Click to enlarge.

The experts at Cox Automotive said today that the U.S. Automotive forecast for 2025 is likely positive with what they termed the Goldilocks economy – not too hot nor too cold but just right. (AutoInformed.com on: Trump Presidency Effects on Auto Industry – All Bad?; Trump’s Losing Trade Wars – Auto and Other Deficits Grow)

“Instead of a slowing economy, we have a stabilizing economy and most importantly, a stabilizing labor market,” said the estimable Jonathon Smoke, Cox Automotive chief economist. “We can stop fretting about a soft landing and acknowledge we’ve navigated restrictive rates, slowing job growth and increasing unemployment. But as we end 2024, momentum is back on our side. And the labor market is expected to remain at full employment,” said Smoke.

“With the Election we took a major negative off the table in the prospect of higher tax rates slowing the economy in the future, and while the exact new tax policy is yet to be determined, measures of consumer and business sentiment have strengthened. Perhaps most importantly for the vehicle market, we’re seeing credit access improve as well. Incomes are higher. Prices of used vehicles are lower. New vehicle incentives have risen and loan approval rates are up, “said Smoke.

This psychology shift in sentiment as AutoInformed interprets it means that it’s now a bigger gamble to expect prices and rates to be lower in the future. Given Trump’s shoot from the lip on inflation and tariff policy – both could easily be higher or much higher by the end of 2025.

Smoke put it thus: “The risks are all related to policy shifts. Let me summarize the major ones for auto:

- A new tax bill will lock in 2017’s tax cuts and maybe more. The IRA could be reduced or eliminated as part of that.

- Fuel efficiency stands in tailpipe emission targets could be reduced.

- Immigration could be restricted and deportations could shrink the labor supply and tariffs could be lathered on disrupting the North American trading region that has enjoyed free trade for 30 years and breaking a truly global industry – sending new and used vehicle prices higher overnight.

“None of this has to happen,” said Smoke, “ and we think most will take time to come to fruition… We hope for the best. So let’s look at the major macro factors. As we end 2024. Real GDP growth slowed only modestly, and again we’ve seen performance that has been better than originally forecasted. The third quarter saw robust growth of 2.8% and the fourth quarter is likely to be at worst at potential for the US economy.

“Growth next year should be similar, and that’s not too hot, not too cold, but just right. Again, the labor market appears to be stable. We came down from a peak in the unemployment rate of 4.3% back in July and we expect to stay where we are or slightly lower in the year ahead. We haven’t proven we will stick to landing at 4.2 percent or lower, but I think we will… This is sustainable without producing inflation. If we continue to see strong productivity growth like we’ve been enjoying this year at this level and the level of inflation, it means the typical consumer continues to enjoy real wage growth. Disposable income growth has stabilized as a result,” said Smoke. [AutoInformed notes the Federal Reserve will make an interest rate decision tomorrow, which will directly affect auto loan rates. Revision to original story follows.]

“The Federal Reserve cut the Fed Funds Rate by another quarter point (~4.4%) but scaled back their outlook for additional cuts. Rate policy is now expected to move only a half point in 2025 (~3.9%), which is half of what they projected just three months ago. This decision signals a data-driven approach, not influenced by speculation about Trump administration policies,” said Chief Economist Jonathan Smoke on Wednesday 18 December.

“Importantly, the announcement today also signals that the Fed is fading into the background while other factors take center stage for the economy and the auto market. In 2025, when it comes to news that impacts the auto business, we’re expecting more influence to come from the halls of Congress and the Oval Office and less from what is decided in the Board Room of the Federal Reserve. We, for one, are glad to see the Fed move off center stage,” said Smoke on Wednesday.

Electric Vehicles

Click to Enlarge.

“As we delve into the broader electrification trends, it’s important to recognize the significant role that alternative power trains play in this,” said Stephanie Valdez Streaty, Director, Industry Insights at Cox. “These vehicles not only offer consumers more options, but also serve as a crucial gateway to pure electrification. In Q3 of 2024, alternative power trains made-up a record 20% of sales, up 1.7% from the previous month, year-over-year. Gas hybrid saw the biggest gain in the third quarter 18% volume growth. While plug ins hybrids were down 8 percent.”

Key Points on EVs

“In the gas hybrid market, Toyota leads and share with Hyundai seeing the biggest gain at one percentage point in the plug in market. Jeep and Toyota are leading with Kia achieving the largest gain at 2 percentage points. We’ve seen shifts in product pipelines as automakers respond to consumer demand for more hybrid vehicles and prepare for potential changes to emission regulations,” said Valdez Streaty.

- Looking ahead to 2025, we expect continued growth in alternative power trains reaching one out of four in sales.

