Click to enlarge.

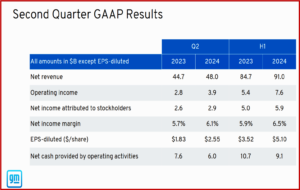

GM (NYSE: GM) posted solid second quarter and first half results today based on sales of traditional trucks, SUVs with stable prices and low incentives, as well as record EV sales and market share in Q2. GM is launching eight all-new or redesigned compact, mid-size and full-size internal combustion engine (ICE) models in North America, including high-volume vehicles such as the Chevrolet Equinox, and its range of mid-size SUVs. All, repeat all, of which have higher margins than the outgoing models.

“With our new investments, we have an even stronger focus on margins and capital efficiency.,” said Mary Barra, GM Chair and CEO “It was truly a great first half. And we have the products, discipline and strategies to drive future success.”

GM Financial posted net income of $610 million for the quarter ended 30 June 2024, compared to $536 million for the quarter ended 31 March 2024, and $571 million for the quarter ended 30 June 2023. Net income for the six months ending 30 June 2024 was $1.1 billion, compared to $1.2 billion for the six months ending 30 June 2023. All told General Motors earned $3.06 a share on an adjusted basis in Q2, up from $1.91 a year ago. Simply put, the strong results in a complex multi-factor equation came from GM increasing market share by selling affordable SUV’s and GM’s freshened mid-size SUV’s are some of the fastest growing vehicles in that segment.

Barra also noted the progress Cruise has made over the last several months. “Our vision to transform mobility using autonomous technology is unchanged, and every mile traveled, and every simulation, brings us closer because Cruise is an AI-first company. As you know, Cruise has returned to the road in Houston, Phoenix and Dallas and we recently made several significant leadership appointments, including hiring Marc Whitten as CEO. Marc has decades of experience on the front-lines of technology transformations, Barra said.

The big development here is a shift in strategy. Cruise will “simplify their path to scale by focusing their next autonomous vehicle on the next-generation Chevrolet Bolt, instead of the Origin. This addresses the regulatory uncertainty we faced with the Origin because of its unique design. In addition, per-unit costs will be much lower, which will help Cruise optimize its resources. As I hope you can see from our results, our new products, the progress at Cruise and our higher guidance, we are making the most of every opportunity,” Barra said. GM petitioned the National Highway Traffic Safety Administration two years ago asking an for OK to deploy ~2500 self-driving Origins annually. These would lack traditional human controls such as brake pedals or mirrors. The agency still has not acted on the request. (AutoInformed: GM, Cruise, Honda – 2026 Autonomous Ridehail in Japan)

Electric Vehicles

The Cadillac Lyric is now the market leading luxury EV in 22 states including Florida, Texas and Michigan. The GMC Hummer EV and the Chevrolet Blazer EV are also growing in sales. “To unleash the next cycle of EV growth, we’re scaling production of the Chevrolet Equinox EV with its unique combination of performance, technology, range and affordability. We delivered our first 1000 units late in the second quarter,” Barra said. In AutoInformed’s opinion this is a great product in the right segment. It’s big trouble for Ford Motor and various Stellantis dealers.

GM’s Ultium Cells joint venture continues to ramp up domestic battery cell supply this year, which will improve profits of its EVs. GM is going to bring additional capacity online. GM plans to reopen the Orion Assembly as a battery electric truck plant in mid-2026. The new timing is 6 months later than originally announced. “We’re confident that we can meet customer demand for stand out EV trucks ,in the interim by leveraging the production capability and flexibility we have in Factory Zero,” Barra said. “As excited as we are about our EVs and our early success, we are committed to disciplined volume growth, which is the key to earning positive variable profits from our portfolio in the fourth quarter, which remains our goal,” Barra said.

