Click to enlarge.

Electrify America President and CEO Giovanni Palazzo, the keynote speaker at AutoMobility LA, claims that mobility will experience a major boost by 2025 when hundreds of new electric vehicle models will enter the U. S. transportation grid. Publicly available, fast charging services will be in high demand in theory.

However, industry observers note that there isn’t a clear focus in the U.S. to create an open electric vehicle charging network. In fact, the grid is to varying degrees populated by self-interested players in for a buck – as in charges via fees – and not necessarily for creating or sustaining potential consumer demands and expectations for convenience, reliability and speed. It’s true that these might ultimately become benefits, but one need only recall Enron* and its history with utility companies and how that worked out for consumers to be wary.

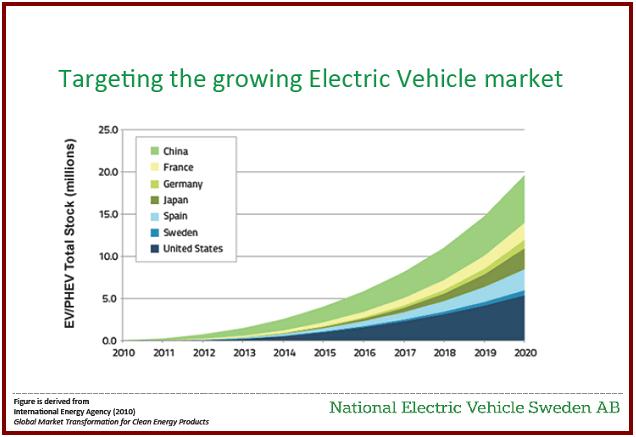

Sales projections continue to show steep rises in electrified vehicles, despite slow sales.

“With the next generation of EVs featuring faster charging speeds, we all need to be focused on the development of a comprehensive and open ultra-fast EV charging network,” urged Palazzo, whose firm is owned by Volkswagen Group, so it too has some self-interest in utility regulation and how it is accomplished. The fact is we all, including AutoInformed, have an interest in effective national regulation free from the manipulation of special interests since clean air and mobility are in the national interest, if not needed for national survival.

For its part, Electrify America is investing $2 billion in an EV charging infrastructure, access and education programs across America as it expands its nationwide charging network, arguably the largest commitment of its kind to date. Electrify America selected four key charging equipment suppliers – ABB, BTC Power, Efacec and Signet – to jointly deploy its new ultra-fast electric vehicle (EV) charging systems throughout the United States. The charging equipment suppliers are sharing the delivery of more than 2,000 chargers across 484 stations in the U.S. Electrify America’s ultra-fast charging systems utilize both HUBER+SUHNER and ITT Cannon high power charging (HPC) systems which have a much smaller cable cross section than the traditional high-powered cable option because they are liquid cooled.

Electrify America plans to have more than 484 ultra-fast EV charging sites with more than 2,000 DC fast chargers installed or under construction by June 2019. The company also is installing more than 2,800 Level 2 chargers at more than 400 community-based sites such as multi-unit dwellings and work-place locations nationwide.

Electrify America’s nationwide DC fast charging stations will be in 17 metropolitan areas and along high-traffic corridors in 42 states, including two cross-country routes.

The charging stations will have charging levels that range from 50 kilowatts (kW) up to 350kW – the latter capable of adding up to 20 miles of range per minute to a vehicle. (Your mileage may vary depending on what you drive and how you drive – editor)

Nationally, each planned charging station site will be located no more than 120 miles apart. Planned locations average only 70 miles apart.

*Senator Phil Gramm, Republican Deregulation Parasite and the Enron Corruption Scandal

Senator Phil Gramm, the corrupt husband of Enron Board member Wendy Gramm was the second largest beneficiary of campaign contributions from Enron, Gram was instrumental in forcing the legislation of California’s energy commodity trading deregulation. Gram also was responsible in AutoInformed’s view for the Republican-induced 2008 Financial Crisis and subsequent Great Recession because of his failed and by now thoroughly disproven deregulation philosophy, which was a cover for lining the pockets of rich special interests. In California consumer groups correctly predicted that this law would give energy traders too much influence over energy commodity prices, the legislation was passed during December 2000.

Public Citizen reported, “Because of Enron’s new, unregulated power auction, the company’s ‘Wholesale Services’ revenues quadrupled—- from $12 billion in the first quarter of 2000 to $48.4 billion in the first quarter of 2001.”

After passage of the deregulation law, California had a total of 38 Stage 3 “rolling blackouts” declared. Federal regulators intervened during June 2001. These blackouts were clearly the result of a poorly designed and rigged market system that was manipulated by traders and marketers, combined with lackluster state management and regulatory oversight.

