Shoot from the lip President Trump, aka Calamity Donald, today imposed tariffs of 25% across North America disrupting the North American auto market that has thrived on 30 years of free trade. Any new tariffs in place for any significant length of time will be disruptive. The tariffs at 25% are significantly higher than the profits made by the automakers and their suppliers. It is widely – if not universally – held by economists that this is an economic disaster.

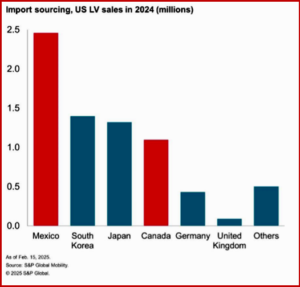

The tariffs are a sharp violation of the free trade deal with Canada, Mexico and the United States that Calamity Donald, renegotiated during his first administration. Using the dispute-settlement system to eliminate or adjust the tariffs could take years. Calamity Donald has already said he won’t act on any ruling against the United States. Roughly 44% of the new vehicles sold in the U.S. last year were imported from countries across North America, Europe and Asia. The automotive business involves a large and complex global supply chain, so new tariffs will challenge an industry that is already facing high costs. Higher costs mean fewer affordable vehicles for consumers. Higher costs result in lower sales volume in an industry that is central to U.S. economic health. (Read AutoInformed.com on: EV Satisfaction Improves But Trump Chaos Looms and Tariffs – Trump’s Next Economic Disaster Looming)

“For economists like myself, the unthinkable is coming true, with tariffs being applied to our free trade partners across North America. We have no history to study for this, but there will be implications. It is not even clear if the U.S. government has a way to efficiently track the movement of goods and impose duties, but set that aside: Production will be disrupted, supply will be restricted, and prices will go up,” said Jonathan Smoke, Chief Economist at Cox Automotive.

“This is happening at a moment when supply is tight already, and just as tax refund season approaches critical mass in dollars being distributed to consumers. Consumers with potential buying plans are very likely to act swiftly, so the short term is likely positive for sale volume. But once prices shift higher, demand will decline. Depending on how long this tariff stance lasts, it will also jeopardize the trajectory of the overall economy, further weakening growth potential later in the year,” said Smoke.

“A 25% tariff across the Mexico and Canadian border will blow a hole in the U.S. industry that we have never seen,” said Jim Farley, the chief executive of the Ford Motor Company last month.

Stephanie Brinley at S&P Global Mobility said: “The North American auto industry is super capital intensive with an extremely integrated supply chain. These are going to be hugely important for all. OEMs and suppliers will only invest capital and resources if there’s long term stability in this. It’s not clear we have that quite yet.”

S&P Global Mobility Handicaps the Probability Scenarios

70% Probability: A Quick Resolution

- Now that the 25% tariff scenario has been deployed, we see a 70% probability for a Quick Resolution. In that case, we would see the tariffs only in effect for 0-2 weeks. We will see some automaker production lost due to supply issues and border gridlock, and short-term OEM production halts. In this scenario, we expect that all lost sales and production is regained in short order.

- S&P Global Mobility estimates that there are about 63,900 light vehicles per day across North America, with 41,700 units produced in the US, 17,6000 units in Mexico and 4,600 units in Canada. We estimate that production disruption caused by the tariffs could result in one-third of production being disrupted in the region within one week. This would equate to disruption of more than 20,000 units per day in short order.

20% Probability: Extended Disruption

- However, we also see potential for an Extended Disruption if the tariffs are held in place for a six-to- eight-week duration. We see a 20% probability for this outcome. In this case, we will see several high exposure vehicles slow or cease production and for OEMs to conserve inventory and be careful to replenish with ‘tariffed’ stock. OEMs will look to protect profitability by replenishing slowly and keep incentives and discounts very low while aiming to keep pricing strong. We do see potential for product development delays during this period having a knock-on effect into future years. Slowed product development will mean that product launches in later years will be delayed, having impact in some years after this has passed. However, with a six-to-eight-week disruption, we expect most sales and production are compensated for within 12 months.

10% Scenario: Tariff Winter

- The more dire scenario is a Tariff Winter. S&P Global Mobility currently puts this at a 10% probability. In this case, tariffs of 25% on Mexico and Canada are integrated long-term into the auto trade structures. This would create an environment of sub-optimal sourcing–vehicles and components produced in Mexico and Canada are currently in those locations because cost and efficiencies are optimal in this arrangement. Moving that production to the US to avoid the tariff also increases the cost of labor for manufacturing, has the potential to further exacerbate a general labor shortage, and could leave automakers with underutilized plants in Mexico or Canada. Though in a Tariff Winter we would expect to see re-sourcing, due to the sub-optimal sourcing increasing the cost of manufacturing, North American light-vehicle sales could decline by 10% for several years with a long-term decline in competitiveness. The decline is likely to be 10% in the US, 8% in Mexico and 15% in Canada. A key issue here is that OEMs and suppliers will only invest capital and resources if there is long-term stability in the trade and source planning environment; a Tariff Winter presumes some level of stability, even at higher costs. In the meantime, the uncertain trade situation may delay development of future vehicle programs. This is particularly true in light of additional emission and fuel economy regulation.

