Click to enlarge.

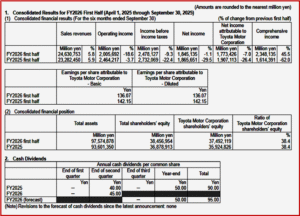

Today, Toyota Motor Corporation (NYSE: TM, 7203T) posted FY 2026 Q2 [1 April 2025 through 30 September 2025- AutoCrat] results that showed total consolidated vehicle unit sales increased globally by 227,000,+ 5.0% to 4,783,000. However, net income attributable to Toyota Motor Corporation was 1,773.4 billion yen, a decrease of 133.6 billion yen or -7.0% compared with FY2025 first half. Nonetheless, Toyota increased its fiscal-year profit forecast. Toyota maintains that its products and sales outside the United States would counter the negative effects of of U.S. President Donald Trump’s import tariffs. The world’s largest automaker forecasts an operating profit of 3.4 trillion yen (~$22.6 billion) for the financial year ending March 26, a jump of +6% from the 3.2 trillion yen it formerly forecast.

“North America is facing a very tough situation due to the impact of tariffs,” said Chief Financial Officer Kenta Kon during the financial results press conference. “While conditions were not easy in other markets such as China, Europe, Asia and Africa, both profitability and sales volume remained solid,” Kon said.

“In Japan, operating income decreased mainly due to the impact of exchange rate fluctuations and increased expenses. In North America, operating income decreased because of the impact of U.S. tariffs. Other regions saw an increase in operating income mainly due to higher sales volume, an improved model mix and other factors,” Kon said.

Consolidated Financial Position for FY2026 First Half

- Total assets increased by 3,973.5 billion yen, or 4.2%, to 97,574.8 billion yen at the end of FY2026 first half compared with the end of FY2025.

- Liabilities increased by 2,395.4 billion yen, or 4.2%, to 59,117.9 billion yen at the end of FY2026 first half compared with the end of FY2025.

- Shareholders’ equity increased by 1,578.0 billion yen, or 4.3%, to 38,456.9 billion yen at the end of FY2026 first half compared with the end of FY2025.

Overview of Cash Flow

- Cash and cash equivalents decreased by 869.4 billion yen, or 9.7%, to 8,112.9 billion yen at the end of FY2026 first half compared with the end of FY2025.

Cash flows From Operating Activities

- Net cash flows from operating activities resulted in an increase in cash by 2,944.6 billion yen for FY2026 first half. Net cash provided by operating activities increased by 1,127.4 billion yen from 1,817.1 billion yen for FY2025 first half.

Cash flows From Investing Activities

- Net cash flows from investing activities resulted in a decrease in cash by 3,517.5 billion yen for FY2026 first half. Net cash used in investing activities increased by 431.7 billion yen from 3,085.7 billion yen for FY2025 first half.

Cash flows From Financing Activities

- Net cash flows from financing activities resulted in a decrease in cash by 362.0 billion yen for FY2026 first half. Net cash used in financing activities increased by 72.3 billion yen from 289.7 billion yen for FY2025 first half.

“We have adopted the full year Foreign Exchange rate assumptions of JPY 146 per dollar and JPY 169 per euro. Our forecast for the full year consolidated performance are sales revenues of 49,000,000,000,000 yen operating income of 3,400,000,000,000.0 yen income before income taxes of 180,000,000,000 and net income of 2,930,000,000.00 yen,” Kon said.

Click for more.

“Despite the impact of U. S. tariffs amounting to 1,450,000,000,000.00 yen improvement efforts such as increasing volume, model mix, cost reductions and expanding value chain profits are expected to result in a positive impact of 900,000,000,000.0 yen To maintain and strengthen our earnings power, we will work with all stakeholders, including suppliers and dealers, to leverage results of the strengthening of our operational foundations to further improve productivity. I believe everyone here has seen the models we unveiled at the Japan Mobility Show. These cars speak more for themselves than I ever could. Each and every product is something that could not be created overnight. Toyota is a company managed through its products, which are the results of long term efforts built up by many people.

“Our products were created by our development teams, production teams, suppliers, dealers and, of course, our customers and the market. The first half financial results reflect these efforts, and our cars have generated solid profit. And now in addition to Toyota, Lexus, Daihatsu and GR, we are able to introduce the new Century brand. By having each brand take on clearer roles within the Toyota Group to form complementary relationships, we can expand customers’ choices even further with a diverse range of products that meet the needs of each individual. We hope you will continue to have even higher expectations for the Toyota Group moving forward,” said Toyota Motor Corporation Chief Officer Takanori Azuma.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Toyota Motor Q2 FY 2026 Net Income Drops 7%

Click to enlarge.

Today, Toyota Motor Corporation (NYSE: TM, 7203T) posted FY 2026 Q2 [1 April 2025 through 30 September 2025- AutoCrat] results that showed total consolidated vehicle unit sales increased globally by 227,000,+ 5.0% to 4,783,000. However, net income attributable to Toyota Motor Corporation was 1,773.4 billion yen, a decrease of 133.6 billion yen or -7.0% compared with FY2025 first half. Nonetheless, Toyota increased its fiscal-year profit forecast. Toyota maintains that its products and sales outside the United States would counter the negative effects of of U.S. President Donald Trump’s import tariffs. The world’s largest automaker forecasts an operating profit of 3.4 trillion yen (~$22.6 billion) for the financial year ending March 26, a jump of +6% from the 3.2 trillion yen it formerly forecast.

“North America is facing a very tough situation due to the impact of tariffs,” said Chief Financial Officer Kenta Kon during the financial results press conference. “While conditions were not easy in other markets such as China, Europe, Asia and Africa, both profitability and sales volume remained solid,” Kon said.

“In Japan, operating income decreased mainly due to the impact of exchange rate fluctuations and increased expenses. In North America, operating income decreased because of the impact of U.S. tariffs. Other regions saw an increase in operating income mainly due to higher sales volume, an improved model mix and other factors,” Kon said.

Consolidated Financial Position for FY2026 First Half

Overview of Cash Flow

Cash flows From Operating Activities

Cash flows From Investing Activities

Cash flows From Financing Activities

“We have adopted the full year Foreign Exchange rate assumptions of JPY 146 per dollar and JPY 169 per euro. Our forecast for the full year consolidated performance are sales revenues of 49,000,000,000,000 yen operating income of 3,400,000,000,000.0 yen income before income taxes of 180,000,000,000 and net income of 2,930,000,000.00 yen,” Kon said.

Click for more.

“Despite the impact of U. S. tariffs amounting to 1,450,000,000,000.00 yen improvement efforts such as increasing volume, model mix, cost reductions and expanding value chain profits are expected to result in a positive impact of 900,000,000,000.0 yen To maintain and strengthen our earnings power, we will work with all stakeholders, including suppliers and dealers, to leverage results of the strengthening of our operational foundations to further improve productivity. I believe everyone here has seen the models we unveiled at the Japan Mobility Show. These cars speak more for themselves than I ever could. Each and every product is something that could not be created overnight. Toyota is a company managed through its products, which are the results of long term efforts built up by many people.

“Our products were created by our development teams, production teams, suppliers, dealers and, of course, our customers and the market. The first half financial results reflect these efforts, and our cars have generated solid profit. And now in addition to Toyota, Lexus, Daihatsu and GR, we are able to introduce the new Century brand. By having each brand take on clearer roles within the Toyota Group to form complementary relationships, we can expand customers’ choices even further with a diverse range of products that meet the needs of each individual. We hope you will continue to have even higher expectations for the Toyota Group moving forward,” said Toyota Motor Corporation Chief Officer Takanori Azuma.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.