Click for more.

Chinese domestic passenger vehicle sales (PV), excluding exports, saw a 5.4% year-on-year (YoY) increase in March and a 4.2% YoY growth in April, according to an analyst comment just made public by the respected Global Data Consultancy.* Year-to-date from January to April 2024, PV sales reached 6.3 million units, reflecting a 5.5% YoY increase. Mass production is higher – +9.0% YoY at 7.6 million over the same period. This suggests that the production growth is outpacing sales volume, indicating potential market saturation or a buildup of inventory, according to GlobalData.

Two very real problems are increasing for non-Chinese global automakers. First, is the penetration rate. This is the market share of the vehicles that are the future of the companies that will survive what is an historic reshaping of a global industry. Here, so-called New Electric Vehicles – [NEVs – battery electric vehicles, plug-in hybrids and range-extended electric vehicles combined] that have been heavy promoted, subsidized and pushed forward by the Chinese government are now accounting a 43% share in April, an historic high. The economies of scale are enormous and a clear Chinese competitive advantage.**

Click for more.

“The average penetration rate for the first four months of the year stood at 38%, an increase of 3 percentage points from the 35% rate of the previous year. This robust performance underscores domestic manufacturers’ notable shift in market dynamics and strategic realignment. Since NEVs are superior to traditional fuel vehicles in terms of ownership cost and driving experience, the decline of traditional fuel (ICE) vehicles in the Chinese market is faster than expected. In addition, in the price war that has been going on last year and this year, ICE vehicles are also at a disadvantage due to the lack of opportunity for price reductions,” said Nan Zhang, Production Analyst, GlobalData.

Export Threat

Exports have played a significant role in the growth of production, with shipments in April 2024 reaching 424,000 units, a giant YoY increase of 36.9%. This represents 21% of total PV production, significantly higher than the 16% average share for the calendar-year 2023.

“The expanding share of exports in total production underscores the significant contribution of international sales to the industry’s growth. The burgeoning potential of overseas markets has encouraged several Chinese automotive manufacturers to contemplate establishing overseas to further reduce production costs,” said Zhang.

Joint Venture Brands on the Ropes

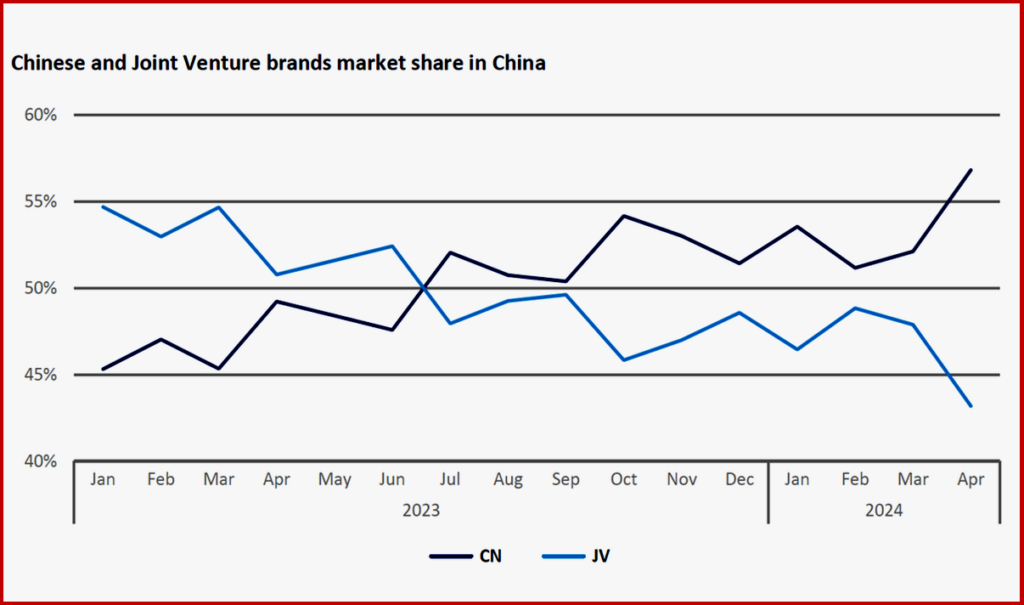

An extremely low penetration rate of NEVs within the JV brands in China has them reeling and on the ropes in the automotive ring. During the first four months of 2024, the penetration rate of NEV sales within Chinese local brands was close to 60%, an increase of seven percentage points over the same period last year. In contrast, the NEV penetration rate for joint venture brands was only 12%, an increase of just one percentage point over the same period last year. GlobalData suggests and AutoInformed agrees that JV brands may be at a competitive disadvantage as the market shifts towards NEVs. This is a complicated matter as customer attitudes and government policies, subsidies and regulations in the home markets of global automakers dictates the need for these brands to go to warp-speed in the transition to new energy solutions, in AutoInformed’s view. Otherwise, these brands will go the way of the Stanley Steamer or Packard or Nash to name but a few of the many deceased auto firms.