“We also benefited from our fixed cost reduction program, realizing $100 million from lower marketing spend compared to last year. We remain on track to achieve $2 billion of net fixed cost savings by the end of 2024,” said GM Chief Financial Officer Paul Jacobson. “Inventory levels ended the quarter at 66 days. This is temporarily above where we were tracking earlier in June as we believe some sales reviewers using the CDK platform (CDK Global dealership management system. (Read AutoInformed on: CDK Cyberattacks Wound June US Light Vehicle Sales) were delayed until the third quarter. We will continue to monitor our inventory and adjust production as necessary to maintain our targeted inventory levels of 50 to 60 days.”

Revised Guidance

Click for more.

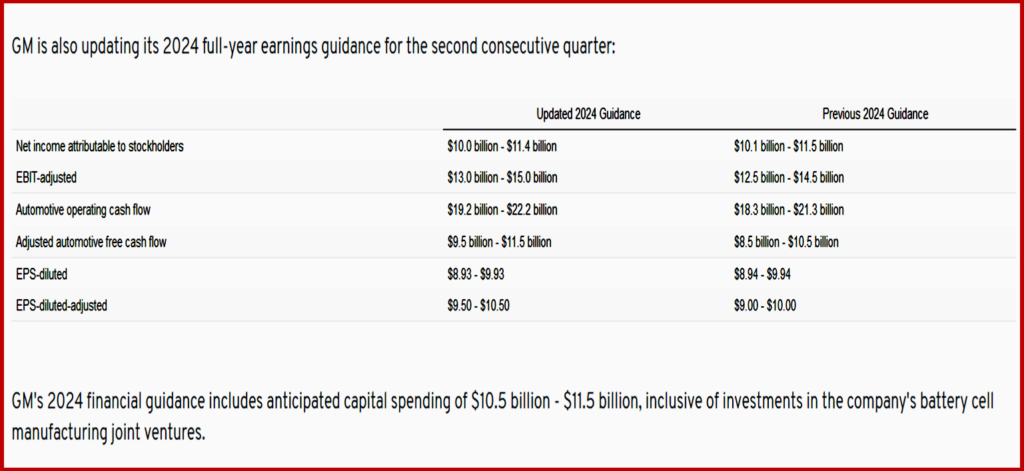

GM is also updating its 2024 full-year earnings guidance for the second consecutive quarter: GM’s 2024 financial guidance includes anticipated capital spending of $10.5 billion – $11.5 billion, inclusive of investments in the company’s battery cell manufacturing joint ventures.

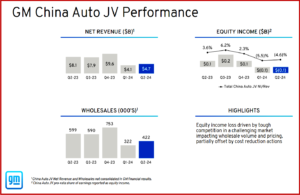

China

The Chinese EV price war continues with potential severe negative effects on makers pursuing production volume.

“As you know, the Chinese market has significant excess capacity and many startups and established competitors continue to prioritize production over profitability. We’ve been taking steps to reduce our inventories, align our production to demand, protect our pricing and reduce fixed costs. But it’s clear the steps we have taken, while significant, have not been enough. We had expected to return to profitability in China in the second quarter. However, we reported a loss and we expect the rest of the year will remain challenging because the headwinds are not easy. We are working closely with our JV partner to restructure the business, make it profitable and sustainable,” Barra said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Earns $4.4 Billion on Record Revenue – Raises Forecast

Click to enlarge.

GM (NYSE: GM) posted solid second quarter and first half results today based on sales of traditional trucks, SUVs with stable prices and low incentives, as well as record EV sales and market share in Q2. GM is launching eight all-new or redesigned compact, mid-size and full-size internal combustion engine (ICE) models in North America, including high-volume vehicles such as the Chevrolet Equinox, and its range of mid-size SUVs. All, repeat all, of which have higher margins than the outgoing models.

“With our new investments, we have an even stronger focus on margins and capital efficiency.,” said Mary Barra, GM Chair and CEO “It was truly a great first half. And we have the products, discipline and strategies to drive future success.”

GM Financial posted net income of $610 million for the quarter ended 30 June 2024, compared to $536 million for the quarter ended 31 March 2024, and $571 million for the quarter ended 30 June 2023. Net income for the six months ending 30 June 2024 was $1.1 billion, compared to $1.2 billion for the six months ending 30 June 2023. All told General Motors earned $3.06 a share on an adjusted basis in Q2, up from $1.91 a year ago. Simply put, the strong results in a complex multi-factor equation came from GM increasing market share by selling affordable SUV’s and GM’s freshened mid-size SUV’s are some of the fastest growing vehicles in that segment.

