Click for more.

Paul Jacobson, GM EVP and Chief Financial Officer said this morning in New York that the aim is to continue to drive GM’s strong cash flow performance while increasing the margins and the returns to investors while cutting capital spending. (NYSE: GM) Speaking at the Barclays Global Automotive and Mobility Tech Conference, Jacobson said, “we remain absolutely committed to driving to the 8% to 10% margin consistently that we’ve said in North America through this transition (to electric vehicles).”

The conference came one day after GM stunned analysts, Ford Motor, and media by announcing a $10 Billion Accelerated Share Repurchase Program (ASR)* and 33% dividend increase to 12 cents per quarter starting in 2024. GM continues to generate huge cash flows and invest in the business in the face of the retro-think of stock mis-analysts. GM has also canceled the $6.0 billion revolving credit facility it entered in October and plans to enter into a new 364-day $3.0 billion committed credit facility with the banks executing the ASR acting as lenders. Ford will address its financial outlook today. GM stock increased ~9% after the announcement.

Jacobsen also provided details on the Street and media got its EV moves wrong. “Our strategy has not changed at all. And I think you know, if you look at the revenue growth even over the last couple of years. We’ve actually grown revenues much faster than even analysts and others anticipated going forward,” Jacobsen said. “The strength of revitalized internal combustion engine (ICE) portfolio and with the limited EV’s that we’ve seen. “We’ve actually increased share when a lot of folks thought that share was going to come down as the EV penetration increased going forward.”

Jacobsen’s points summarized and edited for clarity:

- The first thing we’ve got to do is create the vehicle foundation and do it profitably with the types of margins that that we expect in our portfolio going forward. And from there the business build. So, you know, I don’t, I don’t necessarily think we should be judged as to whether we get to $300 billion of revenue or 250. Because nobody ever thought we were going to 250 yet here we are north of 170. Just a couple of years later, which a lot of people didn’t think was possible as well. We’re going to continue to improve it.

- We’re still holding on to the overall fundamental strategy of ICE, AV (autonomous vehicles) software, EVs across the board. The composition of that might change from time to time. But I would say those are tactics. the reality is things happen and it requires some tactical moves.

- The path to EV profitability, much like EV demand and EV penetration is s not going to be a straight line. So what you’ve got to do is you’ve got to take that vision and combine it with the resiliency that we’ve shown during COVID for the supply chain. And for semiconductors.

- Bumps in the road aren’t going to deter us from where we’re going to and that’s about execution.

- I don’t think we get an A plus for execution by any means. I think there’s still room to improve it, but the first step to a cure is identifying it and making sure that we’re addressing it. I think we’re on top of that, and as a result expressing continued confidence in where we’re going on EV profitability. And I think I think we’ll get there in a sustainable way and a consistent way moving forward.

- Orion plant timing was interpreted as GM was afraid of EV demand. That’s actually not true. What we did is we saw an opportunity. We still have an opportunity to scale truck at Factory Zero in Detroit, Hamtramck. But we have the opportunity to delay and defer Orient to actually incorporate several changes across the board. Work that’s going to make vehicle production more efficient at scale. So we felt it was important to actually incorporate that now rather than rush and make it a significantly costly endeavor to actually shut down production to retool some of those plants. We felt like that was the prudent thing to do. We save a little bit in the CapEx budget in 2024.

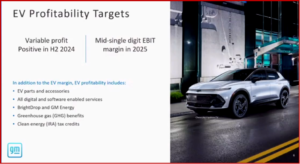

- We still believe EBIT margin in the mid-single digit. This is possible with the benefits of the clean energy tax credits. That’s consistent. I would say it’s kind of the lower end free credits that we talked about at Investor Day. Some of the things that are impacting that, the higher labor costs. Et cetera that we’ve seen.

- Going forward, we do anticipate a lot of tailwinds in terms of how we think about this problem. Where it’s going, you know, some of these things are just going to be with the passage of time. We’ve already done. Some of it is commercially oriented, so for example, the $800 million charge that we took in Q2 is that with LGS part of a resolution of commercial issues with them. Where we get future benefit that’s much greater than the $800 million and it’s in the billions of dollars across the board in terms of our savings that we’re going to get because by working together with LGS.

- We’ve actually been able to close an additional $1000 per vehicle savings to our previous supply agreement by focusing on supply chain efficiencies. Fixed cost utilization, et cetera. So as we think about that in total, we continue to drive towards. Our goal is to try to speed up a little bit here.

