Click to enlarge.

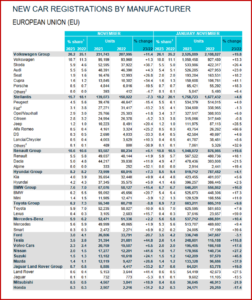

In November 2023, the EU’ car market grew by 6.7%, according to data just released by ACEA.* This was the sixteenth consecutive month of expansion. There were substantial double-digit gains in some markets, including two of the largest – Italy (+16.2%) and France (+14%).

However, the German car market retracted, recording a -5.7% decline compared to November 2022, which provided a small base line for comparison across the EU. Overall new car registrations were +6.7% in November; with a battery electric market share at 16.3%. Eleven months into 2023, new car registrations increased by 15.7%, reaching nearly ten million units. With the exception of Hungary, all EU markets grew during this eleven-month period. The four largest markets contributed to this trend: Italy (+20%), Spain (+17.3%), France (+16.2%), and Germany (+11.4%).

Click to enlarge.

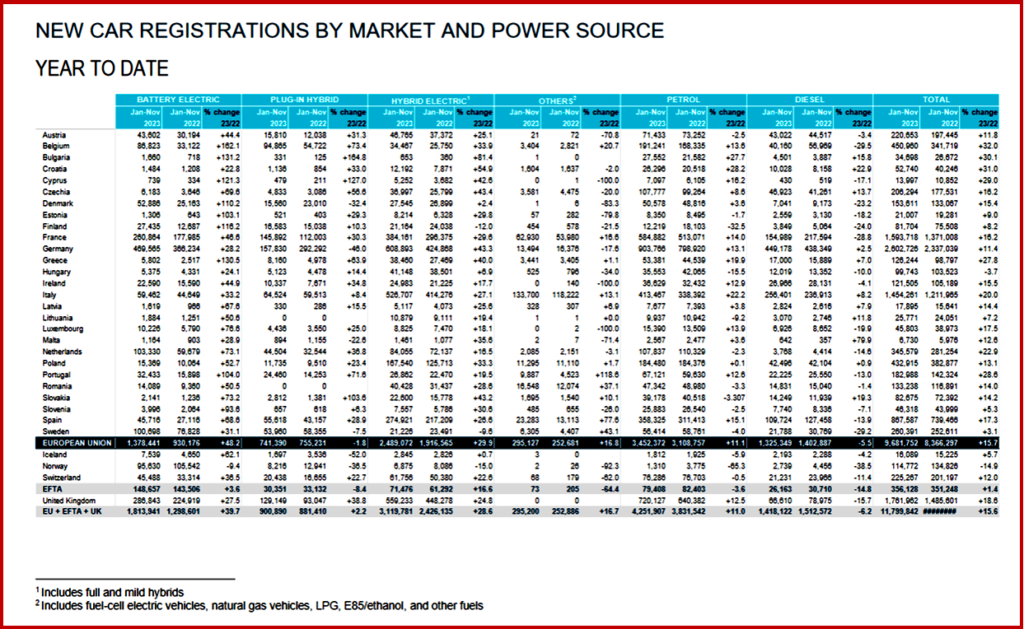

In November, new EU registrations of hybrid-electric cars ascended by 28.7%, driven by double-digit growth in the three largest markets: Germany (+38.4%), France (+35.8%), and Italy (+30.2%). This led to a cumulative 29.9% increase, reaching ~2.5 million units sold as of November –more than a quarter of the EU market share.

Diverging, sales of plug-in hybrid electric cars declined by 22.1% to 72,002 units last month. Despite notable increases in Belgium (+43.8%) and France (+17.8%), these gains were insufficient to offset Germany’s considerable decline (-59.3%), the largest market for this powertrain. Consequently, the market share of plug-in hybrid cars fell from 11.1% last year to 8.1% in November this year.

Gasoline and Diesel cars

In November 2023, the EU gasoline car market grew by 4.2%, despite a continual decline in market share, which stood at 32.7% in October. Key markets in Italy (+20.2%) and Germany (+12.5%) saw significant sales increases, contributing to this overall growth. This resulted in a cumulative volume of 3.5 million units sold, reflecting an 11.1% increase and a 35.7% market share over the eleven-month period.