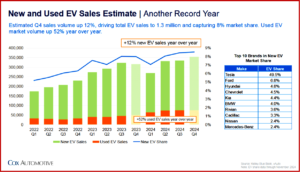

- Moving on to new EV sales, 2024 was definitely a year of more sales despite some bumps along the way and more to come while some new electric models flew off the lots. Others linger longer.

- The EV market continued to grow. We estimate a 12% increase in the fourth quarter over the prior year with an estimated 356,000 EV sold. This leads to a record year with approximately 1.3 million electric vehicles sold. Making up roughly 8% of all new sales, that will be a 7% year over year growth.

- We’ve seen shifts in the market share this year. The top three manufacturers are Tesla, Hyundai Motor Group and General Motors, with GM having the largest increase in market share year over year at 2.7%.

- At the brand level, even though Tesla’s market share has declined below 50%, the Model Y and Model 3 continue to hold the top two spots. Various other models are collectively taking away share from Tesla.

- In 2025, new EV sales will continue to rise, with market are expected to tip over 10%. The introduction of new models and charging infrastructure and advancements in battery technology will help drive this continued adoption.”

Overall Outlook

“The SAAR or seasonally adjusted selling rate in December is forecast to be 16.5 million….just since October, the sales pace has shifted to a higher gear,” said Charlie Chesbrough, Senior Economist at COX. This Q4 quarter is expected to be a SAAR of 16.4 million, up over 5% from Q 3 at the 15.6 million level – and a strongest quarterly pace since the spring of 2021. For the year, vehicle sales are now expected finish above 15.18 units or over 2% higher than last year. And a bit higher than the 15.7 million forecast we shared at this briefing last January.”

The 2025 Question

“One key question for the market is whether the recent sales gains reflect true changes in consumer vehicle demand and a slight improvement vehicle affordability, or is the market looking at a Trump bump -a surge in election activity that will dissipate quickly? Only time tell. So new vehicle sales will finish 100,000 units better than last year, but the gains come from some very specific sources among them is that in the market today, more affordable sells,” said Chesbrough.

“Looking at sales by our Kelley Blue Book data shows the gains this year retail leasing are up 19% over last year. The $7500 battery electric credit having significant impact, as many name plates are utilizing the subsidy to create low lease offers and clearly vehicle buyers are responding.

“The biggest channel decline this year comes from retail purchasing down nearly 5%, high interest rates and high prices are a major headwind to stronger sales – resulting high monthly payments are out of reach for many buyers. Looking at sales by Powertrain, Battery, Electric and plug in EVs are having strong gains, but traditional hybrids are up 26%. Internal combustion engines (ICE) will finish down nearly 2%. Savings and environmental concerns are having some impact on what consumers are buying, as HEVs don’t qualify for battery electric credits. So federal subsidies aren’t contributing to their success.”

“The consumers preference for affordability becomes less clear when looking at product segment performance this year. The top 10 less expensive vehicle segments which represent 86% of the total. We can see sub compact SUV, compact SUV and compact car having the largest market share gains in 2024 with a combined increased total share by over 2%. What products lost share- SUV, mid-size car and full size pickups combined lost nearly 1.4% market. Segments, not incidentally, that also had the lowest share. The average asking price of the Top 3 share gainers is $33,570 or $21,000 less than the bottom 3. … The sales winner in 2021 is General Motors. Their sales are expected to finish near 2.7 million units, up over 4% from last year and twice the national average. Both Buick and Cadillac saw double digit gains this year, but Chevy TRAX had the biggest volume increase and that, not coincidentally, it is also lowest price product.

If we measure success by higher market share. Honda is the big winner this year, they moved ahead of Stellantis into the top five selling US OEM. Honda gained half a point of share thanks to 20% plus sales increases from HRV and Civic, which are the two lowest priced vehicles in their portfolio. 2024…

Stellantis sales are expected to finish the year down 15% from last year, causing a loss of 1.6% market share, every brand in their portfolio of the year with negative sales growth. Tesla also had a challenging 2024. Their sales are expected to reach down over 6% for the year. The first decline in a decade – leading. To a -3% decline [ck] in market share. Increasing EV competition from traditional OEMs has taken a toll on OEMs on Tesla’s performance, and 2025 is likely to be more of the same. So a big story.

Product supply was a major issue for the auto industry in the early post COVID years. The inventory crunch is now in the rearview mirror. Supply has been consistently improving for nearly three years straight, and it is now at the highest point since May of 2020. Nationally, the availability of vehicles on dealer lots is back to pre-COVID levels of over 3 million units and it is trending even higher.