- GM has put in a lot of infrastructure on factories and facilities that have been significantly underutilized today. But we’re building for the future, so as we continue to ramp up. We’re going to see pretty significant benefits going forward. And as you look for 2023-2024, we actually expected over 60 points in EBIT margin improvement in 2024. How do we get there? About 60% of this is really going to come from scale due to higher volumes. We won’t share specific volume numbers, but expect that we’re going to have a meaningful step up volumes as we work through the model challenges we’ve seen. And

- The cost per unit in 2024 is going to be about $20,000 of vehicle lower in 2024 than it was in 2023. We’re actually absorbing a significantly bigger piece of the fixed cost today as we scale up. Were down on a per unit basis. And another $1000 is coming in 2025.

- We also have significant EV expense that’s going in there We expect a 20% improvement primarily from mix. We’ll see higher variable profitability in vehicles like Hummer EVs and significantly fewer Bolt EVs in 2024. The next generation Bolt will be on a much, much lower cost. The Ultium program as well, and by doing that and again this was a point of confusion. I think when we originally closed it, people felt we were using the Bolt as a proxy for Ultium. That’s not true. We’re actually going to incorporate Ultium Battery management system on a redesigned Bolt that’s going to be substantially more profitable. By doing so, we actually were able to take about $5 billion of future program capital out of our forward projections because the alternative to retiring the Bolt was to create a new low cost entry. We really have that with Bolt brand recognition. Then we expect a 20% improvement from battery costs including battery raw materials as well as scaling of the battery joint ventures. I mentioned the efficiencies that we’ve seen with respect to Lordstown and wanting to make sure that we keep that production up. We’ll also have that as we get into 2024 and 25 in Spring Hill coming online and getting up to full capacity. Ultimately, this will significantly decrease our reliance on more expensive imported cells, which we’ve been taking in 2023. We’re working with our partners on that battery.

- Raw materials continue to be volatile, but as you look at what lithium has done. I’m sure many of you are paying attention to that market when you look at lithium plus. The combination of other battery raw material prices we expect over a $4000 per vehicle improvement in cost from 2023 to 24, that’ll take us a little bit of time to start realizing. As I mentioned, we’ve got battery cell inventory that we’ve got to work through as we get into. But when you look at all of this coming forward, we actually believe that we’re on a trajectory and we’re committing to get to a trajectory to be variable profit positive in the second half of 2024 with our EVs. Then as we turn to 2025, we get more benefits of volume. We and scale we get further benefits from battery, low cost etc. As we achieve full capacity and we expect that we’ll hit our mid-single digit margin targets in 2025.

- So what gives us confidence? It’s really about execution and while our execution has been somewhat challenged to date, we believe we’ve identified those challenges and we’ve got a portfolio of really, really strong electric vehicles coming forward that that meet the range and charging characteristics that customers are looking for. We believe that with this purpose that we can actually continue to drive demand with features and price points that customers want.

- Some have talked about what we want to be. Is the next Tesla. We don’t want to be the next Tesla. We want to be the best GM that we can be. We can do that with the EV portfolio that we have coming up as well as the future opportunities with our new joint venture with Samsung, which will bring even lower cost batteries online in 26 and beyond. We’re spending time talking about 2025, this is a long, consistent trajectory.

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM CFO – More Spending Efficiencies on Way for ICE and EVs

Click for more.

Paul Jacobson, GM EVP and Chief Financial Officer said this morning in New York that the aim is to continue to drive GM’s strong cash flow performance while increasing the margins and the returns to investors while cutting capital spending. (NYSE: GM) Speaking at the Barclays Global Automotive and Mobility Tech Conference, Jacobson said, “we remain absolutely committed to driving to the 8% to 10% margin consistently that we’ve said in North America through this transition (to electric vehicles).”

The conference came one day after GM stunned analysts, Ford Motor, and media by announcing a $10 Billion Accelerated Share Repurchase Program (ASR)* and 33% dividend increase to 12 cents per quarter starting in 2024. GM continues to generate huge cash flows and invest in the business in the face of the retro-think of stock mis-analysts. GM has also canceled the $6.0 billion revolving credit facility it entered in October and plans to enter into a new 364-day $3.0 billion committed credit facility with the banks executing the ASR acting as lenders. Ford will address its financial outlook today. GM stock increased ~9% after the announcement.

Jacobsen also provided details on the Street and media got its EV moves wrong. “Our strategy has not changed at all. And I think you know, if you look at the revenue growth even over the last couple of years. We’ve actually grown revenues much faster than even analysts and others anticipated going forward,” Jacobsen said. “The strength of revitalized internal combustion engine (ICE) portfolio and with the limited EV’s that we’ve seen. “We’ve actually increased share when a lot of folks thought that share was going to come down as the EV penetration increased going forward.”

Jacobsen’s points summarized and edited for clarity:

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.