In time Enron traders were exposed as intentionally encouraging the removal of power from the market during California’s energy crisis by encouraging suppliers to shut down plants to perform unnecessary maintenance, as documented in contemporaneous recordings.

These caused the rolling blackouts, which adversely affected many businesses dependent upon a reliable supply of electricity, to say nothing of the retail customers. This supply disruptions increased the price, and Enron traders were thus able to sell power at premium prices, sometimes up to 20 times its previous peak value.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Automobility LA – Fast EV Charging Network Plugged and Supported by Volkswagen Subsidiary Electrify America

Click to enlarge.

Electrify America President and CEO Giovanni Palazzo, the keynote speaker at AutoMobility LA, claims that mobility will experience a major boost by 2025 when hundreds of new electric vehicle models will enter the U. S. transportation grid. Publicly available, fast charging services will be in high demand in theory.

However, industry observers note that there isn’t a clear focus in the U.S. to create an open electric vehicle charging network. In fact, the grid is to varying degrees populated by self-interested players in for a buck – as in charges via fees – and not necessarily for creating or sustaining potential consumer demands and expectations for convenience, reliability and speed. It’s true that these might ultimately become benefits, but one need only recall Enron* and its history with utility companies and how that worked out for consumers to be wary.

Sales projections continue to show steep rises in electrified vehicles, despite slow sales.

“With the next generation of EVs featuring faster charging speeds, we all need to be focused on the development of a comprehensive and open ultra-fast EV charging network,” urged Palazzo, whose firm is owned by Volkswagen Group, so it too has some self-interest in utility regulation and how it is accomplished. The fact is we all, including AutoInformed, have an interest in effective national regulation free from the manipulation of special interests since clean air and mobility are in the national interest, if not needed for national survival.

For its part, Electrify America is investing $2 billion in an EV charging infrastructure, access and education programs across America as it expands its nationwide charging network, arguably the largest commitment of its kind to date. Electrify America selected four key charging equipment suppliers – ABB, BTC Power, Efacec and Signet – to jointly deploy its new ultra-fast electric vehicle (EV) charging systems throughout the United States. The charging equipment suppliers are sharing the delivery of more than 2,000 chargers across 484 stations in the U.S. Electrify America’s ultra-fast charging systems utilize both HUBER+SUHNER and ITT Cannon high power charging (HPC) systems which have a much smaller cable cross section than the traditional high-powered cable option because they are liquid cooled.

Electrify America plans to have more than 484 ultra-fast EV charging sites with more than 2,000 DC fast chargers installed or under construction by June 2019. The company also is installing more than 2,800 Level 2 chargers at more than 400 community-based sites such as multi-unit dwellings and work-place locations nationwide.

Electrify America’s nationwide DC fast charging stations will be in 17 metropolitan areas and along high-traffic corridors in 42 states, including two cross-country routes.

The charging stations will have charging levels that range from 50 kilowatts (kW) up to 350kW – the latter capable of adding up to 20 miles of range per minute to a vehicle. (Your mileage may vary depending on what you drive and how you drive – editor)

Nationally, each planned charging station site will be located no more than 120 miles apart. Planned locations average only 70 miles apart.

*Senator Phil Gramm, Republican Deregulation Parasite and the Enron Corruption Scandal

Senator Phil Gramm, the corrupt husband of Enron Board member Wendy Gramm was the second largest beneficiary of campaign contributions from Enron, Gram was instrumental in forcing the legislation of California’s energy commodity trading deregulation. Gram also was responsible in AutoInformed’s view for the Republican-induced 2008 Financial Crisis and subsequent Great Recession because of his failed and by now thoroughly disproven deregulation philosophy, which was a cover for lining the pockets of rich special interests. In California consumer groups correctly predicted that this law would give energy traders too much influence over energy commodity prices, the legislation was passed during December 2000.

Public Citizen reported, “Because of Enron’s new, unregulated power auction, the company’s ‘Wholesale Services’ revenues quadrupled—- from $12 billion in the first quarter of 2000 to $48.4 billion in the first quarter of 2001.”

After passage of the deregulation law, California had a total of 38 Stage 3 “rolling blackouts” declared. Federal regulators intervened during June 2001. These blackouts were clearly the result of a poorly designed and rigged market system that was manipulated by traders and marketers, combined with lackluster state management and regulatory oversight.

In time Enron traders were exposed as intentionally encouraging the removal of power from the market during California’s energy crisis by encouraging suppliers to shut down plants to perform unnecessary maintenance, as documented in contemporaneous recordings.

These caused the rolling blackouts, which adversely affected many businesses dependent upon a reliable supply of electricity, to say nothing of the retail customers. This supply disruptions increased the price, and Enron traders were thus able to sell power at premium prices, sometimes up to 20 times its previous peak value.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.