Not out of the mud yet…

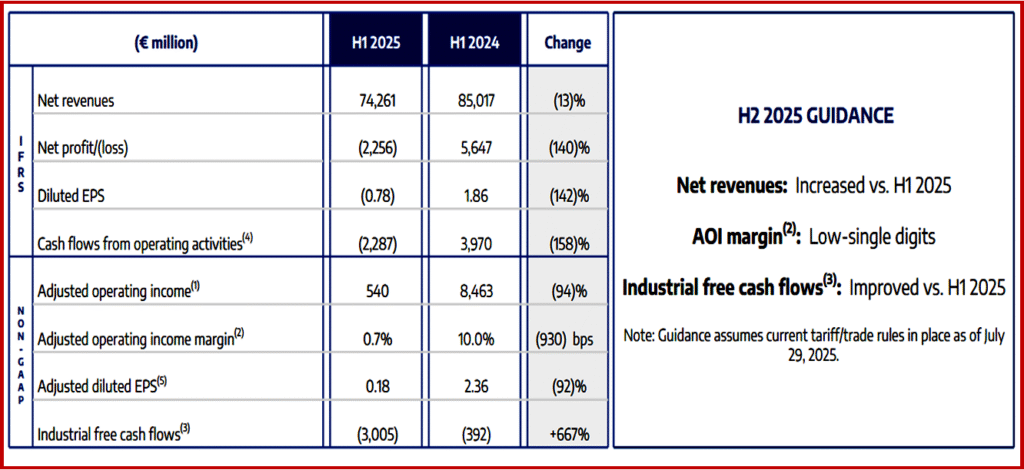

Stellantis N.V. (NYSE: STLA)* today announced results for the H1 2025, reporting Net revenues of €74.3 billion, down 13% compared to H1 2024. The breathtaking net loss was -€2.3) billion, including €3.3 billion of net charges excluded from Adjusted operating income, down compared to H1 2024 Net Profit of €5.6 billion. It updated its tariff cost assumptions to an estimated 2025 net tariff of~€1.5 billion (~$1.7B), of which only €0.3 billion was incurred in H1 2025.

“My first weeks as CEO have reconfirmed my strong conviction that we will fix what’s wrong in Stellantis by capitalizing on everything that’s right in Stellantis – starting from the strength, energy and ideas of our people, combined with the great new products we are now bringing to market,” claimed Antonio Filosa, CEO.

Click to enlarge.

Stellantis Financials at a Glance

- Net revenues of €74.3 billion, down 13% compared to H1 2024 chiefly driven by Y-o-Y declines in North America and Enlarged Europe, partially offset by growth in South America.

- Net loss of (€2.3) billion, including €3.3 billion of net charges excluded from Adjusted operating income (footnote 1)**, down compared to H1 2024 Net Profit of €5.6 billion. AOI (Automotive Operating Income see footnote 1) of €0.5 billion, with AOI margin( footnote 2) of 0.7%, below prior year levels of €8.5 billion and 10.0%, respectively.

- Industrial free cash flows (footnote 3) of -€3 billion, as the meager AOI was more than offset by CapEx and R&D expenditures in H1 2025

- Total industrial available liquidity at 30 June 2025 was €47.2 billion.

- Total inventories of 1.2 million units (Company inventory of 298 thousand units) at June 30, 2025, +1% compared with year-end 2024.

- H1 2025 saw sequential improvement in Shipments, Net revenues, AOI (1) and Industrial free cash flows (3) compared to H2 2024, realizing benefits from an expanded product lineup, revitalized marketing, and strong inventory discipline.

- Stellantis re-established financial guidance and forecasts continued sequential improvement in H2 2025.

*AutoInformed on

**Inevitable Stellantis Footnotes

- Adjusted operating income/(loss) excludes from Net profit/(loss) from continuing operations adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit).Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.

- Adjusted operating income/(loss) margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

- Industrial free cash flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities; (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net intercompany payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition, Industrial free cash flows is one of the metrics used in the determination of the annual performance bonus for eligible employees, including members of the senior management.

- Effective H1 2025, two types of cash flows were reclassified to cash flows from operating activities: (i) the net change in receivables related to financial services activities have been reclassified from investing activities as these are part of our principal revenue-generating activities and (ii) certain financial receivables related to factoring transactions from financing activities. Comparative figures for H1 2024 have been reclassified accordingly.

- Adjusted diluted earnings per share (“EPS”) is calculated by adjusting Diluted earnings per share for the post-tax impact per share of the same items excluded from Adjusted operating income as well as tax expense/(benefit) items that are considered rare or infrequent, or whose nature would distort the presentation of the ongoing tax charge of the Company. We believe this non-GAAP measure is useful because it also excludes items that we do not believe are indicative of the Company’s ongoing operating performance and provides investors with a more meaningful comparison of the Company’s ongoing quality of earnings. Adjusted diluted EPS should not be considered as a substitute for Basic earnings per share, Diluted earnings per share from operations or other methods of analyzing our quality of earnings as reported under IFRS.

