Click to enlarge.

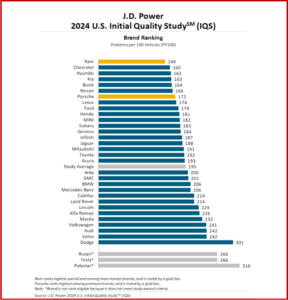

The J.D. Power 2024 U.S. Initial Quality StudySM (IQS),* released today shows an industry average 195 PP100, that is 195 problems per 100 vehicles. A lower score reflects higher vehicle quality. So-called mass market brands, with a combined average of 181 PP100, are better than the industry average. Premium brands, which often include more complicated systems and more reliance on connectivity, average 232 PP100.

“It is not surprising that the introduction of new technology has challenged manufacturers to maintain vehicle quality,” said Frank Hanley, senior director of auto benchmarking (sic) at J.D. Power. “However, the industry can take solace in the fact that some problem areas such as voice recognition and parking cameras are seen as less problematic now than they were a year ago.”

Power has adjusted its survey methodology once again. This year the IQS was changed to amalgamate newly acquired, state-of-the-art vehicle repair data with traditional J.D. Power VOC (voice of customer) data**

“Proponents of battery electric vehicles (BEVs) often state these vehicles should be less problematic and require fewer repairs than gas-powered vehicles since they have fewer parts and systems. However, newly incorporated repair data shows BEVs, as well as plug-in hybrid electric vehicles (PHEVs), require more repairs than gas-powered vehicles in all repair categories. “Owners of cutting edge, tech-filled BEVs and PHEVs are experiencing problems that are of a severity level high enough for them to take their new vehicle to the dealership at a rate three times higher than that of gas-powered vehicle owners,” Hanley said.

“Gas- and diesel-powered vehicles average 180 PP100 this year, while BEVs are 86 points higher at 266 PP100. While there are no notable improvements in BEV quality this year, the gap between Tesla’s BEV quality and that of traditional OEMs’ BEV quality has closed, with both at 266 PP100. In the past, Tesla has performed better, but that is not the case this year and the removal of traditional feature controls, such as turn signals and wiper stalks, has not been well received by Tesla customers,” said Hanley.

Findings of the 2024 IQS

- Frustration rising from false warnings: Often, owners don’t understand what warnings mean. For instance, rear seat reminder technology, designed to help vehicle owners avoid inadvertently leaving a child or pet in the rear seat when exiting the vehicle, contributes 1.7 PP100 across the industry. Some mistakenly perceive it signals an unbuckled seat belt or cite the warning goes off when no one is present in the rear seat. Furthermore, advanced driver assistance systems, intended to save lives and reduce injuries, are irritating vehicle owners with inaccurate and annoying alerts from rear cross traffic warning and reverse automatic emergency braking features, a newly added feature to the survey this year.

- Owners want to cut the cord: Problems with Android Auto and Apple CarPlay persist as the feature remains one of the top 10 problems. Customers most frequently experience difficulties connecting to their vehicle or losing connection. More than 50% of Apple users and 42% of Samsung users access their respective feature every time they drive, illustrating that customers want their smartphone experience brought into the vehicle and also desire the feature to be integrated wirelessly.

- In-vehicle controls are out of control: Features, controls and displays is the second most problematic category in the study, slightly better than only the notoriously issue-prone infotainment category. From such seemingly simple functions like windshield wipers and rear-view mirror to the more intricate operation of an OEM smartphone application, this category is particularly troublesome in EVs. The PP100 incidence in this category is more than 30% higher in EVs than in gas-powered vehicles. This is exacerbated by Tesla’s recent switch to steering wheel-mounted buttons for horn and turn signal functions, a change not well received by owners.

- One problem area that stinks: While, figuratively, all vehicle problems stink, there is one problem that is increasingly prevalent: unpleasant interior smell. This issue has worsened the most from 2023, with every brand except Kia and Nissan having an increase in unpleasant interior smell problems. Problem odors are described by owners to be emanating from their vehicle’s heating, ventilating and air conditioning systems.

