Click to enlarge.

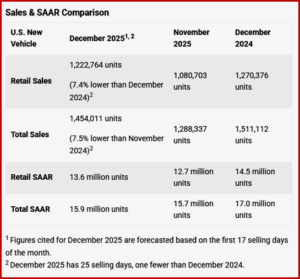

U.S. new-vehicle sales for December 2025, including retail and non-retail transactions, are projected to reach 1,454,000, a 7.5% decrease year over year, according to a joint forecast from J.D. Power and GlobalData released today. December 2025 has 26 selling days, one more than December 2024. Comparing the same sales volume without adjusting for the number of selling days shows a decrease of 3.8% from 2024. The seasonally adjusted annualized rate (SAAR) for total U.S. new-vehicle sales is forecast at 15.9 million units, down 1.1 million from December 2024 as the Trump slump continues.*

“December caps a year marked by volatility, as the industry continues to deal with the consequences of import tariffs and changes to electric vehicle legislation. To say it’s been a sales roller coaster of a year would be an understatement,” said Thomas King, president of OEM solutions at J.D. Power. “Fears of future tariff-related price hikes caused sales to jump by 173,000 vehicles between March and April, followed by a sales slowdown in subsequent months. Another sales jump occurred between August and September as 304,200 electric vehicle shoppers made purchases before the September 30 expiration of federal EV tax credits, followed by another sales slowdown whose effects are still being felt in December.”

Forecast Highlights

- The seasonally adjusted annualized rate (SAAR) for total new-vehicle sales is expected to be 15.9 million units, down 1.1 million units from December 2024.

- New-vehicle total sales for Q4 2025 sales are projected to reach 4,019,200 units, a 5.0% decrease from Q4 2024 when adjusting for the number of selling days.

- New-vehicle total sales for the second half of 2025 are projected to reach 8,061,500 units, a decrease of 1.3% from a year ago when adjusting for the number of selling days.

- New-vehicle total sales for full-year 2025 are projected to reach 16,275,300, an increase of 2.3% when adjusting for the number of selling days.

“All this volatility means that simple year-over-year comparisons of the health of new vehicle sales are inherently noisy. However, there is no escaping the fact that demand for new vehicles remains robust,” said King.

“Retail sales in December will be down 7.4% (selling day adjusted) and Q4 sales will be down nearly 5% while full-year sales will be up 4%. Much of the decline in December is attributable to slower sales of EV’s, which are on track to account for just 6.6% of retail sales in December, down from 11.2% a year ago.

“Despite much speculation regarding major increases in new vehicle prices due to tariffs, the actual increases, as correctly predicted by J.D. Power, have been muted. The average new-vehicle retail transaction price in December for all vehicles is expected to reach $47,104, up $715 or 1.5 percent from December 2024. Separating out electric vehicles, the average price on non-EV’s has powered vehicles rose 1.4% to $46,807.

“In total, retail consumers will have spent $620.0 billion dollars on new vehicles in 2025, up 5.8% from last year. Total aggregate retailer profit from selling new vehicles is expected to be $29.9 billion, down $0.4 billion from last year. Lower EV sales are providing a boost to manufacturer and retailer profitability as the steep discounts once required to drive high EV volumes begin to unwind. This shift marks an important turning point for the industry, though the full impact will be realized in 2026, the first year where these dynamics play out across all twelve months.

“The industry is not without its challenges, however. Affordability pressures remain significant, with monthly finance payments reaching a new record for the month of December at $776. In response, more consumers are turning to extended 84-month loan terms, which are expected to account for 10.1% of financed sales this month — the second highest level on record for the month of December behind 2021.”

“The average manufacturer’s incentive spend per vehicle is on track to reach $3,433, which is $140 higher than November and $77 higher than a year ago. Expressed as a percentage of MSRP, incentive spending is currently at 6.5%, up 0.1 percentage points from last year. Discounts on EVs are expected to average $11,414 in December, down $57 compared with December 2024, and down $472 from November 2025. Discounts on non-EVs are projected at $3,219, an increase of $425 from last year.,” said King.

Global Sales Forecast

“November global light-vehicle sales are estimated to have decreased 2.2% year over year to 8.1 million units, with most regions other than Europe seeing declines. The selling rate for November was estimated at 94.8 million units, down from 95.7 million units in October,” said David Oakley, manager, Americas vehicle sales forecasts at GlobalData.**

“With China and the U.S. being the largest markets worldwide, moderate year over year declines in these countries contributed the most to the global fall in sales. In China, the year over year decrease was linked to extremely strong volumes in November 2024, as consumers rushed to take advantage of a government trade-in scheme, which was eventually extended anyway. On a more positive note, sales in India increased in November, thanks to reductions in the General Sales Tax, as well as heightened demand during India’s festival season.

“December sales are expected to decrease 1.1% from December 2024. The U.S. and Canada are expected to be unable to match strong year-ago demand, while Europe is forecast to see a modest year-over-year decline, especially in France, where political instability appears to be impacting consumer confidence. The global selling rate is expected to reach 93.3 million units in December, down from a rate of 96.4 million units in December 2024.