Barra also noted the progress Cruise has made over the last several months. “Our vision to transform mobility using autonomous technology is unchanged, and every mile traveled, and every simulation, brings us closer because Cruise is an AI-first company. As you know, Cruise has returned to the road in Houston, Phoenix and Dallas and we recently made several significant leadership appointments, including hiring Marc Whitten as CEO. Marc has decades of experience on the front-lines of technology transformations, Barra said.

The big development here is a shift in strategy. Cruise will “simplify their path to scale by focusing their next autonomous vehicle on the next-generation Chevrolet Bolt, instead of the Origin. This addresses the regulatory uncertainty we faced with the Origin because of its unique design. In addition, per-unit costs will be much lower, which will help Cruise optimize its resources. As I hope you can see from our results, our new products, the progress at Cruise and our higher guidance, we are making the most of every opportunity,” Barra said. GM petitioned the National Highway Traffic Safety Administration two years ago asking an for OK to deploy ~2500 self-driving Origins annually. These would lack traditional human controls such as brake pedals or mirrors. The agency still has not acted on the request. (AutoInformed: GM, Cruise, Honda – 2026 Autonomous Ridehail in Japan)

Electric Vehicles

The Cadillac Lyric is now the market leading luxury EV in 22 states including Florida, Texas and Michigan. The GMC Hummer EV and the Chevrolet Blazer EV are also growing in sales. “To unleash the next cycle of EV growth, we’re scaling production of the Chevrolet Equinox EV with its unique combination of performance, technology, range and affordability. We delivered our first 1000 units late in the second quarter,” Barra said. In AutoInformed’s opinion this is a great product in the right segment. It’s big trouble for Ford Motor and various Stellantis dealers.

GM’s Ultium Cells joint venture continues to ramp up domestic battery cell supply this year, which will improve profits of its EVs. GM is going to bring additional capacity online. GM plans to reopen the Orion Assembly as a battery electric truck plant in mid-2026. The new timing is 6 months later than originally announced. “We’re confident that we can meet customer demand for stand out EV trucks ,in the interim by leveraging the production capability and flexibility we have in Factory Zero,” Barra said. “As excited as we are about our EVs and our early success, we are committed to disciplined volume growth, which is the key to earning positive variable profits from our portfolio in the fourth quarter, which remains our goal,” Barra said.

“We also benefited from our fixed cost reduction program, realizing $100 million from lower marketing spend compared to last year. We remain on track to achieve $2 billion of net fixed cost savings by the end of 2024,” said GM Chief Financial Officer Paul Jacobson. “Inventory levels ended the quarter at 66 days. This is temporarily above where we were tracking earlier in June as we believe some sales reviewers using the CDK platform (CDK Global dealership management system. (Read AutoInformed on: CDK Cyberattacks Wound June US Light Vehicle Sales) were delayed until the third quarter. We will continue to monitor our inventory and adjust production as necessary to maintain our targeted inventory levels of 50 to 60 days.”

Revised Guidance

Click for more.

GM is also updating its 2024 full-year earnings guidance for the second consecutive quarter: GM’s 2024 financial guidance includes anticipated capital spending of $10.5 billion – $11.5 billion, inclusive of investments in the company’s battery cell manufacturing joint ventures.

China

The Chinese EV price war continues with potential severe negative effects on makers pursuing production volume.

“As you know, the Chinese market has significant excess capacity and many startups and established competitors continue to prioritize production over profitability. We’ve been taking steps to reduce our inventories, align our production to demand, protect our pricing and reduce fixed costs. But it’s clear the steps we have taken, while significant, have not been enough. We had expected to return to profitability in China in the second quarter. However, we reported a loss and we expect the rest of the year will remain challenging because the headwinds are not easy. We are working closely with our JV partner to restructure the business, make it profitable and sustainable,” Barra said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.