output. The export volume of PVs for the month stood a 407,000, nearly matching the previous month’s total and marking a significant YoY increase of 30.7%.

- Cumulatively, from January to July of this year, the total PV export volume reached 2.8 million units, reflecting an increase of 33.6% compared to last year. Chinese Original Equipment Manufacturers (OEMs) have sustained their leading position in export volumes, with Chery, SAIC, and Geely leading the pack. These three manufacturers alone account for 48% of the total export volume, underscoring their dominance and the significant contribution of Chinese OEMs to the global automotive market.

- In the New Energy Vehicle (NEV) sector, China has experienced remarkable growth, with July’s production soaring to 958,000. This marks a significant YoY increase of 23% and a slight MoM gain of 0.1%. The 2024 YTD figure stands at 5.6 million units, reflecting robust YoY growth of 29.0%.

- However, the market penetration rate for NEVs has dipped to 42.9%. In July, the upward trajectory of NEVs continued, with PHEVs and EREVs being the primary drivers. The production of BEVs saw a modest increase of 1.5% compared to the previous month. Considering consumer concerns about price and range anxiety, EREVs and PHEVs currently offer more appealing solutions. The declining prices of key battery materials including lithium carbonate are contributing to the overall cost reduction of NEVs, which, in turn, will expedite the decline of ICE vehicles.

- The Chinese government’s scrappage policy is also contributing to market growth. Our forecast for overall volume remains largely unchanged, we see a notable shift in the market share dynamics, with EREVs and PHEVs gaining a more significant foothold in the NEV landscape.

- Given the Chinese government’s doubling of trade-in subsidies and expansion of their scope, we predict a significant increase in the forecast for the rest of 2024, especially in Q4, with a revised forecast adding 470,000 units to sales, raising the YoY growth from 2% to nearly 4%.

- In 2025, although the extension of the subsidy into next year is uncertain, we anticipate a continued policy based on the automotive industry’s economic significance, projecting an additional 56,000 units, keeping a positive YoY growth rate of 0.6% in 2025.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Chinese Auto Industry Steady in July?

Click for more GlobalData.

The Chinese automotive industry’s economic operations remained fundamentally stable in July, with just a minor dip in monthly production and sales, according to an analysis of the world’s largest auto market just released by the respected GlobalData* consultancy. Domestic light vehicle (LV) sales, excluding exports, totaled 1.8 million units, reflecting a significant year-on-year (YoY) decrease of 10.4% and a month-on-month (MoM) decline of 12.5%, affected by the high comparative base of the same month last year.

“The passenger vehicle (PV) segment saw a total volume reduction to 1.6 million units, with a 9.8% YoY decline and a substantial MoM decrease of 10.9%. Light commercial vehicle (LCV) sales also contracted to 162,000 units, recording a significant YoY decline of 15.6% and a 25.8% MoM decrease. From January to July of this year, LV sales reached 13.0 million units, experiencing a slight YoY decrease of 0.9%. Within this, PV sales accounted for a total volume of 11.5 million units, with a 0.7% YoY decrease. LCV sales, despite being a significant market segment, experienced a slight YoY downturn of 2.5%, at 1.4 million units,” according to the GlobalData Asia-Pacific Light Vehicle Sales Forecasting Team.**

“China’s domestic market sustained a steady tempo in July, with the selling rate for the month reaching 27.4 million units per year, a slight uptick from the robust June figures. However, the year-to-date (YTD) selling rate averaged only 23.9 million units per year, weighed down by sluggish sales in earlier months. In terms of YoY performance, July sales (domestic wholesale volumes) fell by 10%, partly due to the unusually high levels a year ago and were effectively flat (-0.9%) for the YTD period. A notable milestone was achieved in July, as the share of new energy vehicles (NEVs) among PV sales surpassed 50% for the first time,” GlobalData said.

GlobalData Commentary, Observations

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.