Click to enlarge.

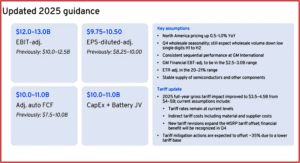

General Motors (NYSE: GM) today posted a Q3 2025 net income of $1.3 Billion down $700 million year-over-year on $48.6B in revenue. This included a gross tariff impact of $1.1 billion. GM offset more than 30% of this amount through what it said was go-to-market, footprint, and cost initiatives. It was a strong quarterly performance, but GM still faces major challenges in China, as well as problems dealing with Korea, Mexico and Canada via the upcoming re-negotiation of the North American Free Trade Agreement with the Trump Administration’s hostile to our northern neighbor. Nonetheless GM stock closed the day at $66.62, up $8.62 for a +14.86% gain.

“Thanks to the collective efforts of our team, and our compelling vehicle portfolio, GM delivered another very good quarter of earnings and free cash flow. In the U.S., we achieved our highest third-quarter market share since 2017 with strong margins, and our restructured China business was profitable once again. Based on our performance, we are raising our full-year guidance, underscoring our confidence in the company’s trajectory,” said Ceo and Chair Mary Barra.

“I also want to thank the President and his team for the important tariff updates they made on Friday. The MSRP offset program will help make U.S.-produced vehicles more competitive over the next five years, and GM is very well positioned as we invest to increase our already significant domestic sourcing and manufacturing footprint. Earlier this year, we announced $4 billion in capital investments to onshore production at plants in Tennessee, Kansas, and Michigan over the next two years. Once these investments come online, we plan to produce more than two million vehicles per year in the United States. We are also investing close to $1 billion to build a new generation of advanced, fuel-efficient V8 engines in New York. Importantly, we are maintaining our capital discipline while adding this production and creating new jobs,” said Barra.

It what can be described charitably as an evolving regulatory framework and the end of the federal consumer incentives, GM like all automakers is looking as a near-term EV adoption rates that will be much lower than planned. This inevitably raises variable costs as GM EV plants and its suppliers run at diminished capacity if they run at all. “By acting swiftly and decisively to address overcapacity, we expect to reduce EV losses in 2026 and beyond,” said Barra.

No surprise here at AutoInformed that Orion Assembly will convert from EV to Internal Combustion Engine (ICE) production. GM also sold its joint venture-owned battery cell plant in Michigan to LG Energy Solution. GM recorded a – gulp – $1.6 billion special item charge Q3 of $1.2 billion for non-cash impairments, most of which GM said are related to the Orion transition, reductions in battery module assembly capacity, as well as GM’s decision to stop development of next-generation hydrogen fuel cells. Also included were the write-off of CAFE credits and associated liabilities. “Today, I’m happy to share that we have decided to more than double the planned Chevrolet Equinox production at our Fairfax plant in Kansas, above and beyond what we announced earlier this year,” said Barra.

Click to enlarge.

New to AutoInformed in terms of liabilities at GM is warranty costs. “Looking ahead, our top priority as a leadership team remains returning North America to our historical 8% – 10% EBIT margins. To do this, we will continue to drive EV profitability improvements, maintain our overall production pricing and incentive discipline, manage our fixed costs, and further reduce our tariff exposure net of our self-help initiatives. In addition, cross-functional teams are attacking our warranty expense by addressing the root cause inside GM, at our suppliers, and at our dealerships. We are also executing plans to grow software and services like OnStar Super Cruise to generate even greater revenue during and after each vehicle sale. So far this year, we have recognized nearly $2 billion in revenue from OnStar Super Cruise, and other software services, and our deferred revenue was up 14% from Q2 to almost $5 billion,” said Barra.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

GM Posts Q3 Net of $1.3 Billion on $48.6B Revenue

Click to enlarge.

General Motors (NYSE: GM) today posted a Q3 2025 net income of $1.3 Billion down $700 million year-over-year on $48.6B in revenue. This included a gross tariff impact of $1.1 billion. GM offset more than 30% of this amount through what it said was go-to-market, footprint, and cost initiatives. It was a strong quarterly performance, but GM still faces major challenges in China, as well as problems dealing with Korea, Mexico and Canada via the upcoming re-negotiation of the North American Free Trade Agreement with the Trump Administration’s hostile to our northern neighbor. Nonetheless GM stock closed the day at $66.62, up $8.62 for a +14.86% gain.

“Thanks to the collective efforts of our team, and our compelling vehicle portfolio, GM delivered another very good quarter of earnings and free cash flow. In the U.S., we achieved our highest third-quarter market share since 2017 with strong margins, and our restructured China business was profitable once again. Based on our performance, we are raising our full-year guidance, underscoring our confidence in the company’s trajectory,” said Ceo and Chair Mary Barra.

“I also want to thank the President and his team for the important tariff updates they made on Friday. The MSRP offset program will help make U.S.-produced vehicles more competitive over the next five years, and GM is very well positioned as we invest to increase our already significant domestic sourcing and manufacturing footprint. Earlier this year, we announced $4 billion in capital investments to onshore production at plants in Tennessee, Kansas, and Michigan over the next two years. Once these investments come online, we plan to produce more than two million vehicles per year in the United States. We are also investing close to $1 billion to build a new generation of advanced, fuel-efficient V8 engines in New York. Importantly, we are maintaining our capital discipline while adding this production and creating new jobs,” said Barra.

It what can be described charitably as an evolving regulatory framework and the end of the federal consumer incentives, GM like all automakers is looking as a near-term EV adoption rates that will be much lower than planned. This inevitably raises variable costs as GM EV plants and its suppliers run at diminished capacity if they run at all. “By acting swiftly and decisively to address overcapacity, we expect to reduce EV losses in 2026 and beyond,” said Barra.

No surprise here at AutoInformed that Orion Assembly will convert from EV to Internal Combustion Engine (ICE) production. GM also sold its joint venture-owned battery cell plant in Michigan to LG Energy Solution. GM recorded a – gulp – $1.6 billion special item charge Q3 of $1.2 billion for non-cash impairments, most of which GM said are related to the Orion transition, reductions in battery module assembly capacity, as well as GM’s decision to stop development of next-generation hydrogen fuel cells. Also included were the write-off of CAFE credits and associated liabilities. “Today, I’m happy to share that we have decided to more than double the planned Chevrolet Equinox production at our Fairfax plant in Kansas, above and beyond what we announced earlier this year,” said Barra.

Click to enlarge.

New to AutoInformed in terms of liabilities at GM is warranty costs. “Looking ahead, our top priority as a leadership team remains returning North America to our historical 8% – 10% EBIT margins. To do this, we will continue to drive EV profitability improvements, maintain our overall production pricing and incentive discipline, manage our fixed costs, and further reduce our tariff exposure net of our self-help initiatives. In addition, cross-functional teams are attacking our warranty expense by addressing the root cause inside GM, at our suppliers, and at our dealerships. We are also executing plans to grow software and services like OnStar Super Cruise to generate even greater revenue during and after each vehicle sale. So far this year, we have recognized nearly $2 billion in revenue from OnStar Super Cruise, and other software services, and our deferred revenue was up 14% from Q2 to almost $5 billion,” said Barra.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.