Click to enlarge.

Stellantis N.V. (NYSE: STLA. STLAM.MI) on Friday announced a vast overhaul of its business and as it prepares for the communication of its new strategic plan in May of this year. In a release Stellanatis claimed that “it has conducted a thorough assessment of its strategy and related costs required to align the Company with the real-world preferences of its customers.” [Translation – STLA is hemorrhaging cash and will take charges and add debt while it tries to return to profitability. The capital markets did not take a wait and see view. STLA dropped ~24% by the time the markets closed – AutoCrat]

“The reset we have announced today is part of the decisive process we started in 2025, to once again make our customers and their preferences our guiding star,” said Stellantis CEO Antonio Filosa. “The charges announced today largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires. They also reflect the impact of previous poor operational execution, the effects of which are being progressively addressed by our new team”

“We have gone deep into every corner of our business and are making the necessary changes, mobilizing all the passion and ingenuity we have within Stellantis. The positive customer reception to our product actions in 2025 resulted in increased orders and a return to top-line growth. In 2026, our unwavering focus is on closing past execution gaps to add further momentum to these early signs of renewed growth. We look forward to sharing the full details of our new strategy at our Investor Day on May 21,” said Filosa.

Initial actions taken in 2025 to reset Stellantis and catalyze growth include:

The announcement of the largest investment in Stellantis’ U.S. history:

- $13 billion of investment over the next 4 years to drive growth in the U.S.

- Introducing 5 new vehicles and initiating 19 other product actions

- Adding more than 5000 jobs and increasing U.S. manufacturing capacity utilization

Launching 10 all-new products in 2025, and expanding powertrain choices, including:

- Returning the iconic HEMI® V-8 to the Ram 1500

- Returning the Jeep® Cherokee and introducing the next generation Jeep® Compass

- Introducing the Dodge Charger SIXPACK two-door

- Introducing the Fiat Grande Panda and Fiat 500 Hybrid

- Introducing the Citroën C3 Aircross and C5 Aircross

The cancellation of products that will be unable to achieve profitable scale, including the previously planned Ram 1500 BEV, recognizing both the need to align with customer demand and the changes to U.S. regulatory frameworks.

- A thorough reorganization of the Company’s global manufacturing and quality management processes. STLA hired more than 2000 engineers during 2025, mainly in North America.

“Decisive organizational changes made include the re-empowerment of regional teams, freeing them to make decisions based on their direct knowledge of the preferences of the customers they serve. The Company has also moved to create a more cost-efficient supply chain to support the long-term development of Stellantis’ electrified vehicle programs. The important product actions taken during 2025, which continue to roll out in 2026, and the disciplined allocation of capital to support these, reflect the new team’s determination to drive profitable growth,” Stellantis said.

Claimed Early Benefits of Actions Taken in 2025

- The effectiveness of these initial measures is evidenced by Stellantis’ return to positive volume growth. H2 2025 Consolidated Shipment volume of 2.8 million units increased by 277 thousand, or +11% year-over-year. North America contributed most strongly to the growth (+39%), benefiting from both improved inventory management and higher sales, while Enlarged Europe, South America, Middle East & Africa, and China and India & Asia Pacific each also contributed year-over-year volume gains.

- Market share in the U.S. at 7.9% for H2 2025 was 60 basis points higher sequentially. In Enlarged Europe, Stellantis retained its overall #2 market share position and was also the leader in the all-hybrids segment, in the passenger car B-segment and in the LCV market. Customer order intake in Enlarged Europe increased throughout the year, with notable acceleration in H2 2025 (+13% y-o-y) with Q4 2025 orders up 23% y-o-y.

- The renewed focus, improved methods and enlarged engineering staff committed to quality management are already seeing encouraging early results. For example, the number of issues reported for vehicles in their first month of service decreased over 50% in North America, and over 30% in Enlarged Europe since the beginning of 2025.

Click for more.

This reset of Stellantis’ business resulted in charges of approximately €22.2 billion, excluded from AOI, for the second half of 2025, including cash payments of approximately €6.5 billion, which are expected to be paid over the next four years.

- €14.7 billion related to re-aligning product plans with customer preferences and new emission regulations in the U.S., largely reflecting significantly reduced expectations for BEV products:

- Includes write-offs related to cancelled products of €2.9 billion and impairment of platforms of €6.0 billion, primarily due to significantly reduced volume and profitability expectations.

- Includes approximately €5.8 billion in projected cash payments over the next four years, relating to both cancelled products as well as other ongoing BEV products whose volumes are now expected to be considerably below prior projections.

- €2.1 billion related to the resizing of the EV supply chain:

- €2.1 billion of charges, including a total of approximately €0.7 billion in cash payments expected to be paid over the next four years, related to steps of rationalizing battery manufacturing capacity.

- €5.4 billion related to other changes in the Company’s operations:

- €4.1 billion due to a change in estimate for contractual warranty provision, resulting from the reassessment of the estimation process, taking into account recent increases in cost inflation and a deterioration in quality, as a result of operational choices, which did not deliver the expected quality performance, now being reversed by the new management team.

- €1.3 billion of other charges, including restructuring primarily related to already communicated workforce reductions in Enlarged Europe.

“The Company has taken the vast majority of decisions required to correct direction, particularly related to aligning our product plans and portfolio with market demand, which are reflected in the amounts accrued.

