Click for more.

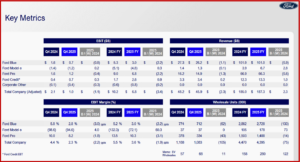

Ford Motor Co. (NYSE: F) today announced its disappointing Q4 and full-year 2025 financial results. Q4 and full-year revenue reached $45.9 billion and $187.3 billion, respectively. This was the fifth consecutive year of full-year revenue growth. However, Q4 and full-year net losses of $11.1 billion and $8.2 billion, respectively, reflected impact of special items, some of them such as Trump tariff chaos and a shortage of aluminum because of a supplier fire were largely out of Ford management’s control.*

“Ford delivered a strong 2025 in a dynamic and often volatile environment,” claimed Jim Farley, Ford president and CEO. “We improved our core business and execution, made significant progress in the areas of the business we control – lowering material and warranty costs and making real progress on quality – and made difficult but critical strategic decisions that set us up for a stronger future. Moving forward, we’ll continue building on our strong foundation to achieve our target of 8% adjusted EBIT margin by 2029.”

Ford Earnings at a Glance

- During 2025, Ford Pro generated more than $66 billion of revenue, with EBIT of $6.8 billion and a double-digit margin. In the U.S., Transit vans had record volume and Super Duty pickups had the best volume year since 2004, up 10%. Ford Pro paid software subscriptions grew by 30% in 2025.

- Ford Model e reported a full-year EBIT loss of $4.8 billion, a tiny $0.3 billion improvement compared to 2024. “The segment continues to focus on improving structural costs and delivering next-generation affordable, high-volume vehicles.

- “Ford Blue delivered $3.0 billion in EBIT for the year, with full-year revenue flat at $101 billion as higher pricing and a strong product lineup offset a 5% decline in wholesales. In the U.S., F-150 and Maverick were the two best-selling hybrid pickup trucks, Bronco had record sales, and Explorer was the best-selling three-row SUV.

- “Ford Credit delivered full-year earnings before taxes (EBT) of $2.6 billion, a 55% increase for the year,” Ford said in a release.

Full-Year 2026 Outlook

For full-year 2026, Ford anticipates company adjusted EBIT of $8.0 billion to $10.0 billion; adjusted free cash flow of $5.0 billion to $6.0 billion; and capital expenditures of $9.5 billion to $10.5 billion, including around $1.5 billion to begin ramping Ford Energy.At the segment level, the EBIT outlook for Ford Pro is $6.5 billion to $7.5 billion; Ford Blue is $4.0 billion to $4.5 billion; and a loss of $4.0 billion to $4.5 billion for Ford Model e. Ford Credit EBT is expected to be about $2.5 billion. Ford plans to report first-quarter 2026 financial results after the close of market on April 28.

“Improvements in our industrial system, a robust product roadmap that leverages our core strengths, and a disciplined approach to capital efficiency will drive even stronger results in 2026 and beyond. We remain relentlessly focused on three key levers to improve margins: improvements in EVs, highly accretive anti-cyclical businesses that grow and change our risk profile and next generation core products,” said Ford CFO Sherry House.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Posts 2025 Loss of $8.2B on Record Revenue

Click for more.

Ford Motor Co. (NYSE: F) today announced its disappointing Q4 and full-year 2025 financial results. Q4 and full-year revenue reached $45.9 billion and $187.3 billion, respectively. This was the fifth consecutive year of full-year revenue growth. However, Q4 and full-year net losses of $11.1 billion and $8.2 billion, respectively, reflected impact of special items, some of them such as Trump tariff chaos and a shortage of aluminum because of a supplier fire were largely out of Ford management’s control.*

“Ford delivered a strong 2025 in a dynamic and often volatile environment,” claimed Jim Farley, Ford president and CEO. “We improved our core business and execution, made significant progress in the areas of the business we control – lowering material and warranty costs and making real progress on quality – and made difficult but critical strategic decisions that set us up for a stronger future. Moving forward, we’ll continue building on our strong foundation to achieve our target of 8% adjusted EBIT margin by 2029.”

Ford Earnings at a Glance

Full-Year 2026 Outlook

For full-year 2026, Ford anticipates company adjusted EBIT of $8.0 billion to $10.0 billion; adjusted free cash flow of $5.0 billion to $6.0 billion; and capital expenditures of $9.5 billion to $10.5 billion, including around $1.5 billion to begin ramping Ford Energy.At the segment level, the EBIT outlook for Ford Pro is $6.5 billion to $7.5 billion; Ford Blue is $4.0 billion to $4.5 billion; and a loss of $4.0 billion to $4.5 billion for Ford Model e. Ford Credit EBT is expected to be about $2.5 billion. Ford plans to report first-quarter 2026 financial results after the close of market on April 28.

“Improvements in our industrial system, a robust product roadmap that leverages our core strengths, and a disciplined approach to capital efficiency will drive even stronger results in 2026 and beyond. We remain relentlessly focused on three key levers to improve margins: improvements in EVs, highly accretive anti-cyclical businesses that grow and change our risk profile and next generation core products,” said Ford CFO Sherry House.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.