Chinese Technological Innovation and Market Disruption

The accelerated transformation of the Chinese market is not only reflected in the transition to new energy and exports but also in the huge changes taking place in technological innovation. Herewith are Zhang’s congent observations:

“In March, Xiaomi made a significant entry into the automotive market with the launch of its first vehicle, the SU7. This move garnered considerable market attention, bolstered by Xiaomi’s strong consumer electronics background. In 2023, the company sold approximately 146,000,000 smartphones, and by year-end, its AIoT platform connected 740,000,000 devices (excluding smartphones, tablets, and laptops), reflecting a 25.5% YoY growth. Xiaomi’s ecosystem, which includes over 13,000,000 users with five or more IoT devices, creates a competitive advantage that extends to its automotive venture. This interconnected ecosystem, linking ‘people, cars, and homes,’ positions Xiaomi Auto as a formidable contender in China’s intelligent automotive market, poised to reshape industry competition.

“Following Xiaomi’s foray, BYD introduced the Qin L at the end of May, with its fifth-generation DM hybrid technology. This innovation challenges traditional market perceptions and offers a compelling alternative to conventional ICE vehicles. The Qin L’s impressive range of 2100 kilometers [~1300 miles – AutoCrat] with a full fuel tank and fully charged battery, along with its competitive pricing between CNY 99,800 and CNY 139,800 (~US$13,800 to ~$19,300), targets both joint-venture C/D-segment cars such as the Honda Accord and Toyota Camry, and popular ICE models such as the Sagitar and Lavida from Volkswagen. BYD’s Qin L meets the demand for low-cost, high-quality transportation, showcasing its strong market competitiveness and accelerating the reshuffle of the automotive industry,” said Zhang.

Price Wars Intensify

“JV brands, primarily focusing on ICE vehicles, felt the squeeze in market share and were compelled to retaliate. Beijing Hyundai and GM Buick were quick to respond; Hyundai reduced the starting price of the new Elantra from CNY99,800 (US$13,800) to CNY75,800 (US$10,500), and Buick offered discounts of up to CNY65,000 (US$9,000) per vehicle. Even brands that were initially slow to react eventually joined the pricing war. Nissan lowered the Sylphy’s price to CNY69,800 (US$9,600), and Volkswagen’s Bora model, a competitor in the same segment, also saw a price drop to CNY68,000 (US$9,400), with a special emphasis on its “NEV value retention rate,” indicating a highly competitive market.

The premium segment was not spared from the price reductions, with Cadillac’s CT5 officially announcing a price cut of CNY70,000 (US$9700). German luxury brands like Mercedes-Benz and BMW also joined the trend, with BMW’s iX1 seeing the highest reduction of nearly CNY150,000 (US$20,700). The entry price for BMW’s i3 and iX3 was set at CNY200,000 (US$27,600), while the Mercedes-Benz EQA and EQB models went below the CNY200,000 (US$27,600) mark.

These price reductions have accelerated the industry’s consolidation, with JV brands facing the dual challenge of shrinking market share and increased competition from new car-making forces. The impact of the price war is pushing the automotive industry into a phase of intense competition and potential market realignment.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Chinese Trade Wars – Exports Growing, Prices Dropping

Click for more.

Chinese domestic passenger vehicle sales (PV), excluding exports, saw a 5.4% year-on-year (YoY) increase in March and a 4.2% YoY growth in April, according to an analyst comment just made public by the respected Global Data Consultancy.* Year-to-date from January to April 2024, PV sales reached 6.3 million units, reflecting a 5.5% YoY increase. Mass production is higher – +9.0% YoY at 7.6 million over the same period. This suggests that the production growth is outpacing sales volume, indicating potential market saturation or a buildup of inventory, according to GlobalData.

Two very real problems are increasing for non-Chinese global automakers. First, is the penetration rate. This is the market share of the vehicles that are the future of the companies that will survive what is an historic reshaping of a global industry. Here, so-called New Electric Vehicles – [NEVs – battery electric vehicles, plug-in hybrids and range-extended electric vehicles combined] that have been heavy promoted, subsidized and pushed forward by the Chinese government are now accounting a 43% share in April, an historic high. The economies of scale are enormous and a clear Chinese competitive advantage.**

Click for more.