Cox Automotive

“New tariffs hitting the U.S. borders are certainly troubling for the North American automotive market, as we know it will add substantial input costs to automakers which inevitably have to be passed along in some capacity to the consumer. Now comes the ultimate test: The industry’s ability to contain the tariff-driven price increases, with the uncertainty of how long these tariffs stay intact and to what degree they are able to be assessed at the border, given the complexity. Ultimately, it is the volatility in policy that is most damaging to the automakers’ ability to strategize for the future; the uncertainty is far worse than knowing what hand they’ve been dealt,” said Erin Keating, Executive Analyst at Cox Automotive.

The Farm Subsidy Disasters

It’s not just the auto industry that is at risk here. The American taxpayer faces another huge economic defeat because of Trump’s reckless Tariff actions. This from the council on Foreign Relations back in October 2020 after the Trump mis-Administration’s first round of self-defeating tariffs:

“American farmers have indeed laid claim to nearly all his China tariff revenue, which now totals $66 billion.

“In 2018 and 2019, Trump authorized payments to U.S. farmers of $28 billion to offset their losses from Chinese trade retaliation. This year, with farmers struggling under the twin crises of the trade war and the pandemic, bailouts have soared way higher. Trump promised angry farmers another $19 billion in April and $14 billion in September – bringing his bailouts to a grand total of $61 billion. He has pledged to continue these bailouts until the trade war ends.”

AutoCrat: So now Trumps 2.0 starts another trade war. All farm subsidy programs cost taxpayers trillions of dollars. This needs a careful review.

As America’s top auto producer, we appreciate President Trump’s work to support our industry and exempt auto companies complying with USMCA.

Since President Trump’s successful USMCA was signed, Ford has invested billions in the United States and committed to billions more in the future to both invest in American workers and ensure all of our vehicles comply with USMCA.

We will continue to have a healthy and candid dialogue with the Administration to help achieve a bright future for our industry and U.S. manufacturing

Tariff Briefing

Thanks and a tip of the non-taxed AutoCrat fedora to the Harvard Kennedy School’s Shorenstein Center. “The Journalist’s Resource curates, summarizes and contextualizes high-quality research on newsy public policy topics. We are supported by generous grants from the Carnegie Corporation of New York, the Robert Wood Johnson Foundation, The National Institute for Health Care Management (NIHCM) Foundation, Lumina Foundation, and individual contributors.”

Douglas Irwin is the John French Professor of Economics at Dartmouth College and author of “Clashing over Commerce: A History of U.S. Trade Policy.”

Irwin describes the government pursuit of tariffs as historically having one of three motivations:

• Revenue. Alexander Hamilton, serving as the first Secretary of the Treasury in 1789, had revenue in mind, Irwin said. Hamilton needed to pay back war debt and fund defense forces. “That’s why Congress passed very quickly a tariff act,” Irwin says.

• Restriction. The second historical reason for tariffs – restriction – aimed to curtail demand of imports in order to boost goods production. “in the U.S. Restriction was the dominant motivator for tariffs from the end of the Civil War through the Great Depression,” Irwin says.

• Reciprocity. “Reciprocity is when tariffs are used to negotiate favorable trade terms between countries using a carrot-or-stick approach, Irwin says.

The stick approach would include threatening countries with retaliatory tariffs for a variety of reasons, such as refusing to renegotiate trade deals.

“The U.S. has largely used the carrot approach since WWII. “When the U.S. says, ‘We’ll pursue a policy of reciprocity wherein we will reduce our tariffs on your goods if you reduce your tariffs on our goods.’ And you reach a trade agreement to reduce trade barriers, expand trade, which is presumably mutually beneficial,” Irwin says.

Key players from tariffs past. In addition to Hamilton, there’s U.S. Senator Henry Clay, the Virginian and Kentuckian who helped broker an agreement to reduce cotton tariffs in the early 1830s. Plantation owners in the South were worried that Great Britain, one of their main trading partners, would retaliate with their own tariffs. Clay’s brokerage of the deal “helped save the Union,” Irwin says. Then there are Reed Smoot and Willis Hawley, the federal legislators behind the “Smoot-Hawley Tariff Act of 1930, which imposed broad tariffs that exacerbated the Great Depression, and led to the period of reciprocity after World War II,” Irwin says.