Click to enlarge.

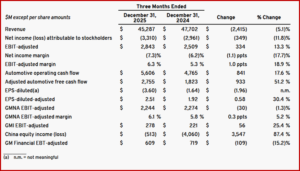

General Motors (NYSE: GM)* today reported full-year 2025 net income attributable to stockholders of $2.7 billion and EBIT-adjusted of $12.7 billion. Fourth-quarter 2025 net income attributable to stockholders was a loss of $3.3 billion, EBIT-adjusted was $2.8 billion. The GM Board announced a dividend at 20% higher quarterly rate, and approved new $6 billion share repurchase authorization. [Earnings per share took a big hit in 2025. Cash flow apparently allows the aggressive dividend increase and share buyback program in what could the least year for the aging – 65 – GM CEO. -AutoCrat]

“We expect the U.S. new vehicle market will continue to be resilient, and with our compelling vehicles, technology-driven services, and operating discipline, 2026 should be an even better year for GM. We expect our full year EBIT-adjusted margins in North America will be back in the 8-10% margin range,” said Mary Barra GM CEO and Chair.

Click to enlarge.

However, Q4 net income was reduced by more than $7.2 billion in special charges largely by a realignment of electric vehicle capacity and investments to adjust to expected declines in consumer demand for EVs, and in response to U.S. Government policy changes including the termination of consumer incentives and the reduction in the stringency of emissions regulations.

GM Highlights

- GM delivered full-year EBIT-adjusted at the high end of its guidance range. GM delivered a total return of 54% for our investors.

- In the United States, GM achieved our highest market share since 2015 with low inventory, low incentives, and strong pricing. It was our fourth consecutive year of market share growth.

- OnStar had a record 12 million global subscribers, including Super Cruise, which grew nearly 80% year-over-year to more than 620,000 subscribers. OnStar fleet subscriptions reached 2 million, twice as many as the closest OEM competitor.

- The Chevrolet Trax, the full-size SUV family, the Chevrolet Corvette and both Cadillac Blackwing sedans were named to Car and Driver’s 10 Best list. In addition, the Cadillac Escalade IQ won MotorTrend’s SUV and Technology of the Year awards.

“For several years now, consistently strong cash generation has allowed us to execute all phases of our capital allocation program, from investing in the business and our people, to maintaining a strong balance sheet, and returning capital to shareholders. We believe this is sustainable, so we are increasing our dividend rate by 20% and our Board authorized a new $6 billion share repurchase program,” said Barra.

“Looking ahead, we are operating in a U.S. regulatory and policy environment that is increasingly aligned with customer demand. As a result, we continue to onshore more production to meet strong customer demand for our vehicles. Over the next few years, our annual production in the U.S. is expected to rise to an industry-leading 2 million units.

“We continue to believe in EVs, and our portfolio brought almost 100,000 new customers to GM in 2025. We know these drivers do not often go back to gas, so we will continue executing our plan to reduce EV-related costs and we remain confident in our path to EV profitability,” said Barra.

GM YoY EBIT-Adjusted Key Assumptions

Tailwinds

- North America ICE wholesales flat to up modestly

- EV losses improve by $1.0–1.5B from right-sizing EV capacity and significantly lower volume.

- Warranty costs benefit of ~$1.0B

- Regulatory benefits of $500–750M, primarily related to savings from

- No longer having to purchase compliance credits

- North America pricing flat to up 0.5%

Headwinds

- Gross tariff costs of $3.0-4.0B, slightly higher primarily due to additional quarter of tariff exposure.

- Commodity inflation, higher DRAM costs and FX headwinds of $1.0–1.5B.

- Onshoring production to the U.S., supply chain investments and higher.

- software expenses resulting in ~$1.0–1.5B of additional costs.

Other Assumptions

- U.S. total SAAR assumed in the low 16M unit range.

- GM Financial EBT-adj. to be in the $2.5–3.0B range.

- GMI results, including China, largely consistent with 2025.

- Full-year EPS-diluted-adj. guidance assumes weighted-avg. diluted.

- Share count of approximately 930M shares.

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Posts 2025 Net of $12.7B on $185B Revenue

Click to enlarge.

General Motors (NYSE: GM)* today reported full-year 2025 net income attributable to stockholders of $2.7 billion and EBIT-adjusted of $12.7 billion. Fourth-quarter 2025 net income attributable to stockholders was a loss of $3.3 billion, EBIT-adjusted was $2.8 billion. The GM Board announced a dividend at 20% higher quarterly rate, and approved new $6 billion share repurchase authorization. [Earnings per share took a big hit in 2025. Cash flow apparently allows the aggressive dividend increase and share buyback program in what could the least year for the aging – 65 – GM CEO. -AutoCrat]

“We expect the U.S. new vehicle market will continue to be resilient, and with our compelling vehicles, technology-driven services, and operating discipline, 2026 should be an even better year for GM. We expect our full year EBIT-adjusted margins in North America will be back in the 8-10% margin range,” said Mary Barra GM CEO and Chair.

Click to enlarge.

However, Q4 net income was reduced by more than $7.2 billion in special charges largely by a realignment of electric vehicle capacity and investments to adjust to expected declines in consumer demand for EVs, and in response to U.S. Government policy changes including the termination of consumer incentives and the reduction in the stringency of emissions regulations.

GM Highlights

“For several years now, consistently strong cash generation has allowed us to execute all phases of our capital allocation program, from investing in the business and our people, to maintaining a strong balance sheet, and returning capital to shareholders. We believe this is sustainable, so we are increasing our dividend rate by 20% and our Board authorized a new $6 billion share repurchase program,” said Barra.

“Looking ahead, we are operating in a U.S. regulatory and policy environment that is increasingly aligned with customer demand. As a result, we continue to onshore more production to meet strong customer demand for our vehicles. Over the next few years, our annual production in the U.S. is expected to rise to an industry-leading 2 million units.

“We continue to believe in EVs, and our portfolio brought almost 100,000 new customers to GM in 2025. We know these drivers do not often go back to gas, so we will continue executing our plan to reduce EV-related costs and we remain confident in our path to EV profitability,” said Barra.

GM YoY EBIT-Adjusted Key Assumptions

Tailwinds

Headwinds

Other Assumptions

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.