Click for more GlobalData.

US Light Vehicle (LV) sales grew by 8.5% year-on-year (YoY) in November, to 1.22 million units, according to preliminary estimates from the respected consultancy GlobalData.* The daily selling rate was estimated at 48,900 units/day in November, compared to 48,200 units/day in October. Despite the uptick in the daily selling rate, it appears that November sales were slightly disappointing, with Thanksgiving and Black Friday sales not delivering quite as robust an acceleration as hoped.

“With the UAW strikes over, the industry could focus on more typical matters of LV demand and the extent to which Thanksgiving sales would spur the market, against the backdrop of many households feeling squeezed and interest rates remaining high. In the end, sales grew by 8.5% YoY, but there was a feeling that results could have been better.

“While consumers still appear willing to spend, many are remaining more cost-conscious, and this is forcing the industry to begin to offer higher incentives, even if discounting remains well below historical averages for now. In addition, several models that were directly impacted by the UAW strikes were still suffering from low inventory in November, and that appeared to restrict their sales. Had these models delivered more typical volumes, the overall market’s performance would have looked more robust,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

According to initial estimates, retail sales totaled ~1.03 million units, while fleet sales accounted for approximately 191,000, ~15.6% of total sales. The YoY growth in the US was helped by weak sales a year ago. While the results were a little lower than expected, the selling rate is at a similar pace to recent months. “However, with inventory improving, it seems that customers are having to be enticed with higher incentives than has been the case since the onset of the chip shortage,” GlobalData observed.

GlobalData Observations

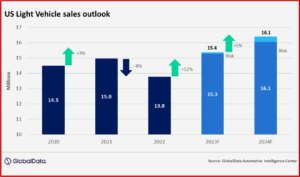

- The year-to-date (YTD) US sales market continues at or above expectations, as 2023 remains on track to reach 15.4 million units, up 12% from 2022. Given the stability in demand and supply constraints being reduced, we have increased the forecast for 2024 to 16.1 million units from 16.0 million units. The YTD daily selling rate is at 50,200, up from 44,600 last year, though October and November were both under the YTD average.

- Inventory levels remain sufficient to support demand at an industry level. Days’ supply is expected to be at 45 days, which is flat from last month. Inventory volume is projected at 2.25 million units, up from 2.16 million units in October.

- At an OEM level, Toyota Group outsold General Motors for the second consecutive month, but this time by a very tight margin of just 178 units. Both OEMs’ market shares rounded to 16.2%, which was down by 0.1 pp month-on-month (MoM) in Toyota’s case, but up by 0.6 pp MoM for General Motors, as the latter recovered from the UAW strikes.

- Ford Group was the third-largest OEM on 140,000 units, although at 11.4%, its market share was the lowest since August 2021.

- The Toyota brand easily led the rankings with 167,000 units, 33,000 ahead of Ford, which only beat Chevrolet by 3,000 units.

- The Toyota RAV4 was the bestselling model for a second straight month with 42,800, finishing 10,000 ahead of the Ford F-150. The RAV4 has been boosted by an unusually high level of imports in recent months, but this is understood to be a temporary situation.

- Compact Non-Premium SUV was once again the number one segment, setting a record-high market share for the third consecutive month, at 21.1%. Mid-size Non-Premium SUV was a distant second on 15.5%, followed by Large Pickup on 13.6%.

“While there isn’t much outlook ahead for 2023, the stability in the market is setting up next year fairly well, despite some headwinds with the overall economy and general pricing trends. Consumers should have more choices next year, which could also be a pivotal year in measuring the speed of the transition to electrification. Several brands have revised the near-term outlook, but investments have been made, so 2024 is shaping up as an important indicator to the health of the overall industry, and, more specifically, to the traditional OEMs,” said Jeff Schuster, Vice President Research and Analysis, Automotive.

Global Outlook

October was a strong month again for global LV sales. The selling rate was 94 million units and volume increased by 10.7% from October 2022. This represented the fifth consecutive month of sales above 90 million units. Many key markets saw double-digit growth, but October 2022 was a weak base for comparison. November is forecast to have ended above the 90-million-unit level again, setting up a strong close to the year.

With less than one month to go in 2023, the outlook for global LV sales has been revised upward yet again on the strength of China’s wholesale market. The 2023 forecast now stands at 89.2 million units, up 600,000 units from a month ago and equating to a 10.0% increase compared to 2022. (GlobalData will be moving to reporting and forecasting domestic sales in China, thus lowering the market by 3.7 million units. For 2023, our current forecast of 92.3 mn units is holding. For 2023, the current forecast of 92.3 million units is unchanged.)

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Light Vehicle Sales up Again in November 2023

Click for more GlobalData.

US Light Vehicle (LV) sales grew by 8.5% year-on-year (YoY) in November, to 1.22 million units, according to preliminary estimates from the respected consultancy GlobalData.* The daily selling rate was estimated at 48,900 units/day in November, compared to 48,200 units/day in October. Despite the uptick in the daily selling rate, it appears that November sales were slightly disappointing, with Thanksgiving and Black Friday sales not delivering quite as robust an acceleration as hoped.

“With the UAW strikes over, the industry could focus on more typical matters of LV demand and the extent to which Thanksgiving sales would spur the market, against the backdrop of many households feeling squeezed and interest rates remaining high. In the end, sales grew by 8.5% YoY, but there was a feeling that results could have been better.

“While consumers still appear willing to spend, many are remaining more cost-conscious, and this is forcing the industry to begin to offer higher incentives, even if discounting remains well below historical averages for now. In addition, several models that were directly impacted by the UAW strikes were still suffering from low inventory in November, and that appeared to restrict their sales. Had these models delivered more typical volumes, the overall market’s performance would have looked more robust,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

According to initial estimates, retail sales totaled ~1.03 million units, while fleet sales accounted for approximately 191,000, ~15.6% of total sales. The YoY growth in the US was helped by weak sales a year ago. While the results were a little lower than expected, the selling rate is at a similar pace to recent months. “However, with inventory improving, it seems that customers are having to be enticed with higher incentives than has been the case since the onset of the chip shortage,” GlobalData observed.

GlobalData Observations

“While there isn’t much outlook ahead for 2023, the stability in the market is setting up next year fairly well, despite some headwinds with the overall economy and general pricing trends. Consumers should have more choices next year, which could also be a pivotal year in measuring the speed of the transition to electrification. Several brands have revised the near-term outlook, but investments have been made, so 2024 is shaping up as an important indicator to the health of the overall industry, and, more specifically, to the traditional OEMs,” said Jeff Schuster, Vice President Research and Analysis, Automotive.

Global Outlook

October was a strong month again for global LV sales. The selling rate was 94 million units and volume increased by 10.7% from October 2022. This represented the fifth consecutive month of sales above 90 million units. Many key markets saw double-digit growth, but October 2022 was a weak base for comparison. November is forecast to have ended above the 90-million-unit level again, setting up a strong close to the year.

With less than one month to go in 2023, the outlook for global LV sales has been revised upward yet again on the strength of China’s wholesale market. The 2023 forecast now stands at 89.2 million units, up 600,000 units from a month ago and equating to a 10.0% increase compared to 2022. (GlobalData will be moving to reporting and forecasting domestic sales in China, thus lowering the market by 3.7 million units. For 2023, our current forecast of 92.3 mn units is holding. For 2023, the current forecast of 92.3 million units is unchanged.)

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.