Click to enlarge.

The J.D. Power 2025 U.S. OEM ICE App ReportSM released this week shows that owner satisfaction with mobile apps for internal combustion engine (ICE) vehicles is more and more shaped by reliable connectivity, intuitive design, and the availability of essential features. Nearly 80% of ICE vehicle owners indicate using the OEM-provided app, “yet engagement and satisfaction remain inconsistent year-over-year. High-performing brands are pulling ahead, widening the gap with competitors,” J.D. Power said.*

“Connectivity and speed continue to be the most significant challenges for ICE vehicle apps,” said Violet Allmandinger, mobile apps lead at J.D. Power. “Owners want apps that work seamlessly every time, with core features that are easy to access and perform reliably. The top performers notably stand out, and this year’s scores reflect that.”**

Click to enlarge.

“The results of this year’s report reinforce trends identified in previous J.D. Power studies. The J.D. Power 2025 Initial Quality StudySM (IQS) shows that OEM app connectivity concerns remain one of the top 10 industry problems.

“Despite slight improvements, satisfaction with vehicle apps, they persist to lag because of slow and inconsistent connection speeds. These observations align with findings in the 2025 U.S. OEM ICE App Report, and stresses the importance of delivering dependable, customer-focused app experiences,” J.D. Power said.

Findings of the 2025 report:

- App usage rises, engagement remains limited: Nearly 80% of owners this year say they use their vehicle’s app, an increase of 2 percentage points from 2024. Despite this growth, only 27% identify as frequent users, which is defined as those who use the app every time or more than half the time they drive. This represents a modest 3-percentage-point increase year over year. Mass market vehicle owners show slightly higher engagement than premium owners, but both remain well behind EV owners, who continue to lead in vehicle app usage and interaction.

- New insights on feature usage: The report provides a clearer picture of how often owners expect to use the features they want. The most wanted feature to use daily is garage door opener (61%), followed by smartphone as key (39%) and heated/cooled seat controls (38%). Remote lock/unlock (34%) and trunk control (31%) show moderate daily use, while low-frequency features such as remote park pilot and vehicle order status checks have much lower interest. Surprisingly, garage door integration is missing from most vehicle apps, creating a strong opportunity for differentiation if offered as a built-in feature rather than through a separate app or a basic setup process in the manufacturer’s app.

- Connectivity and interface issues remain top barriers: Among the 38% of owners who stopped using their app, the most common reason cited is connectivity problems. Non-intuitive interfaces and unreliable remote start are additional pain points, each cited by 14% of owners. Slow response times (10%) and inconsistent functionality (7%) further add to frustration. Additional concerns include lack of desired features (5%), outdated or inaccurate information (4%), and difficulty managing multiple users (4%).

- User-defined accessibility priorities: Owners say they want core commands such as remote lock/unlock, garage access, and climate control to appear on the app’s home screen for maximum convenience. New survey questions added in 2025 reveal that 69% of owners say lock/unlock should be front and center, followed by garage access at 66% and climate control at 66%. Mid-tier features such as service scheduling (37%) and software updates (32%) remain important but are acceptable within one or two taps from the home screen, allowing manufacturers to streamline usability without reducing functionality.

Report Rankings

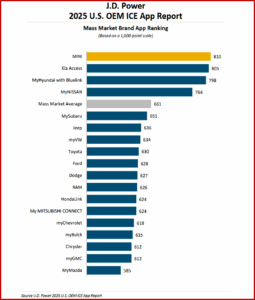

- MINI ranks highest in customer satisfaction among mass market brands with a score of 810 (on a 1000-point scale). Kia Access (805) ranks second and MyHyundai with Bluelink (798) ranks third.

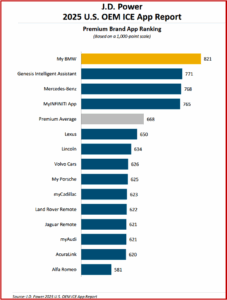

- My BMW ranks highest in overall customer satisfaction and highest among premium brands with a score of 821. Genesis Intelligent Assistant (771) ranks second and Mercedes-Benz (768) ranks third.

*AutoInformed on

**The U.S. OEM ICE App ReportSMgauges ICE vehicle owners’ experience with their brand’s mobile app. Insights are derived from surveying ICE vehicle owners and an expert assessment of the most relevant ICE vehicle mobile apps. Results are based on a standardized assessment approach relying on more than 300 best practices for vehicle apps that include more than 160 mobile app functionality-specific attributes.

The report includes apps from the top 32 award-eligible branded apps that sell ICE vehicles in the United States. More than 2,100 ICE vehicle owners in the United States were surveyed between September-October 2025 to gather insights on app connectivity issues; app usage; feature desirability; and app overall execution.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

ICE Vehicle Mobile Apps – Wide Satisfaction Differences

Click to enlarge.

The J.D. Power 2025 U.S. OEM ICE App ReportSM released this week shows that owner satisfaction with mobile apps for internal combustion engine (ICE) vehicles is more and more shaped by reliable connectivity, intuitive design, and the availability of essential features. Nearly 80% of ICE vehicle owners indicate using the OEM-provided app, “yet engagement and satisfaction remain inconsistent year-over-year. High-performing brands are pulling ahead, widening the gap with competitors,” J.D. Power said.*

“Connectivity and speed continue to be the most significant challenges for ICE vehicle apps,” said Violet Allmandinger, mobile apps lead at J.D. Power. “Owners want apps that work seamlessly every time, with core features that are easy to access and perform reliably. The top performers notably stand out, and this year’s scores reflect that.”**

Click to enlarge.

“The results of this year’s report reinforce trends identified in previous J.D. Power studies. The J.D. Power 2025 Initial Quality StudySM (IQS) shows that OEM app connectivity concerns remain one of the top 10 industry problems.

“Despite slight improvements, satisfaction with vehicle apps, they persist to lag because of slow and inconsistent connection speeds. These observations align with findings in the 2025 U.S. OEM ICE App Report, and stresses the importance of delivering dependable, customer-focused app experiences,” J.D. Power said.

Findings of the 2025 report:

Report Rankings

*AutoInformed on

**The U.S. OEM ICE App ReportSMgauges ICE vehicle owners’ experience with their brand’s mobile app. Insights are derived from surveying ICE vehicle owners and an expert assessment of the most relevant ICE vehicle mobile apps. Results are based on a standardized assessment approach relying on more than 300 best practices for vehicle apps that include more than 160 mobile app functionality-specific attributes.

The report includes apps from the top 32 award-eligible branded apps that sell ICE vehicles in the United States. More than 2,100 ICE vehicle owners in the United States were surveyed between September-October 2025 to gather insights on app connectivity issues; app usage; feature desirability; and app overall execution.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.