However, does the market have the right amount of inventory? Nationally, average days of supply stands at 89 days, nearly three months of inventory. However, days of supply vary substantially across the brands…. the Jeep brand has 120 plus days of supply. BMW, Honda and Toyota have inventory levels well below the national average. These differences are having an impact on vehicle pricing, with heavy discounting expected from high inventory brands and less discounting from those brands with tighter inventory levels. Of 24 the brands in a market returning to pre-COVID levels. The return of inventory has brought the return of incentives, and affordability is now improving. The transaction price prior to COVID had an incentive that was generally 10 to 11% of the transaction price. However, this tightened in the post COVID lean inventory market, reaching a bottom of just 2% in the fall of 2022. But as supply has grown over the last few years, so has discounting rising to 8% of the transaction price – suggesting that prices are moving towards the buyer’s favor. So affordability is improving in the marketplace and trend line suggests it may have further to go in 2025,”said Chesbrough.

US Auto Sales Forecast Trump Bump or Bumpy 25?

Click to enlarge.

The experts at Cox Automotive said today that the U.S. Automotive forecast for 2025 is likely positive with what they termed the Goldilocks economy – not too hot nor too cold but just right. (AutoInformed.com on: Trump Presidency Effects on Auto Industry – All Bad?; Trump’s Losing Trade Wars – Auto and Other Deficits Grow)

“Instead of a slowing economy, we have a stabilizing economy and most importantly, a stabilizing labor market,” said the estimable Jonathon Smoke, Cox Automotive chief economist. “We can stop fretting about a soft landing and acknowledge we’ve navigated restrictive rates, slowing job growth and increasing unemployment. But as we end 2024, momentum is back on our side. And the labor market is expected to remain at full employment,” said Smoke.

“With the Election we took a major negative off the table in the prospect of higher tax rates slowing the economy in the future, and while the exact new tax policy is yet to be determined, measures of consumer and business sentiment have strengthened. Perhaps most importantly for the vehicle market, we’re seeing credit access improve as well. Incomes are higher. Prices of used vehicles are lower. New vehicle incentives have risen and loan approval rates are up, “said Smoke.

This psychology shift in sentiment as AutoInformed interprets it means that it’s now a bigger gamble to expect prices and rates to be lower in the future. Given Trump’s shoot from the lip on inflation and tariff policy – both could easily be higher or much higher by the end of 2025.

Smoke put it thus: “The risks are all related to policy shifts. Let me summarize the major ones for auto:

“None of this has to happen,” said Smoke, “ and we think most will take time to come to fruition… We hope for the best. So let’s look at the major macro factors. As we end 2024. Real GDP growth slowed only modestly, and again we’ve seen performance that has been better than originally forecasted. The third quarter saw robust growth of 2.8% and the fourth quarter is likely to be at worst at potential for the US economy.

“Growth next year should be similar, and that’s not too hot, not too cold, but just right. Again, the labor market appears to be stable. We came down from a peak in the unemployment rate of 4.3% back in July and we expect to stay where we are or slightly lower in the year ahead. We haven’t proven we will stick to landing at 4.2 percent or lower, but I think we will… This is sustainable without producing inflation. If we continue to see strong productivity growth like we’ve been enjoying this year at this level and the level of inflation, it means the typical consumer continues to enjoy real wage growth. Disposable income growth has stabilized as a result,” said Smoke. [AutoInformed notes the Federal Reserve will make an interest rate decision tomorrow, which will directly affect auto loan rates. Revision to original story follows.]

“The Federal Reserve cut the Fed Funds Rate by another quarter point (~4.4%) but scaled back their outlook for additional cuts. Rate policy is now expected to move only a half point in 2025 (~3.9%), which is half of what they projected just three months ago. This decision signals a data-driven approach, not influenced by speculation about Trump administration policies,” said Chief Economist Jonathan Smoke on Wednesday 18 December.

“Importantly, the announcement today also signals that the Fed is fading into the background while other factors take center stage for the economy and the auto market. In 2025, when it comes to news that impacts the auto business, we’re expecting more influence to come from the halls of Congress and the Oval Office and less from what is decided in the Board Room of the Federal Reserve. We, for one, are glad to see the Fed move off center stage,” said Smoke on Wednesday.

Electric Vehicles

Click to Enlarge.

“As we delve into the broader electrification trends, it’s important to recognize the significant role that alternative power trains play in this,” said Stephanie Valdez Streaty, Director, Industry Insights at Cox. “These vehicles not only offer consumers more options, but also serve as a crucial gateway to pure electrification. In Q3 of 2024, alternative power trains made-up a record 20% of sales, up 1.7% from the previous month, year-over-year. Gas hybrid saw the biggest gain in the third quarter 18% volume growth. While plug ins hybrids were down 8 percent.”