Conversely, the EU diesel car market continued its downward plummet in November, contracting by 10.3%. This decline was observed in most of the trade bloc’s markets, including the four largest: France (-28.3%), Spain (-22.8%), Italy (-7.4%), and Germany (-1%). Despite this overall decline, diesel car sales grew in certain Central and Eastern European markets, such as Poland (+13.8%). In November, diesel cars represented a market share of 12.2%, down from 14.5% in the same month last year.

*ACEA: The European Automobile Manufacturers’ Association (ACEA) represents the 14 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group. Data source is ACEA, based on aggregated data provided by national automobile associations, ACEA members and S&P Global Mobility. Some of the interpretations are AutoInformed’s.

About the EU automobile industry

- 9 million Europeans work in the automotive sector.

- 3% of all manufacturing jobs in the EU.

- €392.2 billion in tax revenue for European governments.

- €101.9 billion trade surplus for the European Union.

- Over 7% of EU GDP generated by the auto industry.

- €59.1 billion in R&D spending annually, 31% of EU total.

Inevitable Footnotes

- ACEA estimation based on total by market

- Bentley, Bugatti, Lamborghini, and MAN

- Includes Abarth

- Dodge, Maserati, and RAM

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

November 2023 EU Car Market Grows on Mixed Results

Click to enlarge.

In November 2023, the EU’ car market grew by 6.7%, according to data just released by ACEA.* This was the sixteenth consecutive month of expansion. There were substantial double-digit gains in some markets, including two of the largest – Italy (+16.2%) and France (+14%).

However, the German car market retracted, recording a -5.7% decline compared to November 2022, which provided a small base line for comparison across the EU. Overall new car registrations were +6.7% in November; with a battery electric market share at 16.3%. Eleven months into 2023, new car registrations increased by 15.7%, reaching nearly ten million units. With the exception of Hungary, all EU markets grew during this eleven-month period. The four largest markets contributed to this trend: Italy (+20%), Spain (+17.3%), France (+16.2%), and Germany (+11.4%).

Click to enlarge.

In November, new EU registrations of hybrid-electric cars ascended by 28.7%, driven by double-digit growth in the three largest markets: Germany (+38.4%), France (+35.8%), and Italy (+30.2%). This led to a cumulative 29.9% increase, reaching ~2.5 million units sold as of November –more than a quarter of the EU market share.

Diverging, sales of plug-in hybrid electric cars declined by 22.1% to 72,002 units last month. Despite notable increases in Belgium (+43.8%) and France (+17.8%), these gains were insufficient to offset Germany’s considerable decline (-59.3%), the largest market for this powertrain. Consequently, the market share of plug-in hybrid cars fell from 11.1% last year to 8.1% in November this year.

Gasoline and Diesel cars

In November 2023, the EU gasoline car market grew by 4.2%, despite a continual decline in market share, which stood at 32.7% in October. Key markets in Italy (+20.2%) and Germany (+12.5%) saw significant sales increases, contributing to this overall growth. This resulted in a cumulative volume of 3.5 million units sold, reflecting an 11.1% increase and a 35.7% market share over the eleven-month period.

Conversely, the EU diesel car market continued its downward plummet in November, contracting by 10.3%. This decline was observed in most of the trade bloc’s markets, including the four largest: France (-28.3%), Spain (-22.8%), Italy (-7.4%), and Germany (-1%). Despite this overall decline, diesel car sales grew in certain Central and Eastern European markets, such as Poland (+13.8%). In November, diesel cars represented a market share of 12.2%, down from 14.5% in the same month last year.

*ACEA: The European Automobile Manufacturers’ Association (ACEA) represents the 14 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group. Data source is ACEA, based on aggregated data provided by national automobile associations, ACEA members and S&P Global Mobility. Some of the interpretations are AutoInformed’s.

About the EU automobile industry

Inevitable Footnotes

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.