“Should the December forecast be borne out, it would result in total 2025 global sales of 92.1 million units (+3.7% year over year), up by around 700,000 units from our forecast a month ago. The outlook for India has been upgraded, with that market carrying strong momentum, while tariffs and trade tensions appear to be having a less significant impact on sales than was once feared,” said Oakley.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

December U.S. Vehicle Sales Forecast Down. Global Sales Up

Click to enlarge.

U.S. new-vehicle sales for December 2025, including retail and non-retail transactions, are projected to reach 1,454,000, a 7.5% decrease year over year, according to a joint forecast from J.D. Power and GlobalData released today. December 2025 has 26 selling days, one more than December 2024. Comparing the same sales volume without adjusting for the number of selling days shows a decrease of 3.8% from 2024. The seasonally adjusted annualized rate (SAAR) for total U.S. new-vehicle sales is forecast at 15.9 million units, down 1.1 million from December 2024 as the Trump slump continues.*

“December caps a year marked by volatility, as the industry continues to deal with the consequences of import tariffs and changes to electric vehicle legislation. To say it’s been a sales roller coaster of a year would be an understatement,” said Thomas King, president of OEM solutions at J.D. Power. “Fears of future tariff-related price hikes caused sales to jump by 173,000 vehicles between March and April, followed by a sales slowdown in subsequent months. Another sales jump occurred between August and September as 304,200 electric vehicle shoppers made purchases before the September 30 expiration of federal EV tax credits, followed by another sales slowdown whose effects are still being felt in December.”

Forecast Highlights

“All this volatility means that simple year-over-year comparisons of the health of new vehicle sales are inherently noisy. However, there is no escaping the fact that demand for new vehicles remains robust,” said King.

“Retail sales in December will be down 7.4% (selling day adjusted) and Q4 sales will be down nearly 5% while full-year sales will be up 4%. Much of the decline in December is attributable to slower sales of EV’s, which are on track to account for just 6.6% of retail sales in December, down from 11.2% a year ago.

“Despite much speculation regarding major increases in new vehicle prices due to tariffs, the actual increases, as correctly predicted by J.D. Power, have been muted. The average new-vehicle retail transaction price in December for all vehicles is expected to reach $47,104, up $715 or 1.5 percent from December 2024. Separating out electric vehicles, the average price on non-EV’s has powered vehicles rose 1.4% to $46,807.

“In total, retail consumers will have spent $620.0 billion dollars on new vehicles in 2025, up 5.8% from last year. Total aggregate retailer profit from selling new vehicles is expected to be $29.9 billion, down $0.4 billion from last year. Lower EV sales are providing a boost to manufacturer and retailer profitability as the steep discounts once required to drive high EV volumes begin to unwind. This shift marks an important turning point for the industry, though the full impact will be realized in 2026, the first year where these dynamics play out across all twelve months.

“The industry is not without its challenges, however. Affordability pressures remain significant, with monthly finance payments reaching a new record for the month of December at $776. In response, more consumers are turning to extended 84-month loan terms, which are expected to account for 10.1% of financed sales this month — the second highest level on record for the month of December behind 2021.”

“The average manufacturer’s incentive spend per vehicle is on track to reach $3,433, which is $140 higher than November and $77 higher than a year ago. Expressed as a percentage of MSRP, incentive spending is currently at 6.5%, up 0.1 percentage points from last year. Discounts on EVs are expected to average $11,414 in December, down $57 compared with December 2024, and down $472 from November 2025. Discounts on non-EVs are projected at $3,219, an increase of $425 from last year.,” said King.

Global Sales Forecast

“November global light-vehicle sales are estimated to have decreased 2.2% year over year to 8.1 million units, with most regions other than Europe seeing declines. The selling rate for November was estimated at 94.8 million units, down from 95.7 million units in October,” said David Oakley, manager, Americas vehicle sales forecasts at GlobalData.**

“With China and the U.S. being the largest markets worldwide, moderate year over year declines in these countries contributed the most to the global fall in sales. In China, the year over year decrease was linked to extremely strong volumes in November 2024, as consumers rushed to take advantage of a government trade-in scheme, which was eventually extended anyway. On a more positive note, sales in India increased in November, thanks to reductions in the General Sales Tax, as well as heightened demand during India’s festival season.

“December sales are expected to decrease 1.1% from December 2024. The U.S. and Canada are expected to be unable to match strong year-ago demand, while Europe is forecast to see a modest year-over-year decline, especially in France, where political instability appears to be impacting consumer confidence. The global selling rate is expected to reach 93.3 million units in December, down from a rate of 96.4 million units in December 2024.

“Should the December forecast be borne out, it would result in total 2025 global sales of 92.1 million units (+3.7% year over year), up by around 700,000 units from our forecast a month ago. The outlook for India has been upgraded, with that market carrying strong momentum, while tariffs and trade tensions appear to be having a less significant impact on sales than was once feared,” said Oakley.

*AutoInformed on

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis, and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.