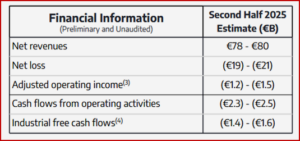

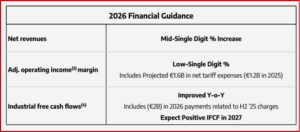

Preliminary financial information for the Second Half 2025 (1): Second half 2025 Net revenues and Industrial free cash flows improved compared to the first half of 2025, consistent with the Company’s latest financial guidance. However, results were negatively impacted by specific items, including the change in estimate for contractual warranties, and other items, resulting in AOI margin for the second half of 2025 finishing below the guided low-single digit range.

Inevitable STLA Footnotes

- Final figures will be provided in our H2 2025 Results. Analysts should interpret these numbers with the understanding that they are preliminary and subject to change.

- Adjusted Operating Income/(Loss) excludes from Net profit/(loss) adjustments comprising restructuring and other termination costs, impairments, asset write-offs, disposals of investments and unusual operating income/(expense) that are considered rare or discrete events and are infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance, and also excludes Net financial expenses/(income) and Tax expense/(benefit).

Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.

- Adjusted Operating Income/(Loss) Margin is calculated as Adjusted operating income/(loss) divided by Net revenues.

- Industrial Free Cash Flows is our key cash flow metric and is calculated as Cash flows from operating activities less: (i) cash flows from operating activities from discontinued operations; (ii) cash flows from operating activities related to financial services, net of eliminations; (iii) investments in property, plant and equipment and intangible assets for industrial activities, (iv) contributions of equity to joint ventures and minor acquisitions of consolidated subsidiaries and equity method and other investments; and adjusted for: (i) net inter-company payments between continuing operations and discontinued operations; (ii) proceeds from disposal of assets and (iii) contributions to defined benefit pension plans, net of tax. The timing of Industrial free cash flows may be affected by the timing of monetization of receivables, factoring and the payment of accounts payables, as well as changes in other components of working capital, which can vary from period to period due to, among other things, cash management initiatives and other factors, some of which may be outside of the Company’s control. In addition Industrial free cash flows is one of the metrics used in the determination of the annual performance for eligible employees, including members of the Senior Management.

Industrial available liquidity is calculated as total cash, cash equivalents and financial securities plus undrawn committed credit lines available to Industrial activities.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Stellantis €22.2B Charges. Dividend Cancelled. Stock Tanks

Click to enlarge.

Stellantis N.V. (NYSE: STLA. STLAM.MI) on Friday announced a vast overhaul of its business and as it prepares for the communication of its new strategic plan in May of this year. In a release Stellanatis claimed that “it has conducted a thorough assessment of its strategy and related costs required to align the Company with the real-world preferences of its customers.” [Translation – STLA is hemorrhaging cash and will take charges and add debt while it tries to return to profitability. The capital markets did not take a wait and see view. STLA dropped ~24% by the time the markets closed – AutoCrat]

“The reset we have announced today is part of the decisive process we started in 2025, to once again make our customers and their preferences our guiding star,” said Stellantis CEO Antonio Filosa. “The charges announced today largely reflect the cost of over-estimating the pace of the energy transition that distanced us from many car buyers’ real-world needs, means and desires. They also reflect the impact of previous poor operational execution, the effects of which are being progressively addressed by our new team”

“We have gone deep into every corner of our business and are making the necessary changes, mobilizing all the passion and ingenuity we have within Stellantis. The positive customer reception to our product actions in 2025 resulted in increased orders and a return to top-line growth. In 2026, our unwavering focus is on closing past execution gaps to add further momentum to these early signs of renewed growth. We look forward to sharing the full details of our new strategy at our Investor Day on May 21,” said Filosa.

Initial actions taken in 2025 to reset Stellantis and catalyze growth include:

The announcement of the largest investment in Stellantis’ U.S. history:

Launching 10 all-new products in 2025, and expanding powertrain choices, including:

The cancellation of products that will be unable to achieve profitable scale, including the previously planned Ram 1500 BEV, recognizing both the need to align with customer demand and the changes to U.S. regulatory frameworks.

“Decisive organizational changes made include the re-empowerment of regional teams, freeing them to make decisions based on their direct knowledge of the preferences of the customers they serve. The Company has also moved to create a more cost-efficient supply chain to support the long-term development of Stellantis’ electrified vehicle programs. The important product actions taken during 2025, which continue to roll out in 2026, and the disciplined allocation of capital to support these, reflect the new team’s determination to drive profitable growth,” Stellantis said.

Claimed Early Benefits of Actions Taken in 2025

Click for more.

This reset of Stellantis’ business resulted in charges of approximately €22.2 billion, excluded from AOI, for the second half of 2025, including cash payments of approximately €6.5 billion, which are expected to be paid over the next four years.

“The Company has taken the vast majority of decisions required to correct direction, particularly related to aligning our product plans and portfolio with market demand, which are reflected in the amounts accrued.

Preliminary financial information for the Second Half 2025 (1): Second half 2025 Net revenues and Industrial free cash flows improved compared to the first half of 2025, consistent with the Company’s latest financial guidance. However, results were negatively impacted by specific items, including the change in estimate for contractual warranties, and other items, resulting in AOI margin for the second half of 2025 finishing below the guided low-single digit range.

Inevitable STLA Footnotes

Unusual operating income/(expense) are impacts from strategic decisions, as well as events considered rare or discrete and infrequent in nature, as inclusion of such items is not considered to be indicative of the Company’s ongoing operating performance. Unusual operating income/(expense) includes, but may not be limited to: impacts from strategic decisions to rationalize Stellantis’ core operations; facility-related costs stemming from Stellantis’ plans to match production capacity and cost structure to market demand, and convergence and integration costs directly related to significant acquisitions or mergers.

Industrial available liquidity is calculated as total cash, cash equivalents and financial securities plus undrawn committed credit lines available to Industrial activities.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.