- Combined shipments include shipments by the Company’s consolidated subsidiaries and unconsolidated joint ventures, whereas Consolidated shipments only include shipments by the Company’s consolidated subsidiaries. This includes the vehicles produced by our joint ventures and associates (including Leapmotor) which are distributed by our consolidated subsidiaries. In addition to the volumes included in consolidated shipments, combined shipments also includes the vehicles distributed by our joint ventures (such as Tofas). Figures by segments may not add up due to rounding.

- Industrial net financial position is calculated as Debt plus derivative financial liabilities related to industrial activities less (i) cash and cash equivalents, (ii) financial securities that are considered liquid, (iii) current financial receivables from the Company or its jointly controlled financial services entities and (iv) derivative financial assets and collateral deposits. Therefore, debt, cash and cash equivalents and other financial assets/liabilities pertaining to Stellantis’ financial services entities are excluded from the computation of the Industrial net financial position. Industrial net financial position includes the Industrial net financial position classified as held for sale.

- Financial securities are comprised of short term or marketable securities which represent temporary investments but do not satisfy all the requirements to be classified as cash equivalents as they may be subject to risk of change in value (even if they are short-term in nature or marketable).

- The majority of our liquidity is available to our treasury operations in Europe and U.S.; however, liquidity is also available to certain subsidiaries which operate in other countries. Cash held in such countries may be subject to restrictions on transfer depending on the foreign jurisdictions in which these subsidiaries operate. Based on our review of such transfer restrictions in the countries in which we operate and maintain material cash balances, (and in particular in Argentina, in which we have €444 million cash and securities at June 30, 2025 (€680 million at December 31, 2024), and in Algeria, in which we have €373 million (€276 million at December 31, 2024), we do not believe such transfer restrictions had an adverse impact on the Company’s ability to meet its liquidity requirements at the dates presented above. Cash and cash equivalents also include €511 million at June 30, 2025 (€451 million at December 31, 2024) held in bank deposits which are restricted to the operations related to securitization programs and warehouses credit facilities of Stellantis Financial Services U.S. Rankings, market share and other industry information are derived from third-party industry sources (e.g. Agence Nationale des Titres Sécurisés (ANTS), Associação Nacional dos Fabricantes de Veículos Automotores (ANFAVEA), Ministry of Infrastructure and Sustainable Mobility (MIMS), S&P Global, Ward’s Automotive) and internal information unless otherwise stated. For purposes of this document, and unless otherwise stated industry and market share information are for passenger cars (PC) plus light commercial vehicles (LCV), except as noted below:

-

- Enlarged Europe excludes Russia and Belarus. From 2025, this includes Israel and Palestine (prior periods have not been restated);

- Middle East & Africa excludes Iran, Sudan and Syria. From 2025, this excludes Israel and Palestine (prior periods have not been restated);

- South America excludes Cuba;

- India & Asia Pacific reflects aggregate for major markets where Stellantis competes (Japan (PC), India (PC), South Korea (PC + Pickups), Australia, New Zealand and South East Asia);

- China represents PC only and includes licensed sales from DPCA; and

- Maserati reflects aggregate for 17 major markets where Maserati competes and is derived from S&P Global data, Maserati competitive segment and internal information.

Prior period figures have been updated to reflect current information provided by third-party industry sources.

-

- EU30 = EU 27 (excluding Malta), Iceland, Norway, Switzerland and UK.

- Low emission vehicles (LEV) = battery electric (BEV), plug-in hybrid (PHEV), range-extender electric vehicle (REEV) and fuel cell electric (FCEV) vehicles.

- All Stellantis reported BEV and LEV sales include Citroën Ami, Opel Rocks-e and Fiat Topolino; in countries where these vehicles are classified as quadricycles, they are excluded from Stellantis reported combined sales, industry sales and market share figures.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis Posts H1 2025 Loss of €2.3 Billion

Not out of the mud yet…

Stellantis N.V. (NYSE: STLA)* today announced results for the H1 2025, reporting Net revenues of €74.3 billion, down 13% compared to H1 2024. The breathtaking net loss was -€2.3) billion, including €3.3 billion of net charges excluded from Adjusted operating income, down compared to H1 2024 Net Profit of €5.6 billion. It updated its tariff cost assumptions to an estimated 2025 net tariff of~€1.5 billion (~$1.7B), of which only €0.3 billion was incurred in H1 2025.

“My first weeks as CEO have reconfirmed my strong conviction that we will fix what’s wrong in Stellantis by capitalizing on everything that’s right in Stellantis – starting from the strength, energy and ideas of our people, combined with the great new products we are now bringing to market,” claimed Antonio Filosa, CEO.

Click to enlarge.

Stellantis Financials at a Glance

*AutoInformed on

**Inevitable Stellantis Footnotes

Prior period figures have been updated to reflect current information provided by third-party industry sources.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.