Key Points on EVs

“In the gas hybrid market, Toyota leads and share with Hyundai seeing the biggest gain at one percentage point in the plug in market. Jeep and Toyota are leading with Kia achieving the largest gain at 2 percentage points. We’ve seen shifts in product pipelines as automakers respond to consumer demand for more hybrid vehicles and prepare for potential changes to emission regulations,” said Valdez Streaty.

Overall Outlook

“The SAAR or seasonally adjusted selling rate in December is forecast to be 16.5 million….just since October, the sales pace has shifted to a higher gear,” said Charlie Chesbrough, Senior Economist at COX. This Q4 quarter is expected to be a SAAR of 16.4 million, up over 5% from Q 3 at the 15.6 million level – and a strongest quarterly pace since the spring of 2021. For the year, vehicle sales are now expected finish above 15.18 units or over 2% higher than last year. And a bit higher than the 15.7 million forecast we shared at this briefing last January.”

The 2025 Question

“One key question for the market is whether the recent sales gains reflect true changes in consumer vehicle demand and a slight improvement vehicle affordability, or is the market looking at a Trump bump -a surge in election activity that will dissipate quickly? Only time tell. So new vehicle sales will finish 100,000 units better than last year, but the gains come from some very specific sources among them is that in the market today, more affordable sells,” said Chesbrough.

“Looking at sales by our Kelley Blue Book data shows the gains this year retail leasing are up 19% over last year. The $7500 battery electric credit having significant impact, as many name plates are utilizing the subsidy to create low lease offers and clearly vehicle buyers are responding.

“The biggest channel decline this year comes from retail purchasing down nearly 5%, high interest rates and high prices are a major headwind to stronger sales – resulting high monthly payments are out of reach for many buyers. Looking at sales by Powertrain, Battery, Electric and plug in EVs are having strong gains, but traditional hybrids are up 26%. Internal combustion engines (ICE) will finish down nearly 2%. Savings and environmental concerns are having some impact on what consumers are buying, as HEVs don’t qualify for battery electric credits. So federal subsidies aren’t contributing to their success.”

“The consumers preference for affordability becomes less clear when looking at product segment performance this year. The top 10 less expensive vehicle segments which represent 86% of the total. We can see sub compact SUV, compact SUV and compact car having the largest market share gains in 2024 with a combined increased total share by over 2%. What products lost share- SUV, mid-size car and full size pickups combined lost nearly 1.4% market. Segments, not incidentally, that also had the lowest share. The average asking price of the Top 3 share gainers is $33,570 or $21,000 less than the bottom 3. … The sales winner in 2021 is General Motors. Their sales are expected to finish near 2.7 million units, up over 4% from last year and twice the national average. Both Buick and Cadillac saw double digit gains this year, but Chevy TRAX had the biggest volume increase and that, not coincidentally, it is also lowest price product.

If we measure success by higher market share. Honda is the big winner this year, they moved ahead of Stellantis into the top five selling US OEM. Honda gained half a point of share thanks to 20% plus sales increases from HRV and Civic, which are the two lowest priced vehicles in their portfolio. 2024…

Stellantis sales are expected to finish the year down 15% from last year, causing a loss of 1.6% market share, every brand in their portfolio of the year with negative sales growth. Tesla also had a challenging 2024. Their sales are expected to reach down over 6% for the year. The first decline in a decade – leading. To a -3% decline [ck] in market share. Increasing EV competition from traditional OEMs has taken a toll on OEMs on Tesla’s performance, and 2025 is likely to be more of the same. So a big story.

Product supply was a major issue for the auto industry in the early post COVID years. The inventory crunch is now in the rearview mirror. Supply has been consistently improving for nearly three years straight, and it is now at the highest point since May of 2020. Nationally, the availability of vehicles on dealer lots is back to pre-COVID levels of over 3 million units and it is trending even higher.

However, does the market have the right amount of inventory? Nationally, average days of supply stands at 89 days, nearly three months of inventory. However, days of supply vary substantially across the brands…. the Jeep brand has 120 plus days of supply. BMW, Honda and Toyota have inventory levels well below the national average. These differences are having an impact on vehicle pricing, with heavy discounting expected from high inventory brands and less discounting from those brands with tighter inventory levels. Of 24 the brands in a market returning to pre-COVID levels. The return of inventory has brought the return of incentives, and affordability is now improving. The transaction price prior to COVID had an incentive that was generally 10 to 11% of the transaction price. However, this tightened in the post COVID lean inventory market, reaching a bottom of just 2% in the fall of 2022. But as supply has grown over the last few years, so has discounting rising to 8% of the transaction price – suggesting that prices are moving towards the buyer’s favor. So affordability is improving in the marketplace and trend line suggests it may have further to go in 2025,”said Chesbrough.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.