“The average penetration rate for the first four months of the year stood at 38%, an increase of 3 percentage points from the 35% rate of the previous year. This robust performance underscores domestic manufacturers’ notable shift in market dynamics and strategic realignment. Since NEVs are superior to traditional fuel vehicles in terms of ownership cost and driving experience, the decline of traditional fuel (ICE) vehicles in the Chinese market is faster than expected. In addition, in the price war that has been going on last year and this year, ICE vehicles are also at a disadvantage due to the lack of opportunity for price reductions,” said Nan Zhang, Production Analyst, GlobalData.

Export Threat

Exports have played a significant role in the growth of production, with shipments in April 2024 reaching 424,000 units, a giant YoY increase of 36.9%. This represents 21% of total PV production, significantly higher than the 16% average share for the calendar-year 2023.

“The expanding share of exports in total production underscores the significant contribution of international sales to the industry’s growth. The burgeoning potential of overseas markets has encouraged several Chinese automotive manufacturers to contemplate establishing overseas to further reduce production costs,” said Zhang.

Joint Venture Brands on the Ropes

An extremely low penetration rate of NEVs within the JV brands in China has them reeling and on the ropes in the automotive ring. During the first four months of 2024, the penetration rate of NEV sales within Chinese local brands was close to 60%, an increase of seven percentage points over the same period last year. In contrast, the NEV penetration rate for joint venture brands was only 12%, an increase of just one percentage point over the same period last year. GlobalData suggests and AutoInformed agrees that JV brands may be at a competitive disadvantage as the market shifts towards NEVs. This is a complicated matter as customer attitudes and government policies, subsidies and regulations in the home markets of global automakers dictates the need for these brands to go to warp-speed in the transition to new energy solutions, in AutoInformed’s view. Otherwise, these brands will go the way of the Stanley Steamer or Packard or Nash to name but a few of the many deceased auto firms.

Chinese Technological Innovation and Market Disruption

The accelerated transformation of the Chinese market is not only reflected in the transition to new energy and exports but also in the huge changes taking place in technological innovation. Herewith are Zhang’s congent observations:

“In March, Xiaomi made a significant entry into the automotive market with the launch of its first vehicle, the SU7. This move garnered considerable market attention, bolstered by Xiaomi’s strong consumer electronics background. In 2023, the company sold approximately 146,000,000 smartphones, and by year-end, its AIoT platform connected 740,000,000 devices (excluding smartphones, tablets, and laptops), reflecting a 25.5% YoY growth. Xiaomi’s ecosystem, which includes over 13,000,000 users with five or more IoT devices, creates a competitive advantage that extends to its automotive venture. This interconnected ecosystem, linking ‘people, cars, and homes,’ positions Xiaomi Auto as a formidable contender in China’s intelligent automotive market, poised to reshape industry competition.

“Following Xiaomi’s foray, BYD introduced the Qin L at the end of May, with its fifth-generation DM hybrid technology. This innovation challenges traditional market perceptions and offers a compelling alternative to conventional ICE vehicles. The Qin L’s impressive range of 2100 kilometers [~1300 miles – AutoCrat] with a full fuel tank and fully charged battery, along with its competitive pricing between CNY 99,800 and CNY 139,800 (~US$13,800 to ~$19,300), targets both joint-venture C/D-segment cars such as the Honda Accord and Toyota Camry, and popular ICE models such as the Sagitar and Lavida from Volkswagen. BYD’s Qin L meets the demand for low-cost, high-quality transportation, showcasing its strong market competitiveness and accelerating the reshuffle of the automotive industry,” said Zhang.

Price Wars Intensify

“JV brands, primarily focusing on ICE vehicles, felt the squeeze in market share and were compelled to retaliate. Beijing Hyundai and GM Buick were quick to respond; Hyundai reduced the starting price of the new Elantra from CNY99,800 (US$13,800) to CNY75,800 (US$10,500), and Buick offered discounts of up to CNY65,000 (US$9,000) per vehicle. Even brands that were initially slow to react eventually joined the pricing war. Nissan lowered the Sylphy’s price to CNY69,800 (US$9,600), and Volkswagen’s Bora model, a competitor in the same segment, also saw a price drop to CNY68,000 (US$9,400), with a special emphasis on its “NEV value retention rate,” indicating a highly competitive market.

The premium segment was not spared from the price reductions, with Cadillac’s CT5 officially announcing a price cut of CNY70,000 (US$9700). German luxury brands like Mercedes-Benz and BMW also joined the trend, with BMW’s iX1 seeing the highest reduction of nearly CNY150,000 (US$20,700). The entry price for BMW’s i3 and iX3 was set at CNY200,000 (US$27,600), while the Mercedes-Benz EQA and EQB models went below the CNY200,000 (US$27,600) mark.

These price reductions have accelerated the industry’s consolidation, with JV brands facing the dual challenge of shrinking market share and increased competition from new car-making forces. The impact of the price war is pushing the automotive industry into a phase of intense competition and potential market realignment.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.