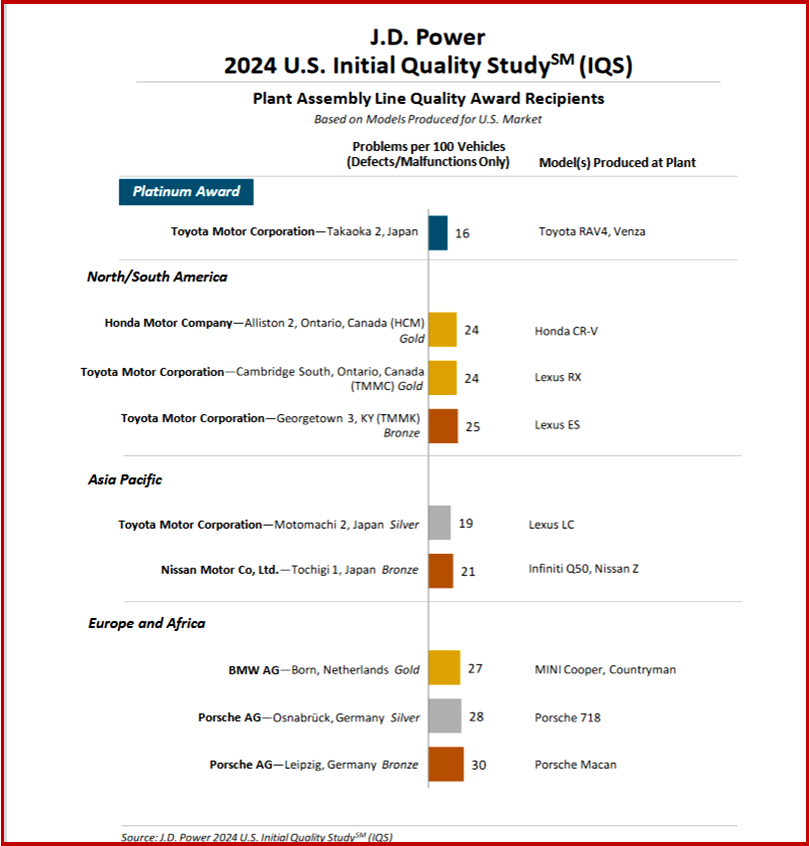

Click for more on Plant Quality Awards.

*“The U.S. Initial Quality Study, now in its 38th year, is based this year on responses from 99,144 purchasers and lessees of new 2024 model-year vehicles who were surveyed after 90 days of ownership. For the first time, the study additionally incorporates repair visit data based on hundreds of thousands of real-world events reported to franchised new-vehicle dealers. The methodology for this year’s IQS was enhanced to unite newly acquired, state-of-the-art vehicle repair data with traditional J.D. Power VOC data while fielding continuously year-round. This enhanced IQS data allows automakers the ability to quickly identify potential issues before they become bigger problems in the quality landscape,” Power said.

**About J.D. Power

J.D. Power says it is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power uses its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance. J.D. Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

“The study is based on a battery of 227 VOC questions plus relevant repair data, all of which is organized into 10 vehicle categories: infotainment; features, controls and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; climate; and unspecified (unique to repair). The study is designed to provide manufacturers with information to facilitate the identification of problems and to drive product improvement. The study was fielded from July 2023 through May 2024,” Power said in a release.

***AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

EVs, PHEVs Worse Than Gas Vehicles On Power 2024 IQS

Click to enlarge.

The J.D. Power 2024 U.S. Initial Quality StudySM (IQS),* released today shows an industry average 195 PP100, that is 195 problems per 100 vehicles. A lower score reflects higher vehicle quality. So-called mass market brands, with a combined average of 181 PP100, are better than the industry average. Premium brands, which often include more complicated systems and more reliance on connectivity, average 232 PP100.

“It is not surprising that the introduction of new technology has challenged manufacturers to maintain vehicle quality,” said Frank Hanley, senior director of auto benchmarking (sic) at J.D. Power. “However, the industry can take solace in the fact that some problem areas such as voice recognition and parking cameras are seen as less problematic now than they were a year ago.”

Power has adjusted its survey methodology once again. This year the IQS was changed to amalgamate newly acquired, state-of-the-art vehicle repair data with traditional J.D. Power VOC (voice of customer) data**

“Proponents of battery electric vehicles (BEVs) often state these vehicles should be less problematic and require fewer repairs than gas-powered vehicles since they have fewer parts and systems. However, newly incorporated repair data shows BEVs, as well as plug-in hybrid electric vehicles (PHEVs), require more repairs than gas-powered vehicles in all repair categories. “Owners of cutting edge, tech-filled BEVs and PHEVs are experiencing problems that are of a severity level high enough for them to take their new vehicle to the dealership at a rate three times higher than that of gas-powered vehicle owners,” Hanley said.

“Gas- and diesel-powered vehicles average 180 PP100 this year, while BEVs are 86 points higher at 266 PP100. While there are no notable improvements in BEV quality this year, the gap between Tesla’s BEV quality and that of traditional OEMs’ BEV quality has closed, with both at 266 PP100. In the past, Tesla has performed better, but that is not the case this year and the removal of traditional feature controls, such as turn signals and wiper stalks, has not been well received by Tesla customers,” said Hanley.

Findings of the 2024 IQS

Click for more on Plant Quality Awards.

*“The U.S. Initial Quality Study, now in its 38th year, is based this year on responses from 99,144 purchasers and lessees of new 2024 model-year vehicles who were surveyed after 90 days of ownership. For the first time, the study additionally incorporates repair visit data based on hundreds of thousands of real-world events reported to franchised new-vehicle dealers. The methodology for this year’s IQS was enhanced to unite newly acquired, state-of-the-art vehicle repair data with traditional J.D. Power VOC data while fielding continuously year-round. This enhanced IQS data allows automakers the ability to quickly identify potential issues before they become bigger problems in the quality landscape,” Power said.

**About J.D. Power

J.D. Power says it is a global leader in automotive data and analytics, and provides industry intelligence, consumer insights and advisory solutions to the automotive industry and selected non-automotive industries. J.D. Power uses its extensive proprietary datasets and software capabilities combined with advanced analytics and artificial intelligence tools to help its clients optimize business performance. J.D. Power was founded in 1968 and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

“The study is based on a battery of 227 VOC questions plus relevant repair data, all of which is organized into 10 vehicle categories: infotainment; features, controls and displays; exterior; driving assistance; interior; powertrain; seats; driving experience; climate; and unspecified (unique to repair). The study is designed to provide manufacturers with information to facilitate the identification of problems and to drive product improvement. The study was fielded from July 2023 through May 2024,” Power said in a release.

***AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.