Click to enlarge.

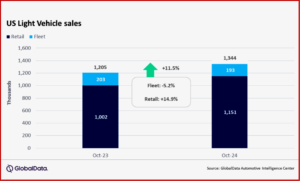

Light Vehicle (LV) sales grew by 11.5% year-on-year (YoY) in October 2024, to 1.34 million units. Although the month had two additional selling days than it did in 2023, sales still exceeded expectations and provided a more cheerful perspective on the industry than has generally been the case in recent months, according to preliminary estimates released today by the respected GlobalData consultancy.*

“Sales have generally disappointed for much of 2024, but October provided a pleasant change of pace. While the fundamentals of the market have probably not shifted to a great extent, some consumers appear to have been enticed by the gradual uptick in incentives, allied with greater vehicle availability and an easing in interest rates. A number of brands highlighted how Electric and Hybrid Vehicles performed better,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData. **

GlobalData Observations

- Recent changes in seasonality have made the annualized selling rate less reliable than has been the case in the past, but the rate registered its highest level for 2024 to date in October. According to initial estimates, retail sales totaled 1,150,000 units in the month, while fleet sales finished at 193,000 units, accounting for 14.3% of total volumes.

- General Motors is accustomed to being the bestselling OEM. It had a particularly strong month in October, reaching 233,000 units. This positioned GM well above second-placed Toyota Group, on 186,000 units. While Toyota Group was the only major automaker to see a YoY decline in volumes, it did have some positive news in the return of the Toyota Grand Highlander and Lexus TX, following the recent stop sales orders, although volumes were modest in October.

- Ford Group was once again the third largest OEM by sales, at 167,000 units.

Brands in October

- Toyota ranked first, but only by a narrow margin, with 159,000 units compared to almost 158,000 units for Ford. Chevrolet was also not far behind, on 149,000 units.

- For the first time since June, the Toyota RAV4 returned to the top of the sales rankings with volumes of 39,400 units, beating the Ford F-150 which recorded 38,700 units. The RAV4 has recently been impeded by a lack of inventory, but this appeared to be less of an issue in October.

Segments

- With the success of the Toyota RAV4, it was perhaps not surprising that the Compact Non-Premium SUV segment enjoyed its best market share since March 2024, at 21.1%.

- However, Mid-size Non-Premium SUVs had a somewhat underwhelming month, recording a market share of 14.2%, which was virtually identical to that of the Large Pickup segment. Large Pickups have not outsold Mid-size Non-Premium SUVs since July 2020, but the edge that the latter held over the former in October was just 206 units.

Global Outlook

September’s global LV selling rate came in at 89 million units/year, slightly lower than August but consistent with the past five months.

- September experienced a 4.2% YoY decrease, marking the fourth consecutive month of decline compared to the same period in 2023.

- Year-to-date volume is now only 0.3% higher than in 2023, putting annual growth at risk as we progress through the fourth quarter.

- Similar to last month, Argentina, Brazil, and Russia were the only markets showing positive growth in September.

As global LV sales appear to be leveling off, some of the previously expected acceleration in the fourth quarter has been tempered. The 2024 forecast now stands at 88,100,000 units/year, down 500,000 units from last month and with volume growth now projected at 1.4% for the year.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

October 2024 US Light Vehicle Sales Up at 1.34 Million

Click to enlarge.

Light Vehicle (LV) sales grew by 11.5% year-on-year (YoY) in October 2024, to 1.34 million units. Although the month had two additional selling days than it did in 2023, sales still exceeded expectations and provided a more cheerful perspective on the industry than has generally been the case in recent months, according to preliminary estimates released today by the respected GlobalData consultancy.*

“Sales have generally disappointed for much of 2024, but October provided a pleasant change of pace. While the fundamentals of the market have probably not shifted to a great extent, some consumers appear to have been enticed by the gradual uptick in incentives, allied with greater vehicle availability and an easing in interest rates. A number of brands highlighted how Electric and Hybrid Vehicles performed better,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData. **

GlobalData Observations

Brands in October

Segments

Global Outlook

September’s global LV selling rate came in at 89 million units/year, slightly lower than August but consistent with the past five months.

As global LV sales appear to be leveling off, some of the previously expected acceleration in the fourth quarter has been tempered. The 2024 forecast now stands at 88,100,000 units/year, down 500,000 units from last month and with volume growth now projected at 1.4% for the year.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.