Click to enlarge.

During November 2024, new EU car registrations fell by 1.9%. France led with a sharp 12.7% decline, followed by Italy (-10.8%), while the German market (0.5%). stagnated slightly [read AutoInformed on November Western European Car Sales Up]* Among the four most significant EU markets, only Spain recorded positive growth (6.4%), according to data from the European Automobile Manufacturers’ Association, aka ACEA derived from its French name.**

“Eleven months into 2024, new car registrations remained stable (+0.4%), reaching 9.7 million units. While the market in Spain performed positively (+5.1%), declines were witnessed in France (-3.7%), Germany (-0.4%), and Italy (-0.2%),” ACEA said in its monthly sales release.

Electric Cars

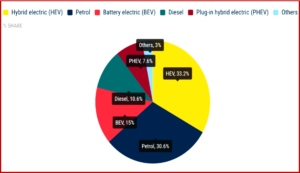

- Registrations of battery-electric cars declined by 9.5% to 130,757 units in November 2024. This drop was primarily driven by a significant decrease in registrations in Germany (-21.8%) and France (-24.4%). It resulted in a year-to-date market volume 5.4% lower than the same period last year, with the total market share now at 13.4%.

- Plug-in hybrid car registrations fell by 8.8% last month, following significant declines in France (-19.6%), Belgium (-61.4%), and Italy (-31.4%). In November, plug-in hybrids accounted for 7.6% of the car market, down from 8.1% last year. Year-to-date volumes were also down, decreasing by 8% compared to the same period last year.

- Hybrid-electric registrations increased by 18.5% in November, with market share rising to 33.2%, up from 27.5% last November, exceeding petrol car registrations for the third consecutive month.

Petrol and Diesel Cars

- In November 2024, petrol car sales dropped by 7.8%. All four major markets recorded decreases: France experienced the steepest drop, with registrations plummeting by 31.5%, followed by Italy with a 12.3% decline. Though more modest, Germany and Spain recorded declines as well (-5.4% and -2.3%, respectively).

- With 266,115 new cars registered last month, the market share for petrol dropped to 30.6%, down from 32.5% in the same month last year. The diesel car market declined by 15.3%, resulting in a 10.6% market share last November. Overall, decreases were observed in most EU markets.

*AutoInformed on

**ACEA

The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group. Stellantis is in the process of rejoining.

About the EU automobile industry

- 2 million Europeans work in the automotive sector.

- 3% of all manufacturing jobs in the EU.

- €383.7 billion in tax revenue for European governments.

- €106.7 billion trade surplus for the European Union.

- Over 7.5% of EU GDP generated by the auto industry.

- €72.8 billion in R&D spending annually, 33% of EU total.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

EU Car Sales Weak Again in November

Click to enlarge.

During November 2024, new EU car registrations fell by 1.9%. France led with a sharp 12.7% decline, followed by Italy (-10.8%), while the German market (0.5%). stagnated slightly [read AutoInformed on November Western European Car Sales Up]* Among the four most significant EU markets, only Spain recorded positive growth (6.4%), according to data from the European Automobile Manufacturers’ Association, aka ACEA derived from its French name.**

“Eleven months into 2024, new car registrations remained stable (+0.4%), reaching 9.7 million units. While the market in Spain performed positively (+5.1%), declines were witnessed in France (-3.7%), Germany (-0.4%), and Italy (-0.2%),” ACEA said in its monthly sales release.

Electric Cars

Petrol and Diesel Cars

*AutoInformed on

**ACEA

The European Automobile Manufacturers’ Association (ACEA) represents the 15 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Nissan, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group. Stellantis is in the process of rejoining.

About the EU automobile industry

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.